Nokia 2015 Annual Report Download - page 170

Download and view the complete annual report

Please find page 170 of the 2015 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

168 NOKIA IN 2015

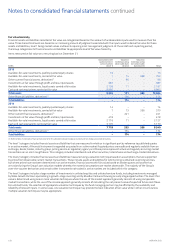

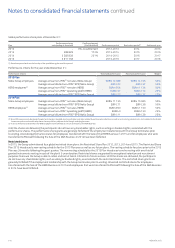

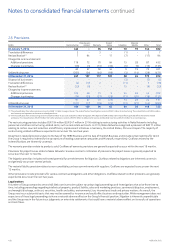

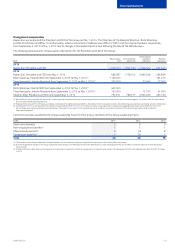

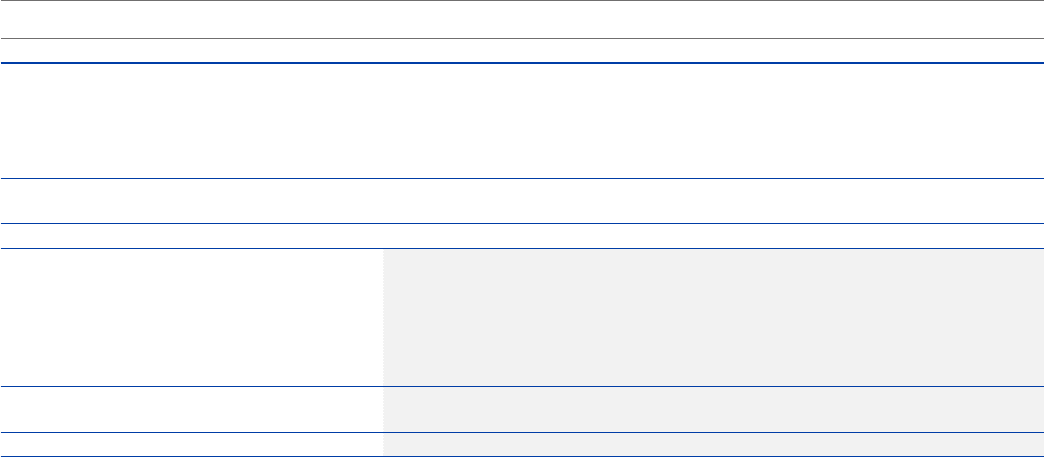

28. Provisions

EURm Restructuring

Divestment-

related Warranty

Project

losses Litigation

Material

liability Other Total

At January 1, 2014 443 –94 152 70 19 144 922

Translation dierences 2 – 3 – (1) – 3 7

Reclassication(1) 7 94 – 17 (7) –(17) 94

Charged to income statement:

Additional provisions 116 72 70 64 15 28 87 452

Changes in estimates (56) (5) (10) (30) (6) (9) (15) (131)

60 67 60 34 9 19 72 321

Utilized during year (265) (24) (40) (96) (3) (14) (29) (471)

At December 31, 2014 247 137 117 107 68 24 173 873

Disposal of businesses – – – – (3) –(2) (5)

Translation dierences (4) (12) 2 – (11) – 7 (18)

Reclassication(2) (33) (6) – – 15 –(9) (33)

Charged to income statement:

Additional provisions 105 49 31 5 24 46 42 302

Changes in estimates (14) (22) (21) (25) (11) (20) (18) (131)

91 27 10 (20) 13 26 24 171

Utilized during year (107) (17) (35) (25) (13) (21) (45) (263)

At December 31, 2015 194 129 94 62 69 29 148 725

(1) The reclassication from other provisions consists of EUR 17 million to project losses. The reclassication from litigation consists of EUR 7 million to restructuring. The reclassication of EUR 94 million

was from accrued expenses to divestment-related provisions.

(2) The reclassication from restructuring consists of EUR 18 million to accruals and EUR 15 million to litigation. VAT deposits of EUR 6 million were reclassied to partially oset divestment-related

provisions. The reclassication of EUR 9 million from other provisions consists of EUR 5 million to allowance for excess and obsolete inventory and EUR 4 million to accrued expenses.

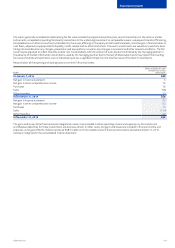

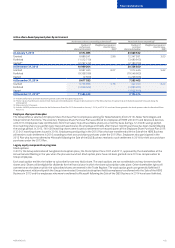

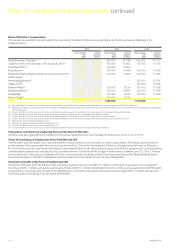

The restructuring provision includes EUR 194 million (EUR 247 million in 2014) relating to restructuring activities in Nokia Networks including

personnel and other restructuring-related costs, such as real estate exit costs. In 2015, Nokia Networks recognized a provision of EUR 71 million

relating to certain new cost reduction and eciency improvement initiatives in Germany, the United States, China and Japan. The majority of

restructuring-related outows is expected to occur over the next two years.

Divestment-related provisions relate to the Sale of the HERE Business and the Sale of the D&S Business and include certain liabilities for which

the Group is required to indemnify the consortium of leading automotive companies and Microsoft, respectively. Outows related to the

indemnications are inherently uncertain.

The warranty provisions relate to products sold. Outows of warranty provisions are generally expected to occur within the next 18 months.

Provisions for project losses relate to Nokia Networks’ onerous contracts. Utilization of provisions for project losses is generally expected to

occur over the next 12 months.

The litigation provision includes estimated potential future settlements for litigation. Outows related to litigations are inherently uncertain

andgenerally occur over several periods.

The material liability provision relates to non-cancellable purchase commitments with suppliers. Outows are expected to occur over the next

12 months.

Other provisions include provisions for various contractual obligations and other obligations. Outows related to other provisions are generally

expected to occur over the next two years.

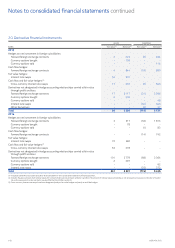

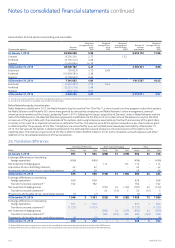

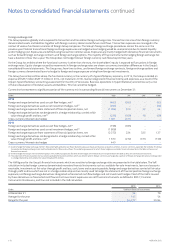

Legal matters

A number of Group companies are and will likely continue to be subject to various legal proceedings and investigations that arise from time to

time, including proceedings regarding intellectual property, product liability, sales and marketing practices, commercial disputes, employment,

and wrongful discharge, antitrust, securities, health and safety, environmental, tax, international trade and privacy matters. As a result, the

Group may incur substantial costs that may not be covered by insurance and could aect business and reputation. While management does not

expect any of these legal proceedings to have a material adverse eect on the Group’s nancial position, litigation is inherently unpredictable

and the Group may in the future incur judgments or enter into settlements that could have a material adverse eect on its results of operations

and cash ows.

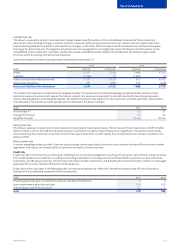

Notes to consolidated nancial statements continued