Nokia 2015 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2015 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

99

Corporate governance

NOKIA IN 2015

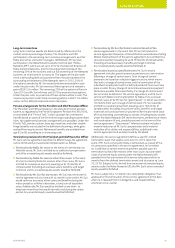

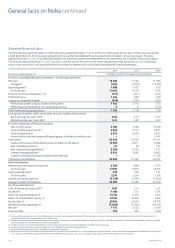

Performance of previous equity programs

The recently vested performance share plan 2013 is the rst to

achieve above-threshold performance for some years, such that

86.25% of the target award granted to participants vesting on

January1, 2016, with diluted EPS for Continuing operations increasing

from negative EUR (0.16) to EUR 0.67 from the scal year 2012 to 2014,

including the two year performance period (2013–2014) of the plan.

The new strategy for Nokia delivered in 2014 with the focus on

networks and the IoT has seen an increase in value for shareholders

and a corresponding change in the performance of long-term

incentive plans. In addition to the performance share plan 2013

achieving 86.25% of itstarget, the 2014 plan has achieved 125.72%

and will vest to participants on January 1, 2017. In the same period

the share price of Nokia hasincreased from EUR 3.49 per share on

January 1, 2013 to EUR 6.60 on December 31, 2015 representing

anincrease of 89% and we have restored dividend payments.

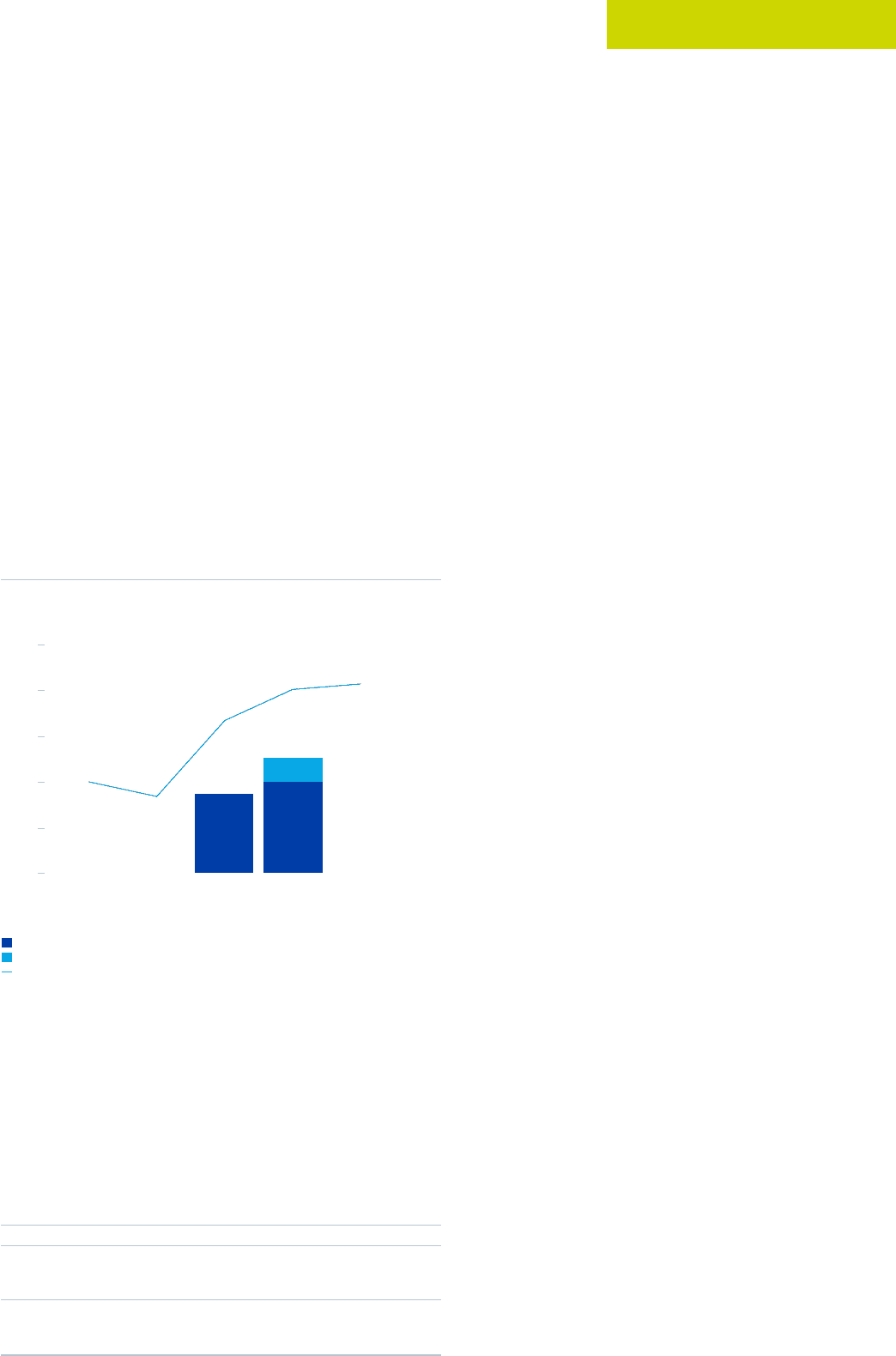

TSR

value

0

50%

100%

150%

200%

250%

2014 20152013

Long-term incentive plan year,

at December 31

20122011

Achieved

Overachieved

Nokia Total Shareholder Return (TSR)

