Nokia 2015 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2015 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

101

Corporate governance

NOKIA IN 2015

0.0

1.0

2.0

3.0

4.0

5.0

6.0

7.0

8.0

9.0

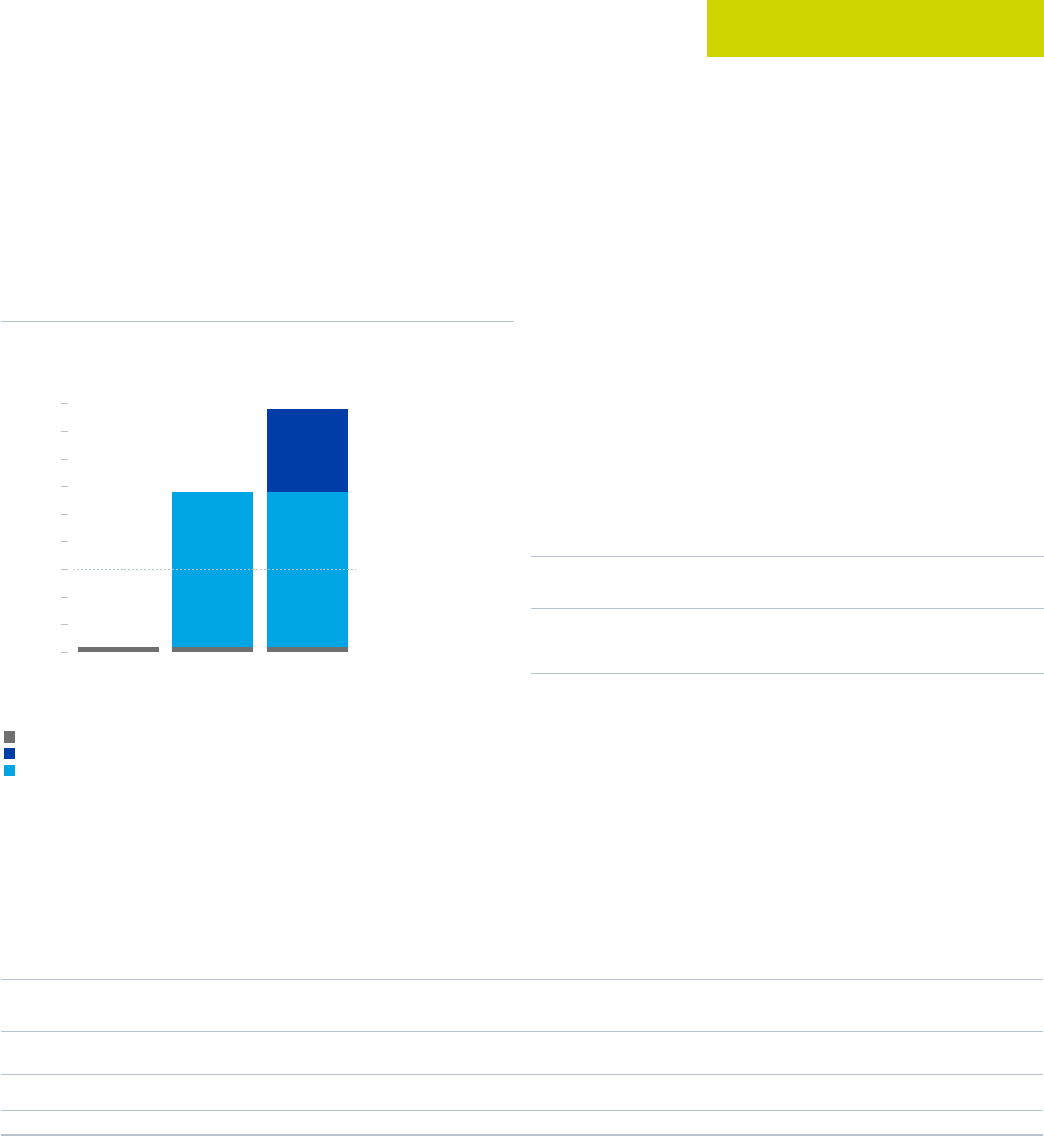

Owned

Dec. 31, 2015

Jan 1, 2017 Jan 1, 2018

Owned

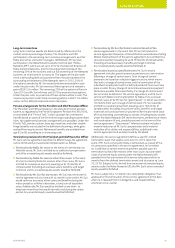

Long-term incentive 2015

Long-term incentive 2014

Value of

shares,

EURm

Threshold

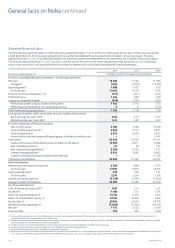

Shareholding target and awards held by the President

and CEO of Nokia

1. Valued at EUR 6.60 per share as at December 31, 2015.

2. Projections do not take into account any potential sales of shares

to meet tax associated liabilities.

