Nokia 2015 Annual Report Download - page 164

Download and view the complete annual report

Please find page 164 of the 2015 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.162 NOKIA IN 2015

Notes to consolidated nancial statements continued

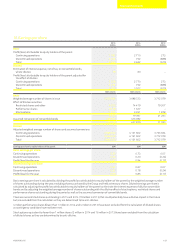

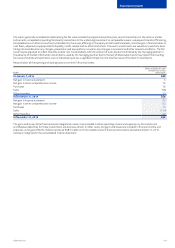

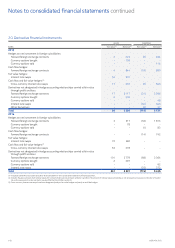

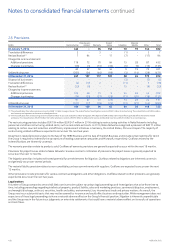

24. Shares of the Parent Company

Shares and share capital

Nokia Corporation (“Parent Company”) has one class of shares. Each share entitles the holder to one vote at General Meetings. At December31,

2015, the share capital of Nokia Corporation is EUR 245 896 461.96 and the total number of shares issued is 3 992 863 716. At December31,

2015, the total number of shares includes 53 668 695 shares owned by Group companies representing 1.3% of share capital and total voting

rights. Under the Nokia Articles of Association, Nokia Corporation does not have minimum or maximum share capital or share par value.

On February 4, 2015, the Parent Company cancelled 66 903 682 shares.

In 2015, under the authorization held by the Board of Directors and in line with the capital structure optimization program, the Parent Company

repurchased 24 516 089 shares representing approximately 0.6% of share capital and total voting rights. The price paid for the shares was

based on the current market price of the Nokia share on the securities market at the time of the repurchase.

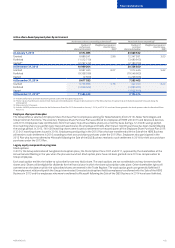

On January 7, 2016, in connection with the transaction with Alcatel Lucent, the Parent Company issued, under the authorization granted to the

Board of Directors in the Extraordinary General Meeting held on December 2, 2015, a total of 1 455 678 563 new Nokia shares as consideration

for the Alcatel Lucent securities tendered into the initial Public Exchange Oers made in France and the United States. On February 12, 2016,

after the oers were reopened and settled in France and the United States, the Parent Company issued, under the authorization granted to the

Board of Directors in the Extraordinary General Meeting held on December 2, 2015, a total of 320 701 193 new Nokia shares as consideration

for the Alcatel Lucent securities tendered into the reopened Public Exchange Oers.

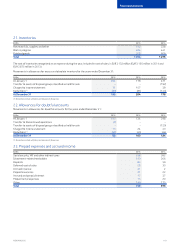

Authorizations

Authorization to issue shares and special rights entitling to shares

At the Annual General Meeting held on June17, 2014, the shareholders authorized the Board of Directors to issue a maximum of

740million shares through one or more issues of shares or special rights entitling to shares. The Board of Directors may issue either new shares

or shares held by the Parent Company. The authorization includes the right for the Board of Directors to resolve on all the terms and conditions

of such share and special rights issuances, including issuance in deviation from the shareholders’ pre-emptive rights. The authorization may be

used to develop the Parent Company’s capital structure, diversify the shareholder base, nance or carry out acquisitions or other arrangements,

settle the Parent Company’s equity-based incentive plans, or for other purposes resolved by the Board of Directors. Theauthorization that

would have been eective until December 17, 2015 was terminated by the resolution of the Annual General Meeting onMay 5, 2015.

At the Annual General Meeting held on May 5, 2015, the shareholders authorized the Board of Directors to issue a maximum of

730 million shares through one or more issues of shares or special rights entitling to shares. The Board of Directors may issue either new shares

or shares held by the Parent Company. The authorization includes the right for the Board of Directors to resolve on all the terms and conditions

of such share and special rights issuances, including issuance in deviation from the shareholders’ pre-emptive rights. The authorization may be

used to develop the Parent Company’s capital structure, diversify the shareholder base, nance or carry out acquisitions or other arrangements,

settle the Parent Company’s equity-based incentive plans, or for other purposes resolved by the Board of Directors. The authorization is

eective until November 5, 2016.

At the Extraordinary General Meeting held on December 2, 2015, the shareholders authorized the Board of Directors to issue, in deviation

fromthe shareholders’ pre-emptive right, a maximum of 2 100 million shares through one or more share issues. The authorization includes

theright for the Board of Directors to resolve on all the terms and conditions of such share issuances. The authorization may be used to issue

Parent Company shares to the holders of Alcatel Lucent shares, American depositary shares and convertible bonds as well as to beneciaries

ofAlcatel Lucent employee equity compensation arrangements for the purpose of implementing the transaction with Alcatel Lucent, including

the consummation of the public Exchange Oers made to Alcatel Lucent shareholders as well as other transactions contemplated by the

memorandum of understanding between the Group and Alcatel Lucent, and/or otherwise to eect the combination of the Group and

AlcatelLucent. Theauthorization is eective until December 2, 2020.

In 2015, the Parent Company issued 1 042 016 new shares following the holders of stock options issued in 2011 and 2012 exercising

theiroptions.

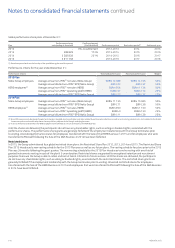

On October26, 2012, the Group issued a EUR 750million convertible bond based on an authorization to issue shares and special rights entitling

to shares, granted by the Annual General Meeting on May6, 2010 and terminated by a resolution in the Annual General Meeting on May7, 2013.

The bonds had a ve-year maturity and a 5.0%per annum coupon payable semi annually. The initial conversion price was EUR2.6116, which

was adjusted to EUR 2.44per share on June18, 2014 due to the distribution of ordinary and special dividends, as resolved bythe Annual General

Meeting on June17, 2014. The conversion price was further adjusted to EUR 2.39 per share on May 6, 2015 due to the distribution of ordinary

dividends, as resolved by the Annual General Meeting on May 5, 2015. The right to convert the bonds into shares commenced on December 6,

2012 and ends on October 18, 2017. Bond terms and conditions require conversion price adjustments following dividend distributions.