Nokia 2015 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2015 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

107

General facts on Nokia

NOKIA IN 2015

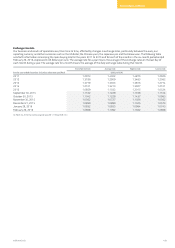

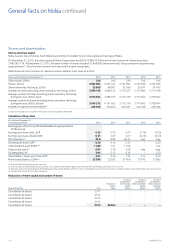

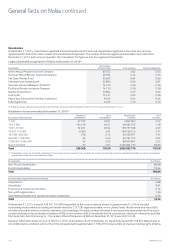

Disclosure of shareholder ownership or voting power

According to the Finnish Securities Market Act, which entered into

force on January 1, 2013, a shareholder shall disclose their ownership

or voting power to the company and theFinnish Financial Supervisory

Authority when the ownership or voting power reaches, exceeds or

falls below 5, 10, 15, 20, 25, 30, 50or 90% of all the shares or the

voting rights outstanding. The term “ownership” includes ownership

by the shareholder, as well as selected related parties,and calculating

the ownership or voting power covers agreements or other

arrangements, which when concluded would cause the proportion of

voting rights or number of shares to reach, exceed or fall below the

aforementioned limits. Upon receiving such notice, the company shall

disclose it by a stock exchange release without undue delay.

Purchase obligation

Our Articles of Association require a shareholder that holds one-third

or one-half of all of our shares to purchase the shares of all other

shareholders that so request, at a price generally based on the

historical weighted average trading price of the shares. A shareholder

who becomes subject to the purchase obligation is also obligated to

purchase any subscription rights, stock options or convertible bonds

issued by the company if so requested by the holder. The purchase

price of the shares under our Articles of Association is the higher of:

(a)the weighted average trading price of the shares on Nasdaq Helsinki

during the ten business days prior to the day on which we have been

notied by the purchaser that its holding has reached or exceeded

thethreshold referred to above or, in the absence of such notication

or its failure to arrive within the specied period, the day on which

ourBoard otherwise becomes aware of this; or (b) the average price,

weighted by the number of shares, which the purchaser has paid for

the shares it has acquired during the last 12 months preceding the

date referred to in (a).

Under the Finnish Securities Market Act, a shareholder whose voting

power exceeds 30% or 50% of the total voting rights in a company

shall, within one month, oer to purchase the remaining shares of the

company, as well as any other rights entitling to the shares issued by

the company, such as subscription rights, convertible bonds or stock

options issued by the company. The purchase price shall be the market

price of the securities in question. The market price is determined

onthe basis of the highest price paid for the security during the

preceding six months by the shareholder or any party in close

connection to the shareholder. This price can be deviated from for a

specic reason. If the shareholder or any related party has not during

the six months preceding the oer acquired any securities that are

thetarget for the oer, the market price is determined based on the

average of the prices paid for the security in public trading during the

preceding three months weighted by the volume of trade. This price

can be deviated from for a specic reason.

Under the Finnish Companies Act, a shareholder whose holding

exceeds nine-tenths of the total number of shares or voting rights

inNokia has both the right and, upon a request from the minority

shareholders, the obligation to purchase all the shares of the minority

shareholders for the current market price. The market price is

determined, among other things, on the basis of the recent market

price of the shares. The purchase procedure under the Finnish

Companies Act diers, and the purchase price may dier, from the

purchase procedure and price under the Finnish Securities Market Act,

as discussed above. However, if the threshold of nine-tenths has been

exceeded through either a mandatory or a voluntary public oer

pursuant to the Finnish Securities Market Act, the market price under

the Finnish Companies Act is deemed to be the price oered in the

public oer, unless there are specic reasons to deviate from it.

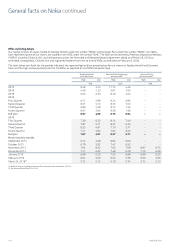

Pre-emptive rights

In connection with any oering of shares, the existing shareholders

have a pre-emptive right to subscribe for shares oered in proportion

to the amount of shares in their possession. However, a general

meeting of shareholders may vote, by a majority of two-thirds of the

votes cast and two-thirds of the shares represented at the meeting,

towaive this pre-emptive right provided that, from the company’s

perspective, weighty nancial grounds exist.

Under the Finnish Act on the Monitoring of Foreign Corporate

Acquisitions (2012/172 as amended), a notication to the Ministry

ofEmployment and the Economy is required for a non-resident of

Finland, directly or indirectly, when acquiring one-tenth or more of

thevoting power or corresponding factual inuence in a company.

TheMinistry of Employment and the Economy has to conrm the

acquisition unless the acquisition would jeopardize important national

interests, in which case the matter is referred to the Council of State.

Ifthe company in question is operating in the defense sector, an

approval by the Ministry of Employment and the Economy is required

before the acquisition is made. These requirements are not applicable

if, for instance, the voting power is acquired in a share issue that is

proportional to the holder’s ownership of the shares. Moreover, the

requirements do not apply to residents of countries in the European

Economic Area or EFTA countries.