Nokia 2015 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2015 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55

Board review

NOKIA IN 2015

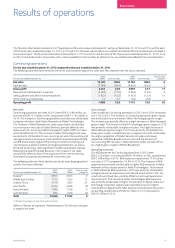

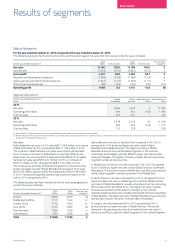

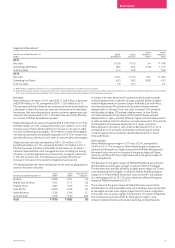

Segment information(1)

For the year ended December 31

EURm

Mobile

Broadband

Global

Services

Nokia

Networks

Other(2)

Nokia

Networks

Total

2014

Net sales 6 039 5 105 54 11 198

Operating prot/(loss) 683 653 (126) 1 210

% of net sales 11.3 12.8 – 10.8

2013

Net sales 5 347 5 753 182 11 282

Operating loss/(loss) 420 693 (693) 420

% of net sales 7.9 12.0 – 3.7

(1) Refer to Note 2, Segment information, of our consolidated nancial statements included in this annual report.

(2) Nokia Networks Other includes net sales and related cost of sales and operating expenses of non-core businesses, IPR net sales and related costs, as well as Nokia Networks’ Optical business until May 6,

2013, when its divestment was completed. It also includes restructuring and associated charges for the Nokia Networks business.

Net sales

Nokia Networks net sales in 2014 were EUR 11 198 million, a decrease

of EUR 84 million, or 1%, compared to EUR 11 282 million in 2013.

Thedecrease in Nokia Networks net sales was primarily attributable to

a decrease in Global Services net sales and the absence of sales from

businesses that were divested and certain customer agreements and

countries that were exited in 2013. The decrease was partly oset by

an increase in Mobile Broadband net sales.

Mobile Broadband net sales increased to EUR 6 039 million in 2014 by

EUR 692 million, or 13%, compared to EUR 5 347 million in 2013. The

increase was primarily attributable to an increase in net sales in radio

and core networking technologies. The increase in radio technologies

net sales was primarily attributable to growth in LTE. The increase was

partially oset by a decrease in net sales in mature radio technologies.

Global Services net sales decreased to EUR 5 105 million in 2014

byEUR 648 million, or 11%, compared to EUR 5 753 million in 2013.

The decrease was primarily attributable to decreases in net sales in

network implementation and managed services including the exiting

ofcertain customer agreements and countries, as well as a decrease

inthe care business line. The decrease was partially oset by an

increase in net sales in the systems integration business line.

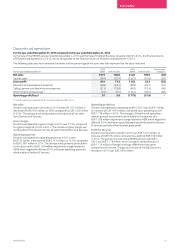

The following table sets forth distribution of net sales by geographical

area for the years indicated.

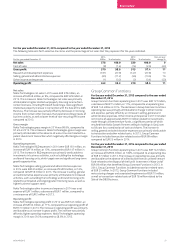

For the year ended December 31

2014

EURm

2013

EURm

Year-on-year

change %

Europe 2 929 3 041 (4)

Middle East & Africa 1 053 1 111 (5)

Greater China 1 380 1 185 16

Asia-Pacic 3 289 3 354 (2)

North America 1 538 1 334 15

Latin America 1 009 1 257 (20)

Total 11 198 11 282 (1)

In Europe, net sales decreased 4% primarily attributable to lower

network deployments in Western Europe, partially oset by higher

network deployments in Eastern Europe. In Middle East and Africa,

netsales decreased 5% primarily attributable to lower network

deployments. In Greater China, net sales increased 16% primarily

attributable to higher LTE network deployments. In Asia-Pacic,

netsales decreased 2% primarily attributable to lower network

deployments in Japan, partially oset by higher network deployments

in India and Korea. In North America, net sales increased 15% primarily

attributable to LTE network deployments at major customers.

NokiaNetworks net sales in Latin America decreased 20% in 2014

compared to 2013 primarily attributable to the exiting of certain

customer agreements and lower network deployments in Brazil,

Chileand Mexico.

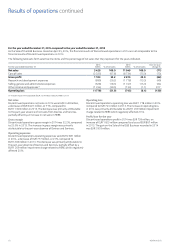

Gross margin

Nokia Networks gross margin in 2014 was 38.7%, compared to

36.6%in 2013. The increase in Nokia Networks gross margin was

primarily attributable to a higher proportion of Mobile Broadband in

the overall sales mix and an increase in the gross margin of Global

Services, partially oset by a slight decrease in the gross margin of

Mobile Broadband.

The decrease in the gross margin of Mobile Broadband was primarily

attributable to a lower gross margin in mature radio technologies.

Thedecrease was partially oset by a higher gross margin in LTE and

core networking technologies. In addition, Mobile Broadband gross

margin in 2014 benetted from lower costs incurred in anticipation

ofa technology shift to TD-LTE, which adversely aected the gross

margin of Mobile Broadband in 2013.

The increase in the gross margin of Global Services was primarily

attributable to a more favorable sales mix including a lower proportion

of managed services and a higher proportion of systems integration

inthe sales mix, as well as margin improvement in systems integration.

The increase was partially oset by lower gross margin in care,

networkimplementation and network planning and optimization.