Nokia 2015 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2015 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

147

Financial statements

NOKIA IN 2015

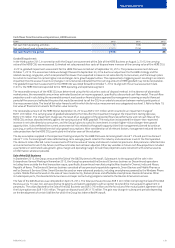

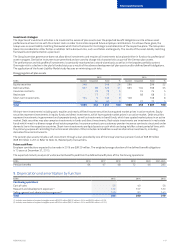

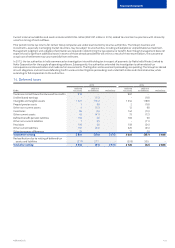

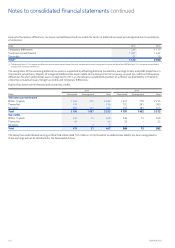

Investment strategies

The objective of investment activities is to maximize the excess of plan assets over the projected benet obligations and to achieve asset

performance at least in line with the interest costs in order to minimize required future employer contributions. To achieve these goals, the

Group uses an asset liability matching framework which forms the basis for its strategic asset allocation of the respective plans. The Group also

takes into consideration other factors in addition to the discount rate, such as ination and longevity. The results of the asset-liability matching

framework are implemented on a plan level.

The Group’s pension governance does not allow direct investments and requires all investments to be placed either in funds or by professional

asset managers. Derivative instruments are permitted and are used to change risk characteristics as part of the German plan assets.

Theperformance and risk prole of investments is constantly monitored on a stand-alone basis as well as in the broader portfolio context.

Onemajor risk is a decline in the plan’s funded status as a result of the adverse development of plan assets and/or dened benet obligations.

The application of the Asset-Liability-Model study focuses on minimizing such risks.

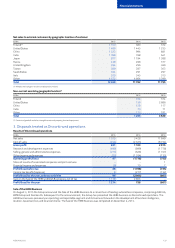

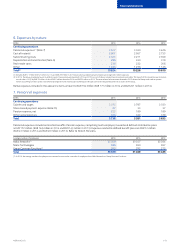

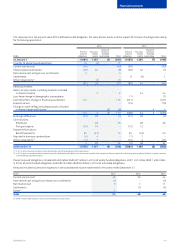

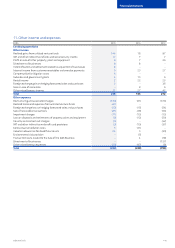

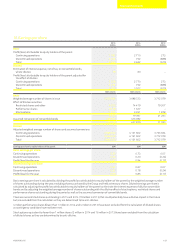

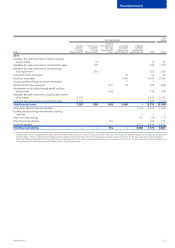

Disaggregation of plan assets

EURm

2015 2014

Quoted Unquoted Total %Quoted Unquoted Total %

Equity securities 348 348 24 296 296 22

Debt securities 627 98 725 51 665 104 769 55

Insurance contracts 78 78 574 74 5

Real estate 77 77 568 68 5

Short-term investments 124 9133 9108 108 8

Others 90 90 672 72 5

Total 1 099 352 1 451 100 1 069 318 1 387 100

All short-term investments including cash, equities and nearly all xed-income securities have quoted market prices in active markets. Equity

securities represent investments in equity funds and direct investments, which have quoted market prices in an active market. Debt securities

represent investments in government and corporate bonds, as well as investments in bond funds, which have quoted market prices in an active

market. Debt securities may also comprise investments in funds and direct investments. Real estate investments are investments in real estate

funds which invest in a diverse range of real estate properties. Insurance contracts are customary pension insurance contracts structured under

domestic law in the respective countries. Short-term investments are liquid assets or cash which are being held for a short period of time, with

the primary purpose of controlling the tactical asset allocation. Other includes commodities as well as alternative investments, including

derivative nancial instruments.

The pension plan assets include a self-investment through a loan provided by one of the Group’s German pension funds of EUR 69 million

(EUR69 million in 2014). Refer to Note 34, Related party transactions.

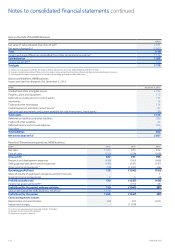

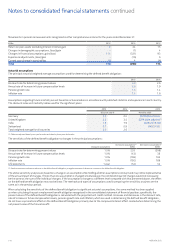

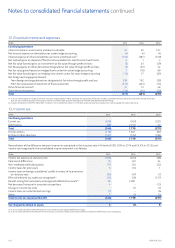

Future cash ows

Employer contributions expected to be made in 2016 are EUR 29 million. The weighted average duration of the dened benet obligations

is15years at December 31, 2015.