3. Subject to disposals to meet tax liabilities it is expected that the President

and CEO will meet the shareholding requirements of Nokia when the long-term incentive

2014 awards vest assuming that they vest at or above target.

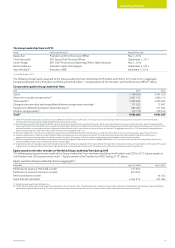

Unvested Equity awards held by the President and Chief Executive

Ocer at December 31, 2015

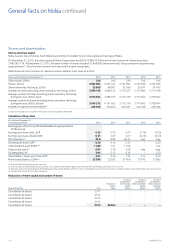

The following table provides certain information relating to

performance shares held by the President and CEO at December 31,

2015. These entitlements were granted pursuant to our performance

share plans 2014 and 2015. The 2014 performance share plan will

vest on January 1, 2017, and is expected to vest at 125.72% of the

target award. For a description of our performance share plans, refer

to Note 25, Share based payment, of our consolidated nancial

statements included in this annual report.

Performance shares:

Shares receivable

through performance

shares at threshold

Shares receivable

through performance

shares at maximum(1)

Number of unvested equity

awards held by the President

and CEO 538 520 2 154 078

(1) At maximum performance under the performance share plans 2014 and 2015, the number

ofshares deliverable equals four times the number of performance shares at threshold.

Theperformance period for the performance share plan 2014 ended on December 31, 2015,

and the threshold performance criteria for net sales and EPS were met and a settlement to the

participants will occur in accordance with the plan in 2017.

Other share-based awards

Additionally, Mr. Suri holds options under the Nokia Networks EIP

asdescribed under “—Long-term incentives” above.

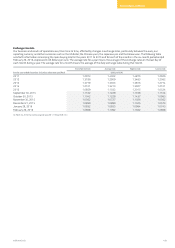

Unvested equity awards held by the Nokia Group Leadership Team at December 31, 2015

The following table sets forth the potential ownership interest through the holding of equity-based incentives of the Nokia Group Leadership

Team, including the President and CEO.

Shares receivable

through stock options

Shares receivable

through performance

shares at threshold

Shares receivable

through performance

shares at maximum(4)

Shares receivable

through restricted

shares

Number of unvested equity awards held by the

Group Leadership Team(1) 565 000 1 108 462 4 433 846 206 164

% of the outstanding shares(2) 0.01% 0.03% 0.11% 0.01%

% of the total outstanding equity incentives (per instrument)(3) 15.52% 9.67% 9.67% 9.80%

(1) Includes the four Group Leadership Team members in oce at year-end 2015.

(2) The percentages are calculated in relation to the outstanding number of shares and total voting rights of Nokia at December 31, 2015, excluding shares held by Nokia Group. No member of the Group

Leadership Team owns more than 1% of the Nokia shares.

(3) The percentages are calculated in relation to the total outstanding equity incentives per instrument.

(4) At maximum performance under the performance share plans 2014 and 2015, the number of shares deliverable equals four times the number of performance shares at threshold. The performance

period for the performance share plan 2014 ended on December 31, 2015, and the threshold performance criteria for net sales and EPS were met and a settlement to the participants will occur in

accordance with the plan in 2017.

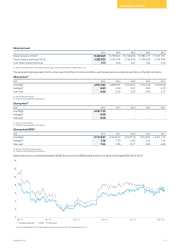

Insider trading in securities

The Board has established a policy in respect of insiders’ trading in Nokia securities (“Insider Policy”). Under the Insider Policy, the holdings of

Nokia securities by the members of the Board and the Group Leadership Team are considered public information. Nokia insiders (as dened in

the Insider Policy) are subject to certain trading restrictions and rules, including, among other things, prohibitions on trading in Nokia securities

during the 30-calendar day “closed-window” period immediately preceding the release of our interim and annual results including the day of the

release. Nokia can also set trading restrictions based on participation in projects. We update our Insider Policy from time to time and provide

training to ensure compliance with the policy. Nokia’s Insider Policy is in line with the Nasdaq Helsinki Guidelines for Insiders and also sets

requirements beyond those guidelines.

Other related party transactions

Other than the paid compensation, as described above, there have been no material transactions during the last three scal years to which

anydirector, executive ocer or 5% shareholder, or any relative or spouse of any of them, was a party. There is no signicant outstanding

indebtedness owed to Nokia by any director, executive ocer or 5% shareholder.

There are no material transactions with enterprises controlling, controlled by or under common control with Nokia or associates of Nokia.

Referto Note 34, Related party transactions, of our consolidated nancial statements included in this annual report.