Nokia 2015 Annual Report Download - page 150

Download and view the complete annual report

Please find page 150 of the 2015 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

148 NOKIA IN 2015

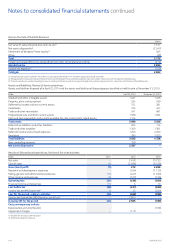

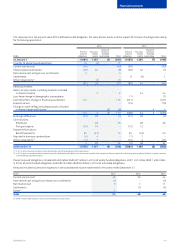

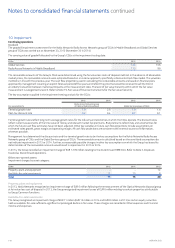

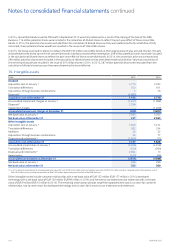

10. Impairment

Continuing operations

Goodwill

The goodwill impairment assessment for the Nokia Networks Radio Access Networks group of CGUs in Mobile Broadband and Global Services

group of CGUs was carried out at November 30, 2015 (November 30 in 2014).

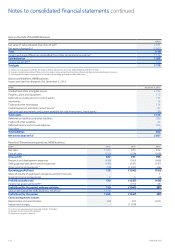

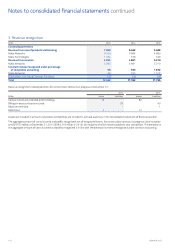

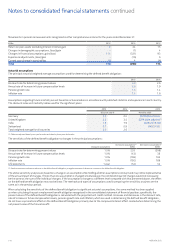

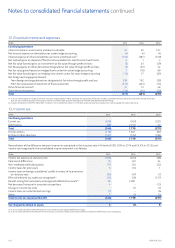

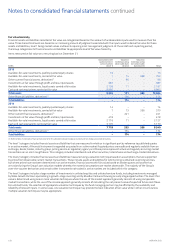

The carrying value of goodwill allocated to the Group’s CGUs at the impairment testing date:

EURm 2015 2014

Global Services 124 106

Radio Access Networks in Mobile Broadband 115 96

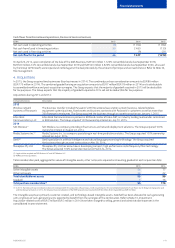

The recoverable amounts of the Group’s CGUs were determined using the fair value less costs of disposal method. In the absence of observable

market prices, the recoverable amounts were estimated based on an income approach, specically a discounted cash ow model. The valuation

method is in line with the previous year. The cash ow projections used in calculating the recoverable amounts are based on nancial plans

approved by management covering an explicit forecast period of ve years and reect the price that would be received to sell the CGU in

anorderly transaction between market participants at the measurement date. The level of fair value hierarchy within which the fair value

measurement is categorized is level 3. Refer to Note 19, Fair value of nancial instruments for the fair value hierarchy.

