Nokia 2015 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2015 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

94 NOKIA IN 2015

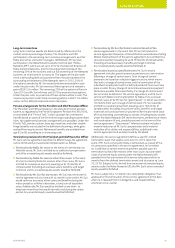

Compensation of the President and Chief Executive Ocer in 2015

and 2014

EUR 2015 2014

Salary 1 000 000 932 666

Short-term variable compensation(1) 1922 125 1 778 105

Stock awards(2) 2 843 711 3 759 936

Payments to dened contribution

retirement plans(3) 491 641 686 206

All other compensation(4) 145 658 168 645

Total(5) 6403 135 7 325 558

(1) Short-term variable compensation payments are part of Nokia’s short-term cash incentive plan.

The amount consists of the annual incentive cash payment and/or other short-term variable

compensation earned and paid or payable by Nokia for the respective scal year.

(2) Amounts shown represent the total grant date fair value of equity grants awarded for the

respective scal year. The fair value of performance shares equals the estimated fair value on

grant date. The estimated fair value is based on the grant date market price of a Nokia share less

the present value of dividends expected to be paid during the vesting period. The value of the

performance shares is presented on the basis of granted number of shares, which is two times

the number of shares at threshold. The value of the 2015 stock awards with performance shares

valued at maximum is (four times the number of shares at threshold) EUR 5 687 422.

(3) Pension arrangements in Finland are characterized as dened contribution pension

arrangements under IAS 19, Employee benets. Mr. Suri is a participant in the Finnish state

mandated TyEL pension arrangements.

(4) All other compensation for Mr. Suri in 2015 includes: housing of EUR 47 950 (2014: EUR 63 708);

EUR 48 510 for travel assistance (2014: EUR 31 576); EUR 0 for tuition of minor children

(2014:EUR 34 055); tax services EUR 17 834 (2014: EUR 17 038) and EUR 31 363 for premiums

paid under supplemental medical and disability insurance and for mobile phone and driver

(2014: EUR22 268).

(5) A signicant portion of equity grants are tied to the performance of the company and aligned

with the value delivered to shareholders. The amounts shown are representative of the value of

the award at grant but are not representative of the amount that will ultimately be received when

the plan vests. The ultimate value of the award will be known when the awards vest.

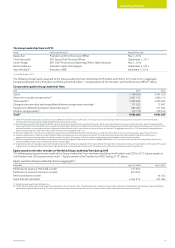

Equity awards to the President and Chief Executive Ocer, grant

date April 22, 2015:

Performance shares at threshold number 198 500

Performance shares at maximum number 794 000

Grant date fair value EUR(1) 2 843 711

(1) The fair value of performance shares equals the estimated fair value of the grant date. The

estimated value is based on the grant date market price of Nokia shares less the present value of

dividends expected to be paid during the vesting. The value of performance shares is presented

on the basis of a number of shares, which is two times the number at threshold.

The Nokia Group Leadership Team

Remuneration of the Nokia Group Leadership Team members

The remuneration of other members of the Group Leadership Team

consists of base salary, fringe benets, short-term and long-term

incentives. The other members of the Group Leadership Team

participate in the same reward programs, including short-term

incentive and long-term incentive programs and under the same

terms as other eligible employees, although, the quantum and mix of

their compensation varies by role and individual. Short-term incentive

plans are based on rewarding business performance and some or all of

the following metrics are appropriate for their role; non-IFRS revenue,

non-IFRS prot, net cash ow and strategic objectives. Long-term

incentive programs are described under “—Equity Compensation”.

All members of the Group Leadership Team have 20% of their

short-term incentive based on personal strategic objectives, at least

30% of their short-term incentive is based on the Nokia scorecard of

the Nokia Group’s non-IFRS revenue, non-IFRS operating prot and net

cash ow and, depending on their role, they may also have business

unit targets in addition based on a mix of non-IFRS revenue, non-IFRS

operating prot and net cashow.

On average, the members of the Group Leadership Team earned

140% oftheir target incentive amount in 2015.

Compensation continued

Pension arrangements for the Nokia Group Leadership Team

The members of the Group Leadership Team participate in the local

retirement plans applicable to employees in the country of residence.

Executives based in Finland participate in the statutory Finnish

pension system, as regulated by the Finnish TyEL. Refer to “—Pension

arrangements for the President and Chief Executive Ocer” above.

Executives based in the United States participate in our US retirement

savings and investment plan. Under this 401(k) plan, participants elect

to make voluntary pre-tax contributions that are 100% matched by

Nokia up to 8% of eligible earnings. 25% of the employer’s match

vests for the participants annually during the rst four years of their

employment. Executives based in Germany participated in the 100%

company funded HERE pension plan. Contributions were based on

pensionable earnings, the pension table and retirement age.

Termination provisions for the Nokia Group Leadership

Teammembers

In all cases, if an executive is dismissed for cause, no compensation

willbe payable and no outstanding equity will vest.

In the event of termination for any other reason than cause, where the

company pays compensation in lieu of notice period’s salary, benets

and target short-term incentive amounts are taken into account.

Additionally, the Board believes that maintaining a stable and eective

leadership team is considered essential for protecting and enhancing

the best interests of Nokia and its shareholders. In order to encourage

the continued focus, dedication and continuity of the members of

theGroup Leadership Team to their assigned duties without the

distraction that may arise from the possibility of termination of

employment as aresult ofa specied change of control event in Nokia,

certain provisions have been made available to them.

As a result some members of the Group Leadership Team have change

of control agreements which serve as an addendum to their executive

agreement and provide for the pro-rata settlement of outstanding

equity awards as follows. The change of control agreements are based

on adouble trigger structure, which means that both the change of

control event and the termination of the individual’s employment

must take place for any change of control based severance payment

tomaterialize. More specically, if a change of control event, as

dened in the agreement, has occurred in the company, and the

individual’s employment with the company is terminated either by

Nokia or its successor without cause, or by the individual for “good

reason” (for example, material reduction of duties and responsibilities),

in either case within 18months from such change of control event,

theindividual will be entitled to his or her notice period compensation

(including base salary, benets and target incentive) and cash payment

(or payments) for the pro-rated value of the individual’s outstanding

unvested equity, includingrestricted shares, performance shares,

stock options and equity awards under Nokia Networks EIP, payable

pursuant to the terms ofthe agreement. The Board has full discretion

to terminate or amend the change of control agreements at any time.

Under inherited change ofcontrol agreements for former Alcatel

Lucent executives, compensation of 18 months’ salary plus target

incentive is payable in the event ofan involuntary termination or

“goodreason” event should either occur within 12 months of

Nokiagaining control of Alcatel Lucent. Additionally, anyremaining

Alcatel Lucent equity awards not already accelerated as part of the

transaction would also be settled.