86%

Nil

100%

25.72%

Share price and Total Shareholder Return vs long-term

incentive performance

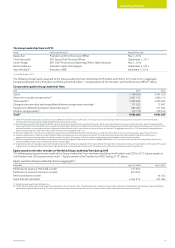

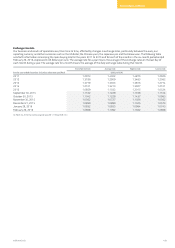

Legacy equity compensation programs

Stock options

Although the granting of stock options ceased at the end of 2013,

awards under the 2011 stock option plans remain in force. Stock

options under the 2007 stock option plan lapsed on January 1, 2016

and no new Nokia shares can be subscribed for with the stock options

awarded under the 2007 stock option plan.

Under the plans, each stock option entitles the holder to subscribe for

one new Nokia share and the stock options are non-transferable and

may be exercised for shares only. The dierence between the two

plans is in the vesting schedule as follows:

Plan Vesting schedule

2007 stock option plan ■25% 12 months after grant

■ 6.25% each quarter thereafter

■Lapsed on January 1, 2016

2011 stock option plan ■ 50% on third anniversary of grant

■ 50% on fourth anniversary of grant

■Term is approximately six years

Shares will be eligible for dividends in respect of the nancial year in

which the share subscription takes place. Other shareholder rights will

commence on the date on which the subscribed shares are entered in

the trade register. The stock option grants are generally forfeited if the

employment relationship terminates with Nokia.

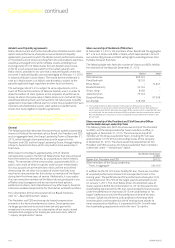

Nokia Networks Equity Incentive Plan

The Nokia Networks EIP was established in 2012 by the board of Nokia

Siemens Networks prior to Nokia’s acquisition of full ownership of the

Nokia Networks business. Under this Plan options over Nokia Solutions

and Networks B.V. shares were granted to Mr. Suri and approximately

65other Nokia Networks employees.

At that time, both Nokia and Siemens were considering a potential

exitfrom Nokia Siemens Networks. The plan had two objectives:

(1) increase the value of Nokia Networks; and

(2) create an exit option for its parent companies. With the signicantly

improved performance of Nokia Networks, the rst objective has been

met. The second objective has not occurred and given the change in

our strategy, the likelihood ofa saleor an initial public oering (“IPO”)

has diminished.

The exercise price of the options is based on a Nokia Networks share

value on grant, as determined for the purposes of the Nokia Networks

EIP. The options will be cash-settled at exercise, unless an IPO has

taken place, at which point they would be converted into

equity-settled options.

The targets of the plan were set at a demanding level and payments

from the plan represent the outstanding achievement of the Networks

team. The actual payments, if any, under the Nokia Networks EIP will be

determined based on the value of the Nokia Networks business and

could ultimately decline to zero if the value of the business falls below

a certain level. There is also a cap that limits potential gain for all plan

participants.

If the second objective of the plan is not achieved and there is no

exitevent, options are cash-settled and the holder will be entitled

tohalf of the share appreciation based on the exercise price and the

estimated value of shares on the exercise date. In the unlikely event

ofan IPO or exit event the holder is entitled to the full value of the

share appreciation. As the likelihood of a sale or IPO has reduced,

thevalue of any payouts under the Nokia Networks EIP is expected

tobe reduced by 50%.

In the event that a sale or an IPO has not occurred, the maximum

totalpayment to Mr. Suri pursuant to the plan would be limited to

EUR10.8million. In the unlikely event of an IPO or exit event, the value

of the options could exceed this maximum.

30% of the options became exercisable on the third anniversary of

thegrant date with the remainder vesting on the fourth anniversary or,

ifearlier, all the options will vest on the occurrence of certain corporate

transactions such as an initial public oering (Refer to “Corporate

Transaction” above).

If a Corporate Transaction has not taken place by the sixth anniversary

of the grant date, the options will be cashed out. If an IPO has taken

place, equity-settled options remain exercisable until the tenth

anniversary of the grant date.