Nokia 2015 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2015 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.48 NOKIA IN 2015

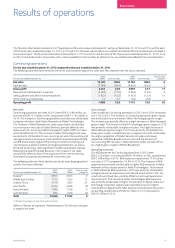

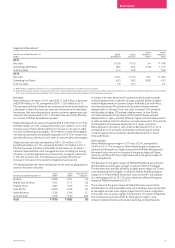

Results of operations continued

Our selling, general and administrative expenses for Continuing

operations in 2015 were EUR 1 652 million, an increase of

EUR 199 million, or 14%, compared to EUR 1 453 million in 2014.

Selling, general and administrative expenses represented 13.2% of

our net sales in 2015 compared to 12.4% in 2014. The increase in

selling, general and administrative expenses was attributable to higher

selling, general and administrative expenses in Nokia Networks, and to

a lesser extent in Group Common Functions and Nokia Technologies.

The increase in Nokia Networks selling, general and administrative

expenses was primarily attributable to higher personnel expenses,

partially oset by a continued focus on cost eciency. The increase in

Group Common Functions selling, general and administrative expenses

was primarily attributable to transaction and other related costs.

In2015, Group Common Functions included transaction-related

costsofEUR 99 million compared to EUR 29 million in 2014. The

increase in Nokia Technologies selling, general and administrative

expenses was primarily attributable to the ramp-up of new businesses,

increased licensing activities, and higher business support costs.

Selling, general and administrative expenses included purchase price

accounting-related items of EUR 44 million in 2015 compared to

EUR 35 million in2014.

Other income and expenses for Continuing operations in 2015

wasanet income of EUR 13 million, an increase of EUR 107 million,

compared to a net expense of EUR 94 million in 2014. The increase

inother income and expenses was primarily attributable to Group

Common Functions, and to a lesser extent Nokia Networks and

NokiaTechnologies. Group Common Functions other income and

expenses in 2015 included net income of approximately EUR 100

million related to investments made through unlisted venture funds.

The change in Nokia Networks other income and expenses in 2015

wasprimarily attributable to the absence of a EUR 31 million charge

in2014 for anticipated contractual remediation costs related to a

technical issue with a third party component, lower costs related to

the sale of receivables, lower net indirect tax expenses and the release

of certain doubtful account allowances, partially oset by higher

restructuring and associated charges. Nokia Networks other income

and expenses included restructuring and associated charges of

EUR 121 million in 2015 compared to EUR 57 million in 2014.

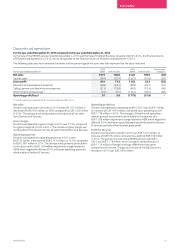

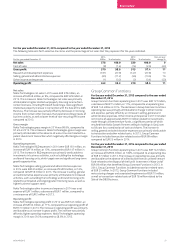

Operating prot

Our operating prot for Continuing operations in 2015 was

EUR 1 688 million, an increase of EUR 276 million, or 19.5%, compared

to an operating prot of EUR 1 412 million in 2014. The increase in

operating prot was primarily attributable to an increase in operating

prot in Nokia Technologies and a lower operating loss from Group

Common Functions, partially oset by lower operating prot in Nokia

Networks. Our operating prot in 2015 included purchase price

accounting-related items, restructuring charges and other special

items of EUR 261 million compared to EUR 188 million in 2014. Our

operating margin in 2015 was 13.5% compared to 12.0% in 2014.

Financial income and expenses

Financial income and expenses for Continuing operations was a net

expense of EUR 177 million in 2015 compared to a net expense of

EUR401 million in 2014, a decrease of EUR 224 million, or 56%.

Thelower net nancial expense in 2015 was primarily attributable to

the absence of a nancial expense of EUR 123 million relating to the

redemption of all material Nokia Networks’ borrowings in 2014, and

theabsence of a non-cash charge of EUR 57 million relating to the

repayment of EUR 1 500 million convertible bonds issued to Microsoft.

Refer to “—Liquidity and capital resources” below.

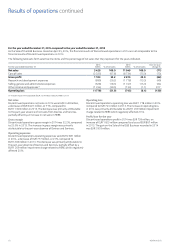

Prot before tax

Our prot before tax for Continuing operations in 2015 was

EUR 1 540 million, an increase of EUR 541 million compared to

EUR 999 million in2014.

Income tax

Income taxes for Continuing operations was a net expense of

EUR346million in 2015, a change of EUR 2 065 million compared

to a net benet of EUR 1 719 million in 2014. In 2014, the net

incometax benet was primarily attributable to the recognition of

EUR 2 126 million deferred tax assets following the reassessment

ofrecoverability of tax assets in Finland and Germany.

Prot attributable to equity holders of the parent and earnings

pershare

Prot attributable to equity holders of the parent in 2015 was

EUR2466 million, a decrease of EUR 996 million, compared to a prot

of EUR 3 462 million in 2014. Continuing operations generated prot

attributable to equity holders of the parent in 2015 of EUR 1 192 million

compared to a prot of EUR 2 710 million in 2014. Prot attributable

to equity holders of the parent in 2014 was favorably impacted by the

recognition of EUR 2 126 million deferred tax assets. Nokia Group’s

total basic EPS in 2015 decreased to EUR 0.67 (basic) and EUR 0.63

(diluted) compared to EUR 0.94 (basic) and EUR 0.85 (diluted) in 2014.

From Continuing operations, EPS in 2015 decreased to EUR 0.32

(basic) and EUR 0.31 (diluted) compared to EUR 0.73 (basic) and

EUR0.67 (diluted) in 2014.