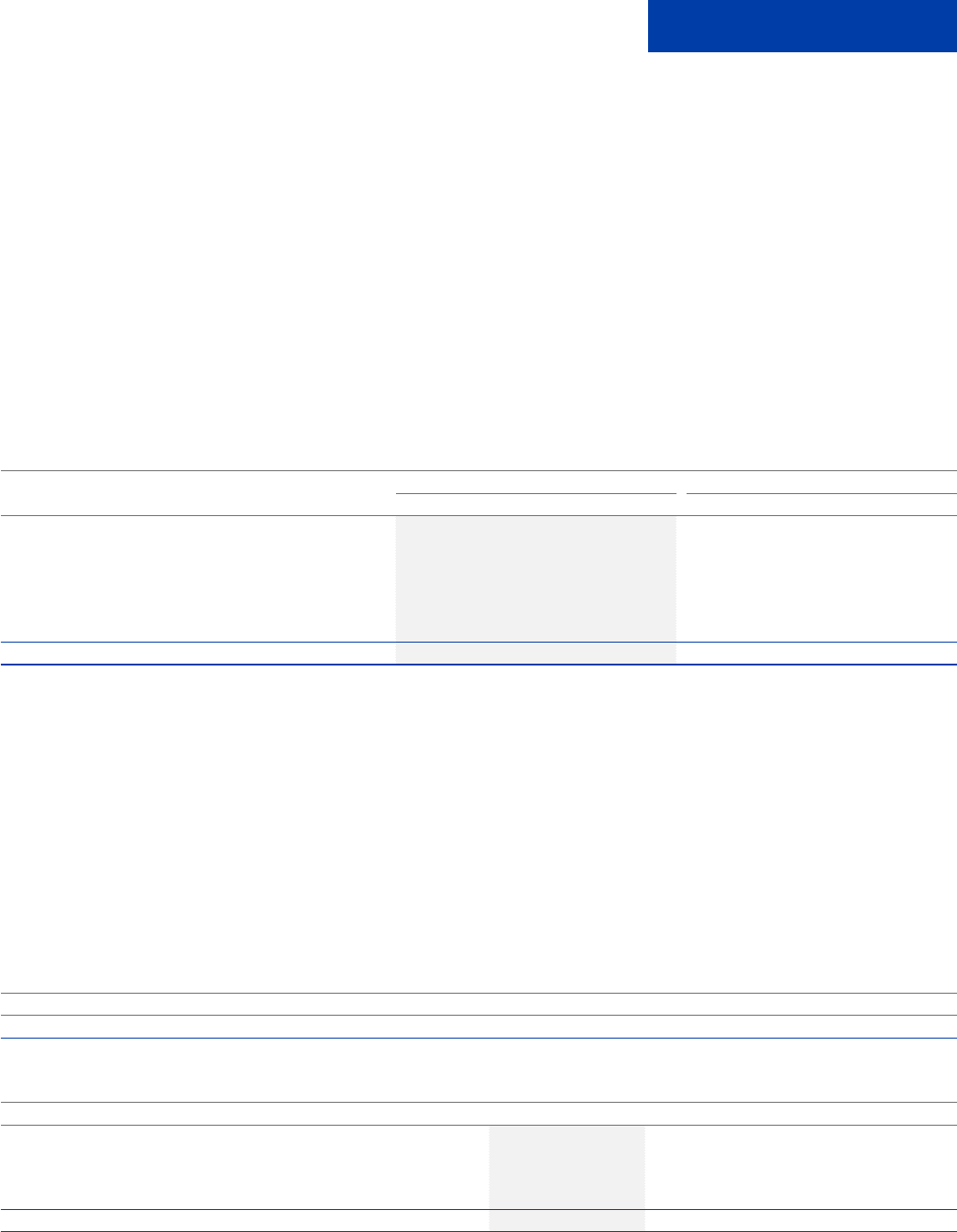

The expected maturity analysis of undiscounted benets paid from the dened benet plans of the Continuing operations:

EURm 2016 2017 2018 2019 2020 2021-2025

Pension benets 64 47 48 72 46 285

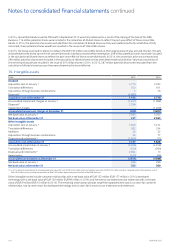

9. Depreciation and amortization by function

EURm 2015 2014 2013

Continuing operations

Cost of sales 55 40 56

Research and development expenses(1) 122 107 120

Selling, general and administrative expenses(2) 109 93 143

Total 286 240 319

(1) Includes amortization of acquired intangible assets of EUR 35 million (EUR 32 million in 2014 and EUR 20 million in 2013).

(2) Includes amortization of acquired intangible assets of EUR 44 million (EUR 35 million in 2014 and EUR 80 million in 2013 ).