Nokia 2015 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2015 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

123

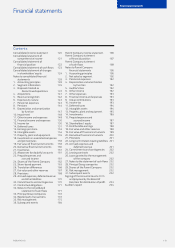

Financial statements

NOKIA IN 2015

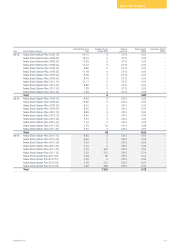

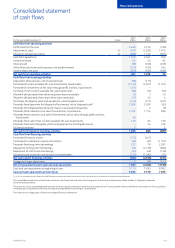

For the year ended December 31 Notes

2015

EURm

2014

EURm

2013

EURm

Cash ow from operating activities

Prot/(loss) for the year 2 468 3 476 (739)

Adjustments, total 32 (261) (2 262) 1 913

Change in net working capital 32 (998) 1 153 (945)

Cash from operations 1 209 2 367 229

Interest received 62 45 92

Interest paid (99) (336) (208)

Other nancial income and expenses, net (paid)/received (375) (165) 345

Income taxes, net paid (290) (636) (386)

Net cash from operating activities 507 1 275 72

Cash ow from investing activities

Acquisition of businesses, net of acquired cash (98) (175) –

Purchase of current available-for-sale investments, liquid assets (3 133) (2 977) (1 021)

Purchase of investments at fair value through prot and loss, liquid assets (311) – –

Purchase of non-current available-for-sale investments (88) (73) (53)

(Payment of)/proceeds from other long-term loans receivable (2) 7 (1)

(Payment of)/proceeds from short-term loans receivable (17) 20 4

Purchases of property, plant and equipment, and intangible assets (314) (311) (407)

Proceeds from/(payment for) disposal of businesses, net of disposed cash(1) 2 586 2 508 (63)

Proceeds from disposal/(purchase) of shares in associated companies –7 (8)

Proceeds from maturities and sale of investments, liquid assets 3 074 1 774 586

Proceeds from maturities and sale of investments at fair value through prot and loss,

liquid assets 48 – –

Proceeds from sale of non-current available-for-sale investments 149 62 129

Proceeds from sale of property, plant and equipment and intangible assets –44 138

Dividends received 2 – 5

Net cash from/(used in) investing activities 1 896 886 (691)

Cash ow from nancing activities

Purchase of treasury shares (173) (427) –

Purchase of a subsidiary’s equity instruments (52) (45) (1 707)

Proceeds from long-term borrowings 232 79 2 291

Repayment of long-term borrowings (24) (2 749) (862)

Repayment of short-term borrowings (55) (42) (128)

Dividends paid and other contributions to shareholders (512) (1 392) (71)

Net cash used in nancing activities (584) (4 576) (477)

Foreign exchange adjustment 6 (48) (223)

Net increase/(decrease) in cash and cash equivalents 1 825 (2 463) (1 319)

Cash and cash equivalents at beginning of year 5 170 7 633 8 952

Cash and cash equivalents at end of year 6 995 5 170 7 633

(1) In 2014, proceeds from the Sale of the D&S Business are presented net of the amount of principal and accrued interest on the repaid convertible bonds.

The consolidated statement of cash ows combines cash ows from both the Continuing and the Discontinued operations. Refer to Note 3, Disposals treated as

Discontinued operations.

The amounts in the consolidated statement of cash ows cannot be directly traced from the statement of nancial position without additional information on the acquisitions

and disposals of subsidiaries and the net foreign exchange dierences arising on consolidation.

The notes are an integral part of these consolidated nancial statements.

Consolidated statement

of cash ows