Nokia 2015 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2015 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

145

Financial statements

NOKIA IN 2015

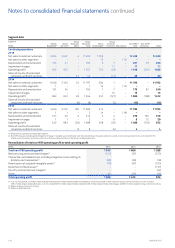

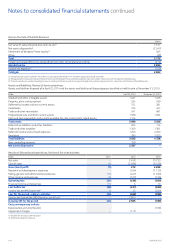

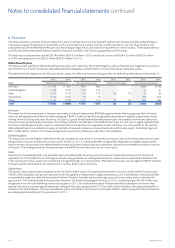

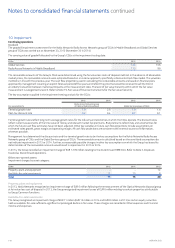

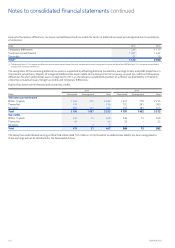

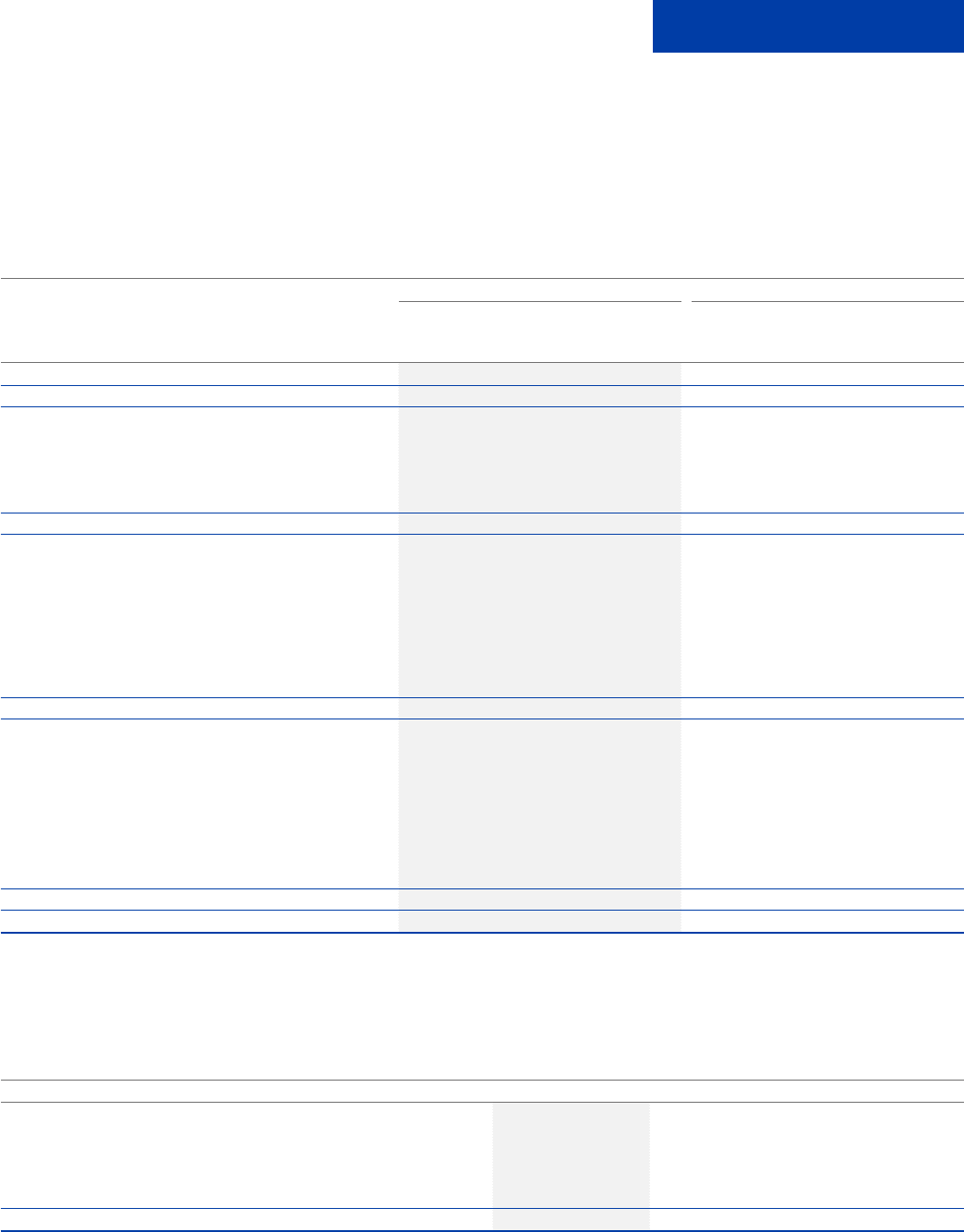

The movements in the present value of the dened benet obligation, fair value of plan assets and the impact of minimum funding/asset ceiling

for Continuing operations:

EURm

2015 2014

Present

value of

obligation

Fair value

of plan

assets

Impact of

minimum

funding/

asset ceiling Total

Present

value of

obligation

Fair value

of plan

assets

Impact of

minimum

funding/

asset ceiling Total

At January 1 (1 884) 1 387 (3) (500) (1 453) 1 261 (7) (199)

Transfer to Discontinued operations 16 (5) 11 –

Current service cost (46) (46) (39) (39)

Interest (expense)/income (49) 40 (9) (59) 52 (7)

Past service cost and gains on curtailments 5 5 –

Settlements – 9 (8) 1

Other movements(1) (1) (1)

–

(90) 39 – (51) (89) 44 – (45)

Remeasurements:

Return on plan assets, excluding amounts included

ininterest income 2 2 44 44

Loss from change in demographic assumptions – (1) (1)

Gain/(loss) from change in nancial assumptions 114 114 (321) (321)

Experience loss – (16) (16)

Change in asset ceiling, excluding amounts included

ininterest (expense)/income (6) (6) 4 4

114 2 (6) 110 (338) 44 4 (290)

