Nokia 2015 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2015 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

89

Corporate governance

NOKIA IN 2015

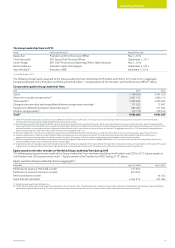

Additionally, the Extraordinary General Meeting resolved that the new

members of the Board elected at the meeting will receive the same

annual remuneration as is paid to the members of the Board elected

atthe Annual General Meeting on May 5, 2015, prorated by the new

Board members’ time in service until the closing of the Annual General

Meeting in 2016.

For more details on the composition of the Board, refer to

“CorporateGovernance Statement—Main corporate governance

bodies of Nokia”above. The new members of the Board were not

paidany compensation during the scal year 2015. The following

tableoutlines the total annual compensation paid to the new

members of the Board for their services in 2016, as resolved by

shareholders of Nokia at the Extraordinary General Meeting on

December 2, 2015.

(EUR)(1)

Olivier Piou, Vice Chair as of January 8, 2016(2) 70 082

Louis Hughes, Board member as of January 8, 2016(3) 65 410

Jean Monty, Board member as of January 8, 2016(4) 65 410

(1) The new Board members have received the same annual remuneration as was paid to the

members ofthe Board elected at the Annual General Meeting on May 5, 2015, prorated by the

new Board members’ time in service until the closing of the Annual General Meeting in 2016.

Approximately 40% of each Board member’s annual compensation was paid in Nokia shares

purchased from the market and the remaining approximately 60% in cash.

(2) Represents compensation paid to Olivier Piou, consisting of EUR 70 082 for services as the

ViceChair of the Board.

(3) Represents compensation paid to Louis Hughes, consisting of EUR 60 738 for services as

amember of the Board and EUR 4 672 for services as a member of the Audit Committee.

(4) Represents compensation paid to Jean Monty, consisting of EUR 60 738 for services as

amember of the Board and EUR 4 672 for services as a member of the Audit Committee.

Executive compensation

Introduction

The year 2015 was the rst full year following the Sale of the

D&SBusiness and the integration of the Nokia Networks business.

Witha stable leadership team in place and certain changes in the

compensation structure introduced in 2014, 2015 was about

executing change in the business, preparing for the acquisition

ofAlcatel Lucent and the Sale of the HERE Business.

Our focus for executive compensation is to:

■Attract and retain the right talent;

■Drive performance; and

■Align with shareholder interests.

We have undergone signicant structural changes over the past three

years and continue to do so following our acquisition of Alcatel Lucent.

Additionally, the corporate reporting environment is expected to

evolve further e.g., as a result of the pending shareholder rights

directive in Europe, which would further change disclosure

requirements. To simplify reporting, we have decided to report

information related to executive compensation in accordance

withFinnish regulatory requirements (and in compliance with SEC

requirements) and to provide disclosure of compensation of our

President and CEO and aggregated information for our Group

Leadership Team, as well as to provide a clear explanation of our

policies and practices that relate to the President and CEO and to

ourexecutives and employees more broadly.

Variable compensation plans have paid out in a manner consistent

with the 2015 business results. Short-term incentive plans paid out

above target for 2015 in line with the performance on all three key

metrics we use as a basis for calculating variable compensation—

non-IFRS revenue, non-IFRS operating prot and net cash ow.

Our long-term incentive plan performance condition achievement is

also tied to our business results. In recent years, our performance

shares have not paid out as the required business performance was

not met. It is satisfying to see that the 2013 performance share plan

that vested on January 1, 2016 has delivered value to participants as

they have participated in delivering value to shareholders. The 2013

performance share plan vested at 86.25% of target during which time

we saw an increase in diluted EPS for Continuing operations from

anegative EUR (0.16) for the scal year 2012 to positive EUR 0.67

pershare for the scal year 2014 and the share price increase from

EUR3.49 before the plan was approved to EUR 6.60 atDecember 31,

2015. The 2014 performance share plan will vest onJanuary 1, 2017

and is expected to vest at 125.72% of the targetaward.

Compensation philosophy, design and strategy

Our compensation programs are designed to attract, incentivize and

retain the talent necessary to deliver strong nancial results to the

ultimate benet of our shareholders. Rewards are tied to our strategy

by adopting an appropriate mix of xed and variable compensation to

engage and motivate employees in the performance of the business

and ensure alignment with shareholder interests.

A single compensation framework is used across the Nokia Group

witha varying mix of xed and variable compensation for each level

ofresponsibility. Higher levels of performance-based compensation

andequity compensation are used to reward executives for delivering

long-term sustainable growth and creating value for our shareholders.

We aim to provide a globally competitive compensation oering,

whichis comparable to that of our peer group companies, taking into

account industry, geography, size and complexity. The peer group

isreviewed annually and external advice is sought to conrm

theappropriateness of the peer group and also the quantum and

therelative mix of compensation packages.

In designing our variable compensation programs key consideration

isgiven to:

■incorporating specific performance measures that align directly

withthe execution of our strategy and driving long-term

sustainablesuccess;

■delivering an appropriate amount of performance-related variable

compensation for the achievement of strategic goals and financial

targets in both the short- and long-term;

■appropriately balancing rewards between company and individual

performance; and

■fostering an ownership culture that promotes sustainability and

long-term value creation that aligns the interests of participants

with those of our shareholders.