Nokia 2015 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2015 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.134 NOKIA IN 2015

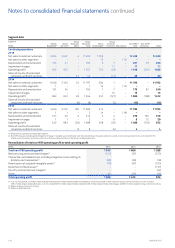

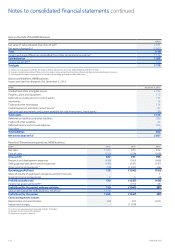

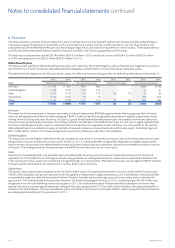

Allowances for excess and obsolete inventory

Allowances for excess and obsolete inventory are recognized for

excess amounts, obsolescence and declines in net realizable value

below cost. Estimation and judgment are required in determining

thevalue of the allowance for excess and obsolete inventory at each

statement of nancial position date. Management specically analyzes

estimates of future demand for products when determining

allowances for excess and obsolete inventory. Changes in these

estimates could result in revisions to the valuation of inventory

infuture periods. Based on these estimates and assumptions,

allowances for excess and obsolete inventory are EUR 195 million

(EUR204 million in 2014), representing 16%of inventory (14% in

2014). Refer to Note 21, Inventories.

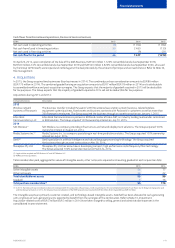

Fair value of derivatives and other nancial instruments

The fair value of derivatives and other nancial instruments that

arenot traded in an active market such as unlisted equities is

determined using valuation techniques. Estimation and judgment

arerequired in selecting an appropriate valuation technique and

indetermining the underlying assumptions. Where quoted market

prices are not available for unlisted shares, the fair value is based

onanumber of factors including, but not limited to, the current

market value of similar instruments; prices established from recent

arm’s- length transactions; and/or analysis of market prospects and

operating performance of target companies with reference to public

market comparable companies in similar industry sectors. Changes

inthese estimates could result in impairments or losses in future

periods. Based on these estimates and assumptions, the fair value

ofderivatives and other nancial instruments that are not traded in

anactive market, using non-observable data (level 3 of the fair value

hierarchy), is EUR 688 million (EUR 556 million in 2014), representing

6% of total nancial assets measured at fair value on a recurring basis

(7% in 2014). Refer to Note 19, Fair value of nancial instruments.

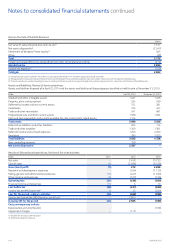

Provisions

Provisions are recognized when the Group has a present legal or

constructive obligation as a result of past events, it is probable that

anoutow of resources will be required to settle the obligation, and

areliable estimate of the amount can be made. At times, judgment is

required in determining whether the Group has a present obligation;

estimation is required in determining the value of the obligation.

Whilstprovisions are based on the best estimate of unavoidable costs,

management may be required to make a number of assumptions

surrounding the amount and likelihood of outow of economic

resources, and the timing of payment. Changes in estimates of timing

or amounts of costs to be incurred may become necessary as time

passes and/or more accurate information becomes available. Based

onthese estimates and assumptions, provisions amount to

EUR 725 million (EUR 873 million in 2014). Refer to Note 28, Provisions.

Legal contingencies

Legal proceedings covering a wide range of matters are pending or

threatened in various jurisdictions. Provisions are recognized for

pending litigation when it is apparent that an unfavorable outcome is

probable and a best estimate of unavoidable costs can be reasonably

estimated. Due to the inherently uncertain nature of litigation, the

ultimate outcome or actual cost of settlement may vary materially

from estimates. Refer to Note 28, Provisions.

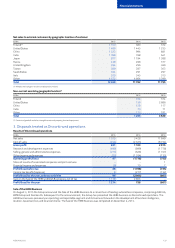

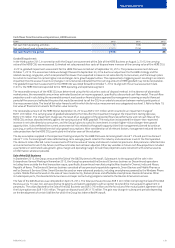

New accounting pronouncements under IFRS

The Group will adopt the following new and revised standards,

amendments and interpretations to existing standards issued by

theIASB that are expected to be relevant to its operations and

nancial position:

IFRS 9, Financial Instruments, was issued in July 2014 and replaces

IAS39, Financial Instruments: Recognition and Measurement. The

Group will adopt the standard at the latest on the eective date of

January 1, 2018. The adoption of the new standard will impact the

classication and measurement of the Group’s nancial assets and

introduces a new hedge accounting model. The Group is currently

assessing the impact of IFRS 9.

IFRS 15, Revenue from Contracts with Customers, was issued in May

2014 and establishes a new ve-step model that will apply to revenue

arising from contracts with customers. Under IFRS 15, revenue is

recognized to reect the transfer of promised goods and services

tocustomers for amounts that reect the consideration to which an

entity expects to be entitled in exchange for those goods or services

to a customer. The Group will adopt the standard on the eective date

of January 1, 2018. The adoption of the new standard is likely to have

an impact on revenue recognition. The impact of IFRS 15 is currently

being assessed.

IFRS 16, Leases, was issued in January 2016 and sets out the

principles for the recognition, measurement, presentation and

disclosure requirements on leases. The Group expects to adopt the

standard on the eective date of January 1, 2019. The standard

provides a single lessee accounting model, requiring lessees to

recognize assets and liabilities for all leases unless the lease term

is12months or less or the underlying asset has a low value. The

adoption of the new standard will have an impact on the way leases

arerecognized and presented. The full impact of IFRS 16 is currently

being assessed.

On January 1, 2016, the Group will adopt amendments to multiple

IFRS standards, which result from the IASB’s annual improvement

projects for the 2012-2014 cycle. They comprise amendments

thatresult in accounting changes for presentation, recognition

ormeasurement purposes as well as terminology or editorial

amendments related to a variety of individual IFRS standards.

Theamendments will not have a material impact on the Group’s

consolidated nancial statements.

Notes to consolidated nancial statements continued