Exchange dierences (35) 28 (7) (31) 28 (3)

Contributions:

Employers 26 26 28 28

Plan participants (16) 16 – (12) 12 –

Payments from plans:

Benet payments 60 (47) 13 55 (35) 20

Acquired in business combinations (4) 4 – (1) 1 –

Other movements(2) (1) 1 – (15) 4 (11)

4 28 – 32 (4) 38 – 34

At December 31 (1 840) 1 451 (9) (398) (1 884) 1 387 (3) (500)

(1) In 2015, other movements relate to the administration costs that are deducted from plan assets.

(2) In 2014, other movements relate to the inclusion of the dened benet liability of end of service benets that have previously been reported as other long-term employee liabilities in certain countries

in the Middle East and Africa region.

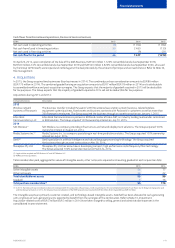

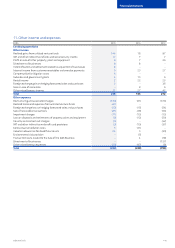

Present value of obligations include EUR 428 million (EUR 407 million in 2014) of wholly funded obligations, EUR 1 337 million (EUR 1 408 million

in 2014) of partly funded obligations and EUR 75 million (EUR 69 million in 2014) of unfunded obligations.

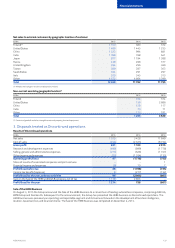

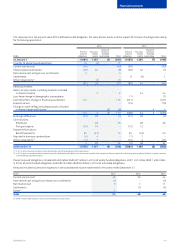

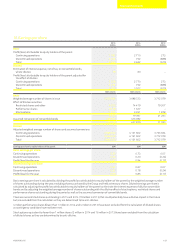

Amounts included in personnel expenses in the consolidated income statement for the years ended December 31:

EURm 2015 2014 2013

Current service cost 46 39 44

Past service cost and gains and losses on curtailments (5) –(5)

Net interest cost 9711

Settlements –(1) (4)

Other(1) 1– –

Total 51 45 46

(1) Other includes administration costs that are deducted from plan assets.