Nokia 2015 Annual Report Download - page 181

Download and view the complete annual report

Please find page 181 of the 2015 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

179

Financial statements

NOKIA IN 2015

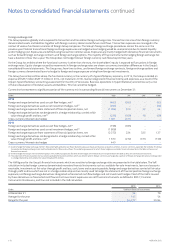

Financial credit risk

Financial instruments contain an element of risk resulting from changes in the market price due to counterparties becoming less creditworthy

orrisk of loss due to counterparties being unable to meet their obligations. Financial credit risk is measured and monitored centrally by

GroupTreasury. Financial credit risk is managed actively by limiting counterparties to a sucient number of major banks and nancial

institutions, andby monitoring the creditworthiness and the size of exposure continuously. Additionally, the Group enters into netting

arrangements with allmajor counterparties, which give the Group the right to oset in the event that the counterparty would not be able to

fulll its obligations. The Group enters into collateral agreements with certain counterparties, which require counterparties to post collateral

against derivative receivables.

Investment decisions are based on strict creditworthiness and maturity criteria as dened in the Treasury-related policies and procedures.

Asaresult of this investment policy approach and active management of outstanding investment exposures, the Group has not been subject

toany material credit losses in its nancial investments in the years presented.

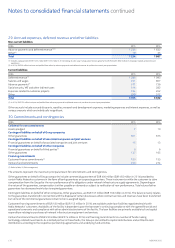

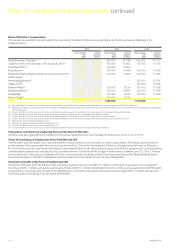

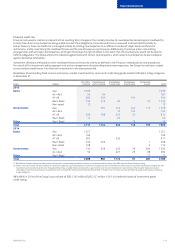

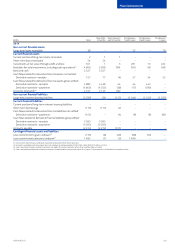

Breakdown of outstanding xed-income and money-market investments by sector and credit rating grade ranked to Moody’s rating categories

at December 31:

EURm Rating(1)

Due within

3 months

Due between 3

and 12 months

Due between

1 and 3 years

Due between

3 and 5 years

Due beyond

5 years Total(2)

2015

Banks Aaa 3 269 3 269

Aa1-Aa3 93 94 187

A1-A3 280 320 100 700

Baa1-Baa3 738 475 90 50 1 353

Non-rated 12 12

Governments Aaa 267 252 444 113 1 076

Aa1-Aa3 10 140 150

A1-A3 309 198 257 50 814

Baa1-Baa3 12 23 35

Other Baa1-Baa3 12 12

Total 4 713 1 354 632 746 163 7 608

2014

Banks Aaa 1 227 1 227

Aa1-Aa3 162 162

A1-A3 587 330 917

Baa1-Baa3 332 325 1 658

Non-rated 108 2 110

Governments Aaa 130 556 423 26 385 1 520

Aa1-Aa3 50 421 25 88 584

Other Baa1-Baa3 11 11

Total 2 596 881 1 174 51 487 5 189

(1) Bank Parent Company ratings are used here for bank groups. In some emerging markets countries, actual bank subsidiary ratings may dier from the Parent Company rating.

(2) Fixed-income and money-market investments include term deposits, structured deposits, investments in liquidity funds and investments in xed income instruments classied as available-for-sale

investments and investments at fair value through prot and loss. Liquidity funds invested solely in government securities are included under Governments. Other liquidity funds are included

underBanks. Fixed-income and money-market investments include EUR 5 million of restricted investments (EUR 11 million in 2014). These are restricted nancial assets under various contractual

orlegalobligations.

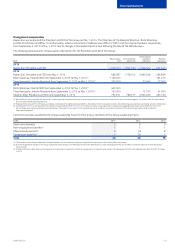

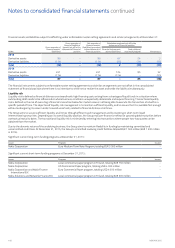

98% (98% in 2014) of the Group’s cash at bank of EUR 2 242 million (EUR 2 527 million in 2014) is held with banks of investment grade

creditrating.