Nokia 2015 Annual Report Download - page 165

Download and view the complete annual report

Please find page 165 of the 2015 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

163

Financial statements

NOKIA IN 2015

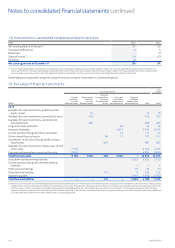

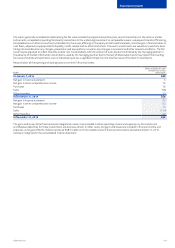

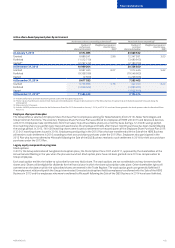

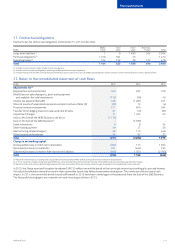

In 2015 and until October 2015, due to the bondholders exercising their conversion rights, a total of 40 983 Nokia shares were subscribed for

and issued in deviation from the pre-emptive subscription right of the shareholders under the authorization held by the Board of Directors.

On October 8, 2015, the Group announced that it had decided to exercise its option to redeem the EUR 750 million convertible bond on

November 26, 2015 at the principal amount outstanding plus accrued interest. Prior to the redemption, the bondholders had the option to

convert their convertible bonds into Nokia shares at a conversion price of EUR 2.39. Due to the bondholders using their conversion right, a total

of 313 640 153 Nokia shares were subscribed for and issued in deviation from the pre-emptive subscription right of the shareholders under

theauthorization held by the Board of Directors. On the redemption date, November 26, 2015, the outstanding amount of convertible bonds,

EUR 200 000, was redeemed at their principal amount plus accrued unpaid interest.

At December31, 2015, the Board of Directors had no other authorizations to issue shares, convertible bonds, warrants or stock options.

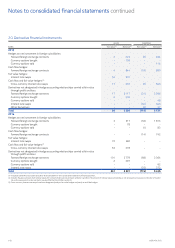

Other authorizations

At the Annual General Meeting held on June17, 2014, the shareholders authorized the Board of Directors to repurchase a maximum of

370million Nokia shares. The amount corresponds to less than 10% of the total number of Nokia shares. The shares may be repurchased in

order to develop the capital structure of the Parent Company and are expected to be cancelled. In addition, the shares may be repurchased

inorder to nance or carry out acquisitions or other arrangements, to settle the Parent Company’s equity-based incentive plans, or to be

transferred for other purposes. The authorization that would have been eective until December 17, 2015 was terminated by the resolution

ofthe Annual General Meeting on May 5, 2015.

At the Annual General Meeting held on May 5, 2015, the shareholders authorized the Board of Directors to repurchase a maximum of

365 million shares. The amount corresponds to less than 10% of the total number of Parent Company’s shares. The shares may be repurchased

in order to optimize the capital structure of the Parent Company, to nance or carry out acquisitions or other arrangements, to settle the

ParentCompany’s equity-based incentive plans or to be transferred for other purposes. The authorization is eective until November 5, 2016.

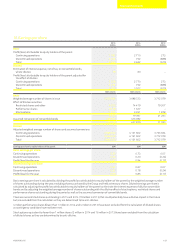

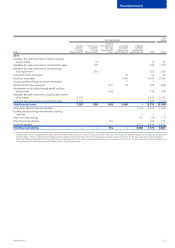

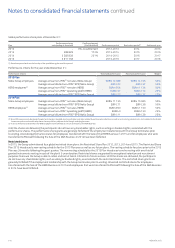

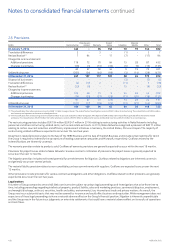

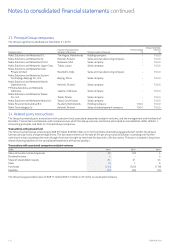

25. Share-based payment

The Group has several equity-based incentive programs for employees. The plans include performance share plans, restricted share plans,

employee share purchase plans, and stock option plans. Both executives and employees participate in these programs. The global equity-based

incentive programs are oered to employees of Nokia Networks (from 2014), Nokia Technologies and Group Common Functions. The global

equity-based incentive programs were oered to the employees of HERE until 2015 and Devices & Services until 2013. The equity-based

incentive grants are generally conditional on continued employment as well as the fulllment of the performance, service and other conditions

determined in the relevant plan rules. The share-based payment expense for all equity-based incentive grants for Continuing operations

amounts to EUR 67 million (EUR 53 million in 2014 and EUR 37 million in 2013). The share-based payment expense for allequity-based incentive

grants related to Discontinued operations is EUR 10 million (EUR 20 million for 2014 and EUR 20 million in 2013). In 2015, at the closing date

ofthe Sale of the HERE Business, all unvested equity grants held by HERE employees were forfeited. In 2015, the share-based payment

expense for Discontinued operations includes a separately agreed liability for the cash settlement of HERE equity grants that were to vest

inJanuary 2016.

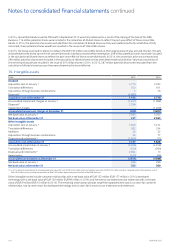

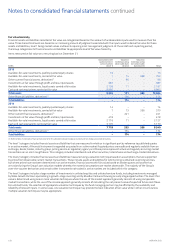

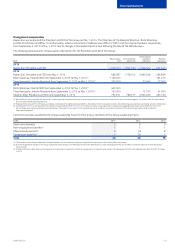

Performance shares

In 2015, the Group administered four global performance share plans, the Performance Share Plans of 2012, 2013, 2014 and 2015. The

performance shares represent a commitment by the Group to deliver Nokia shares to employees at a future point in time, subject to the

fulllment of predetermined performance criteria. In the Performance Share Plan of 2015, performance shares were granted with dened

performance criteria and included a minimum payout amount guarantee. As a result of the minimum payout amount dened in the terms

andconditions of the 2015 Plan, at the end of the performance period, the number of shares to be settled following the restriction period will

start at a minimum of 50% of the granted amount at threshold. The threshold number of performance shares at threshold is the amount of

performance shares granted to an individual that will be settled if the threshold performance with respect to one performance criterion is

achieved. Any additional payout beyond the minimum amount will be determined based on the nancial performance against the established

performance criteria during the two-year performance period. At maximum performance, the settlement amounts to four times the amount

atthreshold.