Nokia 2015 Annual Report Download - page 173

Download and view the complete annual report

Please find page 173 of the 2015 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

171

Financial statements

NOKIA IN 2015

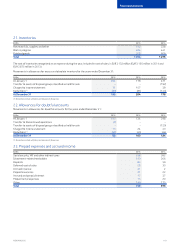

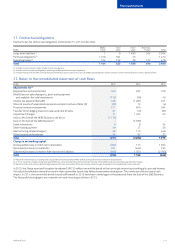

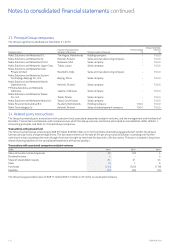

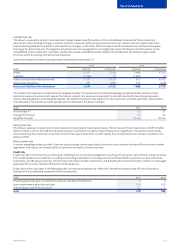

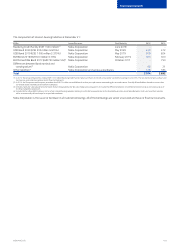

31. Contractual obligations

Payments due for contractual obligations at December 31, 2015 by due date:

EURm

Within

1 year

1 to 3

years

3 to 5

years

More than

5 years Total

Long-term liabilities(1) 1 9 1 480 554 2 044

Purchase obligations(2) 1 019 361 40 – 1 420

Operating leases(3) 124 152 78 122 476

Total 1 144 522 1 598 676 3 940

(1) Includes current maturities. Refer to Note 35, Risk management.

(2) Includes inventory purchase obligations, service agreements and outsourcing arrangements.

(3) Includes leasing costs for oce, manufacturing and warehouse space under various non-cancellable operating leases. Certain contracts contain renewal options for various periods of time.

