Nokia 2015 Annual Report Download - page 193

Download and view the complete annual report

Please find page 193 of the 2015 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

191

Financial statements

NOKIA IN 2015

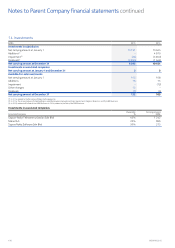

Accounts receivable

Accounts receivable include both amounts invoiced to customers and

amounts where the Parent Company’s revenue recognition criteria

have been fullled but the customers have not yet been invoiced.

Accounts receivable are carried at the original amount invoiced to

customers less allowances for doubtful accounts. Allowances for

doubtful accounts are based on a periodic review of all outstanding

amounts, including an analysis of historical bad debt, customer

concentrations, customer creditworthiness, past due amounts,

current economic trends and changes in customer payment terms.

Impairment charges on receivables identied as uncollectible are

included in other operating expenses. The Parent Company

derecognizes an accounts receivable balance only when the

contractual rights to the cash ows from the asset expire or it

transfers the nancial asset and substantially all the risks and rewards

of the asset to another entity.

Loans payable

Loans payable are recognized initially at fair value net of transaction

costs. In subsequent periods, loans payable are presented at

amortized cost using the eective interest method. Transaction costs

and loan interest are recognized in the income statement as nancial

expenses over the life of the instrument.

Accounts payable

Accounts payable are carried at invoiced amount which is considered

to be the fair value due to the short-term nature of the Parent

Company’s accounts payable.

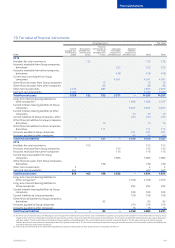

Derivative nancial instruments

Interest income or expense on interest rate derivatives is accrued in

the income statement during the nancial year. In the nancial

statements, outstanding interest rate forward contracts, interest rate

future contracts, interest rate option contracts and interest rate swap

contracts are stated at market values and included in the income

statement.

Forward foreign exchange contracts are valued using the forward

exchange rate of the statement of nancial position date. The

exchange dierences arising from outstanding derivative contracts are

reported in nancial items. Foreign exchange option contracts are

valued using an option valuation model on the statement of nancial

position date and reported in nancial items.

Fair values of forward rate agreements, interest rate options, futures

contracts and exchange traded options are calculated based on

quoted market rates at each statement of nancial position date.

Discounted cash ow analyses are used to value interest rate and

cross-currency interest rate swaps.

Hedge accounting

The Group applies hedge accounting on certain forward foreign

exchange contracts, certain options or option strategies, and certain

interest rate derivatives.

Fair value hedges

The Group applies fair value hedge accounting to reduce exposure to

fair value uctuations of interest-bearing liabilities due to changes in

interest rates and foreign exchange rates. Changes in the fair value of

derivatives designated and qualifying as fair value hedges, together

with any changes in the fair value of hedged liabilities attributable to

the hedged risk, are recognized in nancial income and expenses. If

the hedged item no longer meets the criteria for hedge accounting,

hedge accounting ceases and any fair value adjustments made to the

carrying amount of the hedged item while the hedge was eective are

recognized in nancial income and expenses based on the eective

interest method.

Deferred tax

Deferred tax liabilities and deferred tax assets are calculated for

temporary dierences between book values and tax bases using an

enacted or substantively enacted tax rate at each statement of

nancial position date that are expected to apply in the period when

the asset is realized or the liability is settled. Non-current and current

deferred tax liabilities and deferred tax assets are presented

separately on balance sheet. Deferred tax assets are recognized at the

probable amount estimated to be received. Deferred tax assets and

deferred tax liabilities are oset for presentation purposes, because a

company has a legally enforceable right to set o current tax assets

against current tax liabilities.