Nokia 2015 Annual Report Download - page 186

Download and view the complete annual report

Please find page 186 of the 2015 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.184 NOKIA IN 2015

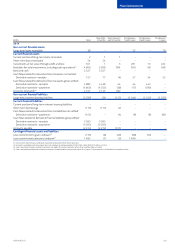

Notes to consolidated nancial statements continued

36. Subsequent events

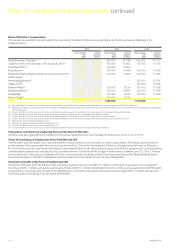

Adjusting events after the reporting period

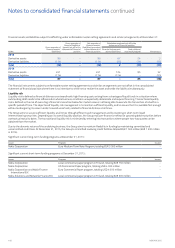

Decision on patent licensing arbitration

On February 1, 2016 the Group announced it had received the decision on patent licensing arbitration with Samsung. The award covers ve

years from January 1, 2014 until December 31, 2018. The outcome of the arbitration is reected in the 2015 nancial statements as far as it

relates to the years presented.

Non-adjusting events after the reporting period

Acquisition of Alcatel Lucent

On April 15, 2015, the Group and Alcatel Lucent announced their intention to combine through a public exchange oer (“exchange oer”) in

France and the United States. Alcatel Lucent is a global leader in IP networking, ultra-broadband access and Cloud applications. The combined

company will leverage the combined scale of operations, complementary technologies, portfolios and geographical presence; and unparalleled

innovation capabilities to lead in the next generation network technology and services and to create access to an expanded addressable market

with improved long-term growth opportunities.

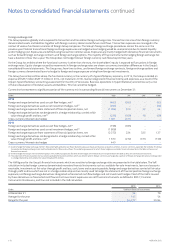

Exchange oers

As part of the exchange oers, holders of Alcatel Lucent ordinary shares, Alcatel Lucent American Depositary Shares (“ALU ADS”) and OCEANE

convertible bonds (collectively “Alcatel Lucent Securities”) can exchange their Alcatel Lucent Securities for Nokia shares and Nokia American

Depositary Shares (“Nokia ADS”) on the basis of 0.55 Nokia share or Nokia ADS for every Alcatel Lucent share or ALU ADS.

The Group obtained control of Alcatel Lucent on January 4, 2016 when the interim results of the successful initial exchange oer were

announced by the French stock market authority, Autorité des Marchés Financiers (“AMF”). As part of the initial exchange oer, the Group

acquired 76.31% of the share capital and at least 76.01% of the voting rights of Alcatel Lucent, 89.14% of the OCEANEs 2018, 24.34% of

theOCEANEs 2019 and 15.11% of the OCEANEs 2020. On January 7, 2016, the Group issued a total of 1 455 678 563 new Nokia shares

asconsideration for the Alcatel Lucent Securities tendered in the initial public exchange oer.

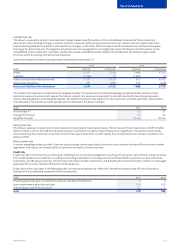

On January 14, 2016, as required by the AMF general regulation, the Group reopened its exchange oer in France and the United States, based

on the same terms and conditions as the initial exchange oer, for the outstanding Alcatel Lucent Securities not tendered during the initial

exchange oer period. Following the initial and reopened exchange oer, the Group holds 90.34% of the share capital and at least 90.25% of

the voting rights of Alcatel Lucent. The Group holds 99.62% of the OCEANEs 2018, 37.18% of the OCEANEs 2019 and 68.17% of the OCEANEs

2020. On February 12, 2016 the Group issued a total of 320 701 193 new Nokia shares as consideration for the Alcatel Lucent Securities

tendered in the reopened exchange oer.

Following the initial and reopened exchange oers, the total number of Parent Company shares outstanding is 5 769 443 837 shares. Assuming

the conversion of all remaining outstanding Alcatel Lucent Securities into Nokia shares and Nokia ADSs at the exchange ratio oered in the initial

and reopened exchange oers, the total number of Nokia shares outstanding would equal approximately 6 billion shares.

Alcatel Lucent announced on February 11, 2016 that its Board of Directors has resolved to voluntarily delist ALU ADS from the New York Stock

Exchange. On March 17, 2016 the Group announced that will issue a maximum of 72 842 811 new shares in deviation from shareholders’

pre-emptive rights based on a resolution by the Board of Directors pursuant to the authorization granted by the Extraordinary General Meeting

held on December 2, 2015 to be paid by contribution in kind with the Alcatel Lucent shares purchased from the JPMorgan Chase Bank, N.A.,

asdepositary in the ALU ADS program.

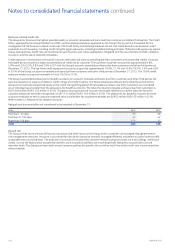

The Group is assessing alternatives to obtain at least 95% of the share capital and voting rights of Alcatel Lucent. With 95% of the share capital and

voting rights, the Group can, in accordance with applicable law and following a buy-out oer, squeeze-out the remaining Alcatel Lucent Equity

Securities, enabling the Group to obtain 100% of the share capital and voting rights of Alcatel Lucent.

In accordance with the terms of the OCEANEs and subject to applicable law, the Group reserves the right to cause Alcatel Lucent to redeem

forcash at par value plus, as applicable, accrued interest, any series of the OCEANEs if less than 15% of the issued OCEANEs of any series

remain outstanding at any time.

The Group has determined that the initial and the reopened exchange oers are linked transactions that are to be considered together as

asingle arrangement given that the reopened exchange oer is required by AMF general regulation and is based on the same terms and

conditions as the initial exchange oer.

Alcatel Lucent Equity Securities that may be acquired by the Group in the future (including through the squeeze-out) will be accounted for as equity

transactions with the remaining non-controlling interests in Alcatel Lucent. As such, any new Nokia shares or cash consideration paid to obtain

the additional Alcatel Lucent Equity Securities will be recorded directly within equity against the carrying amount of non-controlling interests.