Nokia 2015 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2015 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

95

Corporate governance

NOKIA IN 2015

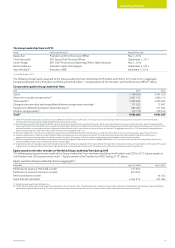

The Group Leadership Team in 2015:

Name Position held in 2015 Appointment date

Rajeev Suri President and Chief Executive Ocer May 1, 2014

Timo Ihamuotila EVP, Group Chief Financial Ocer September 1, 2011

Samih Elhage EVP, Chief Financial and Operating Ocer, Nokia Networks May 1, 2014

Ramzi Haidamus President, Nokia Technologies September 3, 2014

Sean Fernback(1) President, HERE November 1, 2014

(1) Until December 5, 2015.

The following compensation was paid to the Group Leadership Team (excluding the President and CEO) in 2015 and 2014, in aggregate.

Compensation paid to the President and CEO is presented under “—Compensation of the President and Chief Executive Ocer” above.

Compensation paid to Group Leadership Team:

EUR 2015 2014

Salary 2 149 029 3 461 250

Short-term variable compensation(1) 2 801 131 1 880 115

Stock awards(2) 3 295 955 3 679 383

Change in pension value and nonqualied deferred compensation earnings(3) 111 203 73 967

Payments to dened contribution retirement plans(4) 493 027 311 494

All other compensation(5) 773 718 278 720

Total(6) 9 624 063 9 684 929

(1) Short-term variable compensation payments are part of Nokia’s short-term cash incentive plan. The amount consists of the annual incentive cash payment and/or other short-term variable

compensation earned and paid or payable by Nokia for the respective scal year.

(2) Amounts shown represent the total grant date fair value of equity grants awarded for the respective scal year. The fair value of performance shares and restricted shares equals the estimated fair

value ongrant date. The estimated fair value is based on the grant date market price of a Nokia share less the present value of dividends expected to be paid during the vesting period. The value of the

performance shares is presented on the basis of granted number of shares, which is two times the number of shares at threshold. The aggregate value of the 2015 stock awards with performance

shares valued at maximum is (four times the number of shares at threshold) EUR 6 591 910.

(3) Pension arrangements in Germany are considered to be payments to a dened benet plan where the pension is determined by reference to executive’s base salary, age and years of service.

(4) Pension arrangements in Finland are characterized as dened contribution pension arrangements under IAS 19, Contributions are made to the state mandated TyEL plan and there are no

supplementary pension arrangements. Contributions made in the US to the company 401k plan are also considered payments to dened contribution pension plans.

(5) All other compensation refers to mobility related payments or benet programs under which executives are eligible. Additionally, in 2015, a special one-time retention arrangement related to the

Saleof the HERE Business is also included under all other compensation.

(6) A signicant portion of equity grants are tied to the performance of the company and aligned with the value delivered to shareholders. The amounts shown are representative of the value of the award

at grant but are not representative of the amount that will ultimately be received when the plan vests. The ultimate value of the award will be known when the awards vest.

Equity awards to the other members of the Nokia Group Leadership Team during 2015

The following equity awards were made to the Group Leadership Team members (excluding the President and CEO) in 2015. Equity awards to

the President and CEO are presented under “—Equity awards to the President and CEO during 2015” above.

Equity awards to Group Leadership Team, in aggregate(1):

Grant date April 22, 2015(2) July 7, 2015

Performance shares at threshold number 212 500 –

Performance shares at maximum number 850 000 –

Restricted shares number –44 000

Grant date fair value EUR 3 044 275 251 680

(1) Excluding equity awards made to Rajeev Suri.

(2) The fair value of performance shares equals the estimated fair value of the grant date. The estimated value is based on the grant date market price of Nokia share less the present value of dividends

expected to be paid during the vesting. The value of performance shares is presented on the basis of a number of shares, which is two times the number at threshold.