Nokia 2015 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2015 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

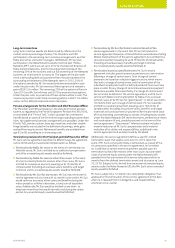

100 NOKIA IN 2015

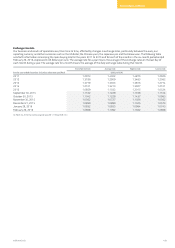

Alcatel Lucent liquidity agreements

Nokia, Alcatel Lucent and certain beneciaries of Alcatel Lucent stock

option and performance share plans have entered into liquidity

agreements, pursuant to which the Alcatel Lucent performance shares,

or the Alcatel Lucent shares resulting from the stock options exercises,

would be exchanged to for either (i) Nokia shares according to an

exchange ratio of 0.55 Nokia shares for each Alcatel Lucent share,

orfor (ii) a cash amount equivalent to the market value of such

Nokiashares, provided in any case that a reduced liquidity event has

occurred. A reduced liquidity was acknowledged on February 12, 2016

in respect of Alcatel Lucent shares. The choice for the settlement in

cash or in Nokia shares isat Nokia’s sole discretion, subject to the

possible applicable legal, regulatory or other local constraints.

The exchange ratio of 0.55 is subject to some adjustments in the

event of nancial transactions of Nokia or Alcatel Lucent, in order to

allow theholders of stock options or the recipients of performance

shares to obtain the same value in Nokia shares or in cash which they

would have obtained had such transactions not taken place. Liquidity

agreements have been oered also to current Group Leadership Team

members whoheld Alcatel Lucent stock options or performance

shares that were eligible for liquidity agreements.

Share ownership of the Board of Directors, the

President and Chief Executive Ocer and the

Nokia Group Leadership Team

General

The following section describes the ownership or potential ownership

interest in Nokia of the members of our Board, the President and CEO

and, on aggregate level, the Group Leadership Team at December 31,

2015, either through share ownership or, with respect to the

Presidentand CEO and the Group Leadership Team, through holding

of equity-based incentives, which may lead to share ownership in

thefuture.

With respect to the Board, approximately 40% of director

compensation is paid in the form of Nokia shares that are purchased

from the market or, alternatively, by using treasury shares held by

Nokia. The remainder of the remuneration, approximately 60%, is

paidin cash, most of which istypically used to cover related taxes.

Itisalso our policy that the directors retain until the end of their

directorship the net after-tax number ofshares that they have

received as remuneration for their duties as members of the Board

during their rst three years of service. Additionally, itis ourpolicy

thatnon-executive members of the Board do not participate in any

ofNokia’s equity programs and do not receive stock options,

performance shares, restricted shares or any other equity-based or

otherwise variable compensation for their duties as Board members.

For a description of the remuneration of our Board members,

refer to “—Board of Directors” above.

The President and CEO receives equity-based compensation

primarilyin the form of performance shares. Stock options are

nolonger granted and restricted shares are only granted in

exceptionalcircumstances. For a description of our equity-based

compensation programs for employees and executives, refer to

“—Equity compensation” above.

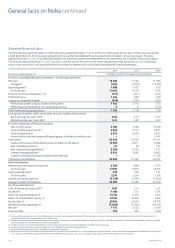

Compensation continued

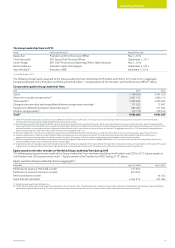

Share ownership of the Board of Directors

At December 31, 2015, the members of our Board held the aggregate

of 1 414 445 shares and ADSs in Nokia, which represented 0.04% of

our outstanding shares and total voting rights excluding shares held

byNokia Group at that date.

The following table sets forth the number of shares and ADSs held by

the members of the Board at December 31, 2015:

Name(1) Shares(1) ADSs(1)

Risto Siilasmaa 992 334 –

Vivek Badrinath 19 255 –

Bruce Brown –74 847

Elizabeth Doherty 30 754 –

Simon Jiang 8 666 –

Jouko Karvinen 72 723 –

Elizabeth Nelson –87 308

Kari Stadigh 128 558 –

(1) The number of shares or ADSs includes not only shares or ADSs received as director

compensation, but also shares or ADSs acquired through any other means. Stock options or

other equity awards that are deemed as being benecially owned under the applicable SEC rules

are not included. For the number of shares or ADSs received as director compensation, refer to

Note 34, Related party transactions, of our consolidated nancial statements included in this

annual report.

Share ownership of the President and Chief Executive Ocer

andthe Nokia Group Leadership Team

The following table sets forth the share ownership of the President

and CEO, and the Group Leadership Team members in oce, in

aggregate, at December 31, 2015. The share ownership of all

members of the Group Leadership Team, including Mr. Suri, was

approximately 0.01% of the outstanding shares of the company

atDecember 31, 2015. The share ownership requirement of the

President and CEO as well as the Group Leadership Team members

isdescriber under “—Variable pay” above.

Beneficially owned shares

number

Rajeev Suri, President and CEO 29 722

Other members of the Group Leadership

Team, in aggregate 200 055

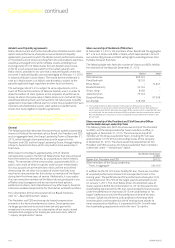

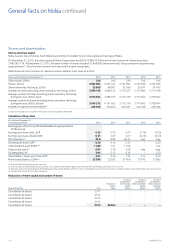

In addition to the 29 722 shares held by Mr. Suri, there are a number

ofunvested performance shares that are expected to vest in the

coming years. The performance of the performance share plan 2014

isnow known and 125.72% of the target award is expected to vest

onJanuary 1, 2017. The chart below shows the expected value of

shares valued at EUR 6.60 on December 31, 2015 compared to the

shareholding requirement for Mr. Suri. Unvested performance shares

under the performance share plan 2015 are valued below at “on

target” performance until the nal performance level of the plan

isknown. Subject to the terms and conditions of the long-term

incentive plans and the potential saleof vesting share awards to

meetassociated tax liabilities, it is expected that Mr. Suri will meet

theshareholding requirements within the next 12 months.