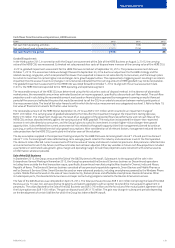

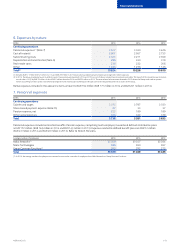

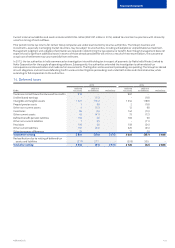

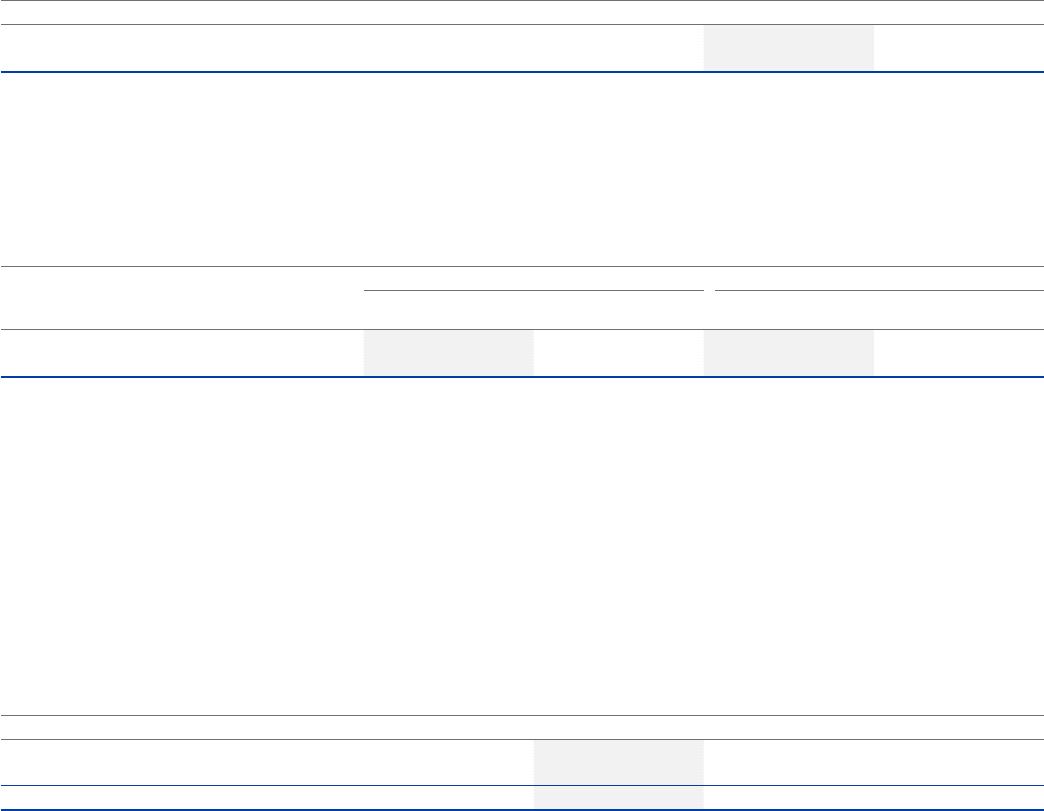

The key assumptions applied in the impairment testing analysis for the CGUs:

Key assumption %

2015 2014 2015 2014

Radio Access Networks group

of CGUs in Mobile Broadband Global Services group of CGUs

Terminal growth rate 1.0 2.6 1.0 1.6

Post-tax discount rate 9.2 9.4 8.7 9.1

Terminal growth rates reect long-term average growth rates for the industry and economies in which the CGUs operate. The discount rates

reect current assessments of the time value of money and relevant market risk premiums. Risk premiums reect risks and uncertainties for

which the future cash ow estimates have not been adjusted. Other key variables in future cash ow projections include assumptions on

estimated sales growth, gross margin and operating margin. All cash ow projections are consistent with external sources of information,

wherever possible.

Management has determined the discount rate and the terminal growth rate to be the key assumptions for the Nokia Networks Radio Access

Networks group of CGUs and the Global Services group of CGUs. The recoverable amounts calculated based on the sensitized assumptions do

not indicate impairment in 2015 or 2014. Further, no reasonably possible changes in other key assumptions on which the Group has based its

determination of the recoverable amounts would result in impairment in 2015 or 2014.

In 2014, the Group recorded an impairment charge of EUR 1 209 million relating to the discontinued HERE CGU. Refer to Note 3, Disposals

treated as Discontinued operations.

Other non-current assets

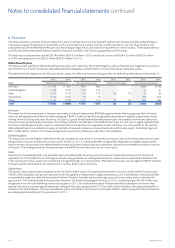

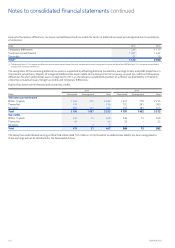

Impairment charges by asset category:

EURm 2015 2014 2013

Property, plant and equipment –– 12

Available-for-sale investments 11 15 8

Total 11 15 20

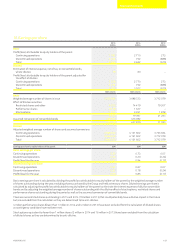

Property, plant and equipment

In 2013, Nokia Networks recognized an impairment charge of EUR 6 million following the remeasurement of the Optical Networks disposal group

at fair value less cost of disposal. In 2013, the Group recognized impairment losses of EUR 6 million relating to certain properties attributable

toGroup Common Functions.

Available-for-sale investments

The Group recognized an impairment charge of EUR 11 million (EUR 15 million in 2014 and EUR 8 million in 2013) as certain equity securities

held as available-for-sale suered a signicant or prolonged decline in fair value. These charges are recorded in Otherexpenses and Financial

income and expenses.

Notes to consolidated nancial statements continued