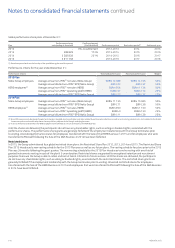

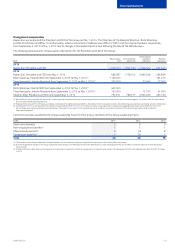

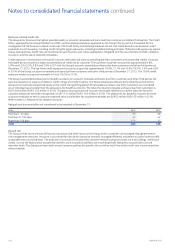

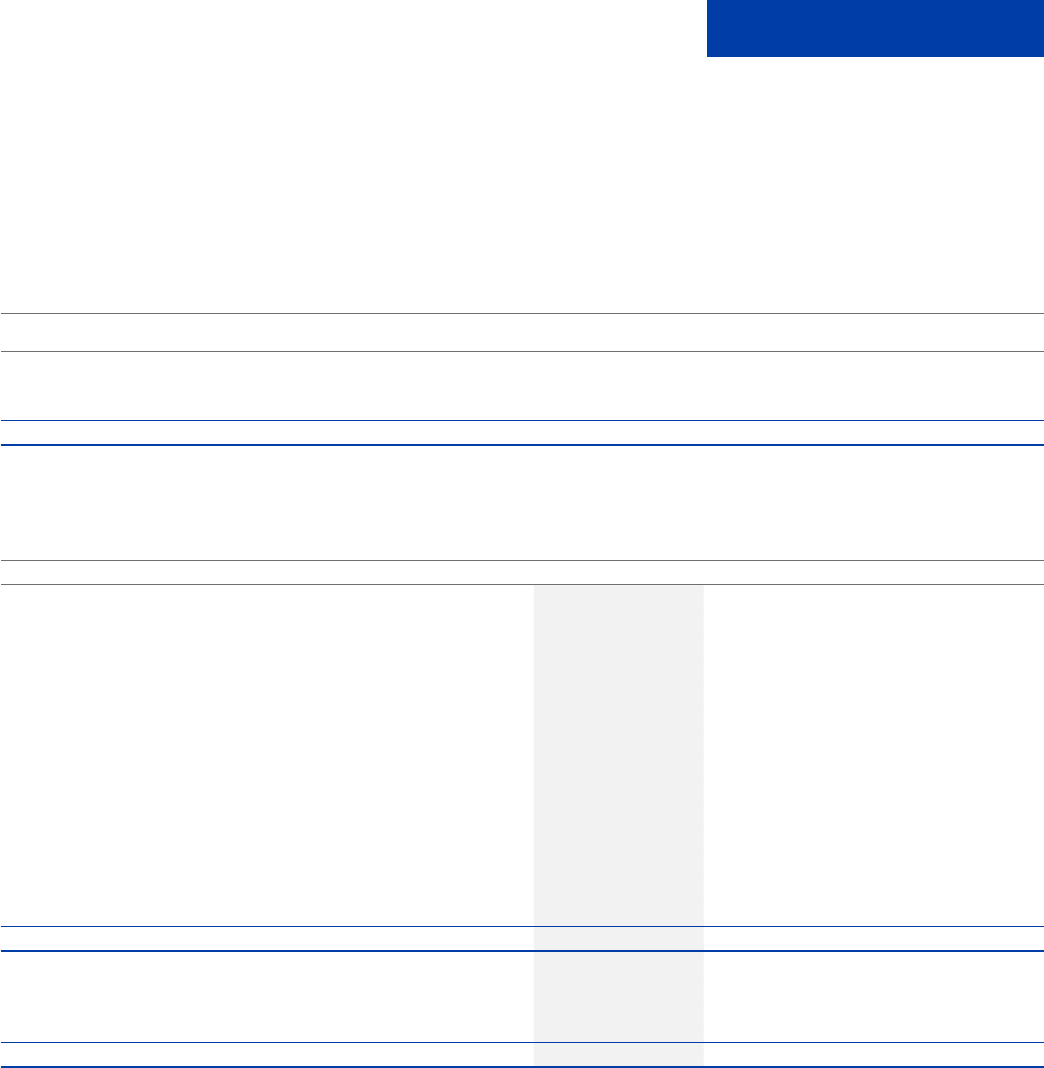

32. Notes to the consolidated statement of cash ows

EURm 2015 2014 2013

Adjustments for (1)

Depreciation and amortization 320 297 728

(Prot)/loss on sale of property, plant and equipment

and available-for-sale investments (132) (56) 40

Income tax expense/(benet) 338 (1 281) 401

Share of results of associated companies and joint ventures (Note 18) (29) 12 (4)

Financial income and expenses 211 600 264

Transfer from hedging reserve to sales and cost of sales 61 (10) (87)

Impairment charges 11 1 335 20

Gain on the Sale of the HERE Business, net of tax (1 178) – –

Gain on the Sale of the D&S Business(2) –(3 386) –

Asset retirements 6 8 24

Share-based payment 49 37 56

Restructuring-related charges(3) 48 115 446

Other income and expenses 34 67 25

Total (261) (2 262) 1 913

Change in net working capital

(Increase)/decrease in short-term receivables (693) 115 1 655

Decrease/(increase) in inventories 341 (462) 193

(Decrease)/increase in interest-free short-term liabilities (646) 1 500 (2 793)

Total (998) 1 153 (945)

(1) Adjustments for the Group, including Continuing and Discontinued operations. Refer to Note 3, Disposals treated as Discontinued operations.

(2) In 2014, impairment charges, foreign exchange dierences, taxes and other adjustments relating to the Sale of the D&S Business are presented separately from the gain.

(3) Adjustments for restructuring-related charges represent the non-cash portion of the restructuring-related charges recognized in the consolidated income statement.

In 2015, the Group exercised its option to redeem EUR 750 million convertible bonds at their principal amount outstanding plus accrued interest.

Virtually all bondholders elected to convert their convertible bonds into Nokia shares before redemption. The conversion did not have a cash

impact. In 2014, the convertible bonds issued to Microsoft in 2013 have been netted against the proceeds from the Sale of the D&S Business.

The Group did not engage in any material non-cash investing activities in 2013.