Nokia 2015 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2015 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216

|

|

151

Financial statements

NOKIA IN 2015

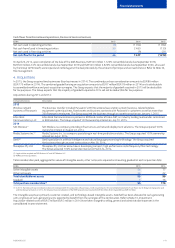

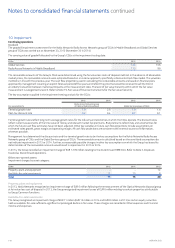

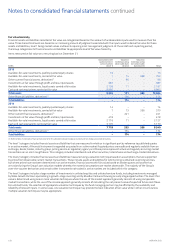

Current income tax liabilities and assets include net EUR 394 million (EUR 387 million in 2014) related to uncertain tax positions with inherently

uncertain timing of cash outows.

Prior period income tax returns for certain Group companies are under examination by local tax authorities. The Group’s business and

investments, especially in emerging market countries, may be subject to uncertainties, including unfavorable or unpredictable tax treatment.

Management judgment and a degree of estimation are required in determining the tax expense or benet. Even though management does not

expect that any signicant additional taxes in excess of those already provided for will arise as a result of these examinations, the outcome or

actual cost of settlement may vary materially from estimates.

In 2013, the tax authorities in India commenced an investigation into withholding tax in respect of payments by Nokia India Private Limited to

Nokia Corporation for the supply of operating software. Subsequently, the authorities extended the investigation to other related tax

consequences and issued orders and made certain assessments. The litigation and assessment proceedings are pending. The Group has denied

all such allegations and continues defending itself in various Indian litigation proceedings and under both Indian and international law, while

extending its full cooperation to the authorities.

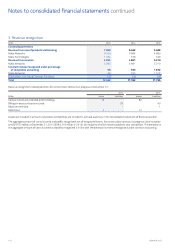

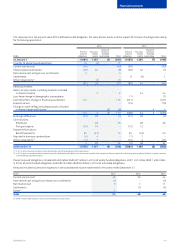

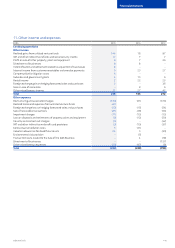

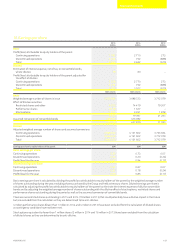

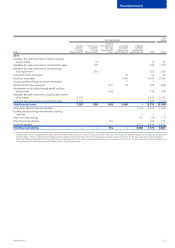

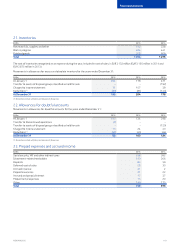

14. Deferred taxes

EURm

2015 2014

Deferred

tax assets

Deferred

tax liabilities Net balance

Deferred

tax assets

Deferred

tax liabilities Net balance

Tax losses carried forward and unused taxcredits 916 – 967 –

Undistributed earnings – (15) – (18)

Intangible and tangible assets 1 321 (154) 1 254 (188)

Prepaid pension costs 1 (9) 2 (18)

Other non-current assets 4 (12) 12 (9)

Inventories 85 (6) 142 (10)

Other current assets 43 (41) 75 (12)

Dened benet pension liabilities 154 (3) 183 (9)

Other non-current liabilities 1 (2) – (11)

Provisions 106 (3) 159 (34)

Other current liabilities 191 (33) 220 (25)

Other temporary dierences 29 – 11 (3)

Total before netting 2 851 (278) 2 573 3 025 (337) 2 688

Reclassication due to netting of deferred tax

assets and liabilities (217) 217 – (305) 305 –

Total after netting 2 634 (61) 2 573 2 720 (32) 2 688