Nokia 2015 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2015 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

141

Financial statements

NOKIA IN 2015

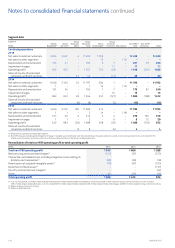

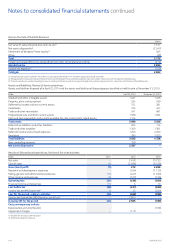

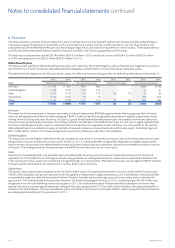

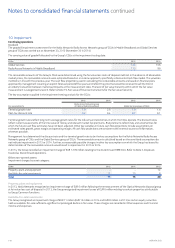

Cash ows from Discontinued operations, Devices & Services business

EURm 2015 2014 2013

Net cash used in operating activities (6) (1 054) (1 062)

Net cash from/(used in) investing activities 50 2 480 (130)

Net cash used in nancing activities – (9) (21)

Net cash ow for the period 44 1 417 (1 213)

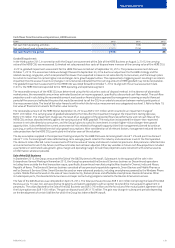

On April25, 2014, upon completion of the Sale of the D&S Business, EUR 500million 1.125% convertible bonds due September 2018,

EUR500million 2.5% convertible bonds due September 2019 and EUR 500million 3.625% convertible bonds due September 2020, all issued

by the Group to Microsoft, were repaid and netted against the deal proceeds by the amount of principal and accrued interest. Refer to Note 35,

Risk management.

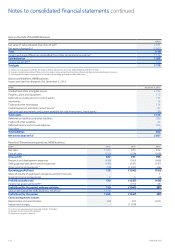

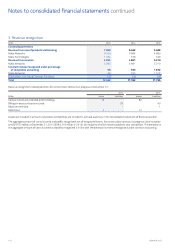

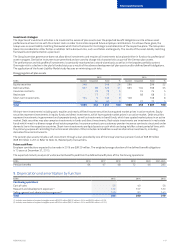

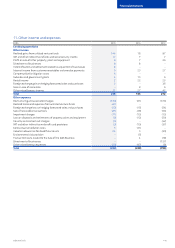

4. Acquisitions

In 2015, the Group acquired two businesses (four businesses in 2014). The combined purchase consideration amounts to EUR 96 million

(EUR175 million in 2014). The combined goodwill arising on acquisition amounts to EUR 7 million (EUR 76 million in 2014) and is attributable

toassembled workforce and post-acquisition synergies. The Group expects that the majority of goodwill acquired in 2015 will be deductible

fortax purposes. The Group expects that the majority of goodwill acquired in 2014 will not be deductible for tax purposes.

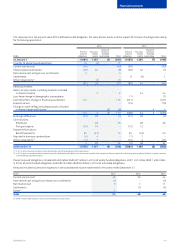

Acquisitions during 2015 and 2014:

Company/business Description

2015

Wireless network

business of Panasonic

The business transfer included Panasonic’s LTE/3G wireless base station system business, related wireless

equipment system business, xed assets and business contracts with Panasonic’s customers as well as more than

300 Panasonic employees. The Group acquired the business through an asset transaction on January 1, 2015.

Eden Rock

Communications, LLC

Eden Rock Communications is pioneer in SON and creator of Eden-NET, an industry leading multivendor centralized

in SON solution. The Group acquired 100% ownership interest on July 10, 2015.

2014

SAC Wireless(1) SAC Wireless is a company providing infrastructure and network deployment solutions. The Group acquired 100%

ownership interest on August 22, 2014.

Medio Systems Inc.(2) Medio Systems Inc. is a company specializing in real-time predictive analytics. The Group acquired 100% ownership

interest on July 2, 2014.

Desti(2) Desti specializes in articial intelligence and natural language processing technology. The Group acquired

thebusiness through an asset transaction on May 28, 2014.

Mesaplexx Pty Ltd. Mesaplexx Pty Ltd. has know-how in developing compact, high performance radio frequency lter technology.

TheGroup acquired 100% ownership interest on March 24, 2014.

(1) Legal entities acquired are SAC Wireless LLC and HCP Wireless LLC.

(2) HERE business acquisitions.

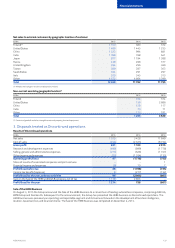

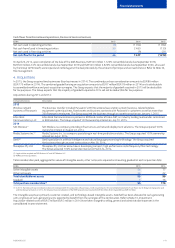

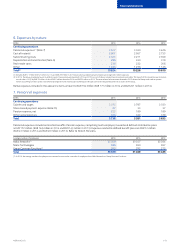

Total consideration paid, aggregate fair values of intangible assets, other net assets acquired and resulting goodwill at each acquisition date:

EURm 2015 2014

Other intangible assets 56 77

Other net assets 33 22

Total identiable net assets 89 99

Goodwill 776

Total purchase consideration(1) 96 175

(1) In 2015, the total purchase consideration does not correspond with the acquisition of businesses, net of acquired cash in the consolidated statement of cash ows due to foreign exchange rate used

and the closing mechanism. In 2014, the total purchase consideration of the HERE acquisitions amounted to EUR 84 million of which goodwill was EUR 65 million.

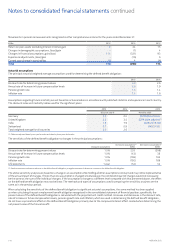

The intangible assets are primarily customer-related, and technology-based intangible assets. Goodwill has been allocated to cash-generating

units or groups of cash-generating units expected to benet from the synergies of the combination. Refer to Note 10, Impairment.

Acquisition-related costs of EUR 3 million (EUR 3 million in 2014) have been charged to selling, general and administrative expenses in the

consolidated income statement.