Nokia 2015 Annual Report Download - page 169

Download and view the complete annual report

Please find page 169 of the 2015 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

167

Financial statements

NOKIA IN 2015

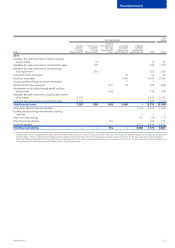

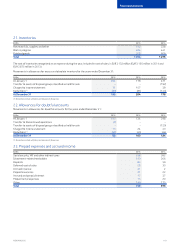

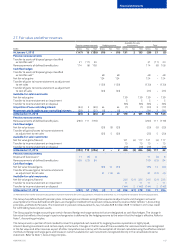

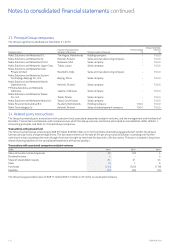

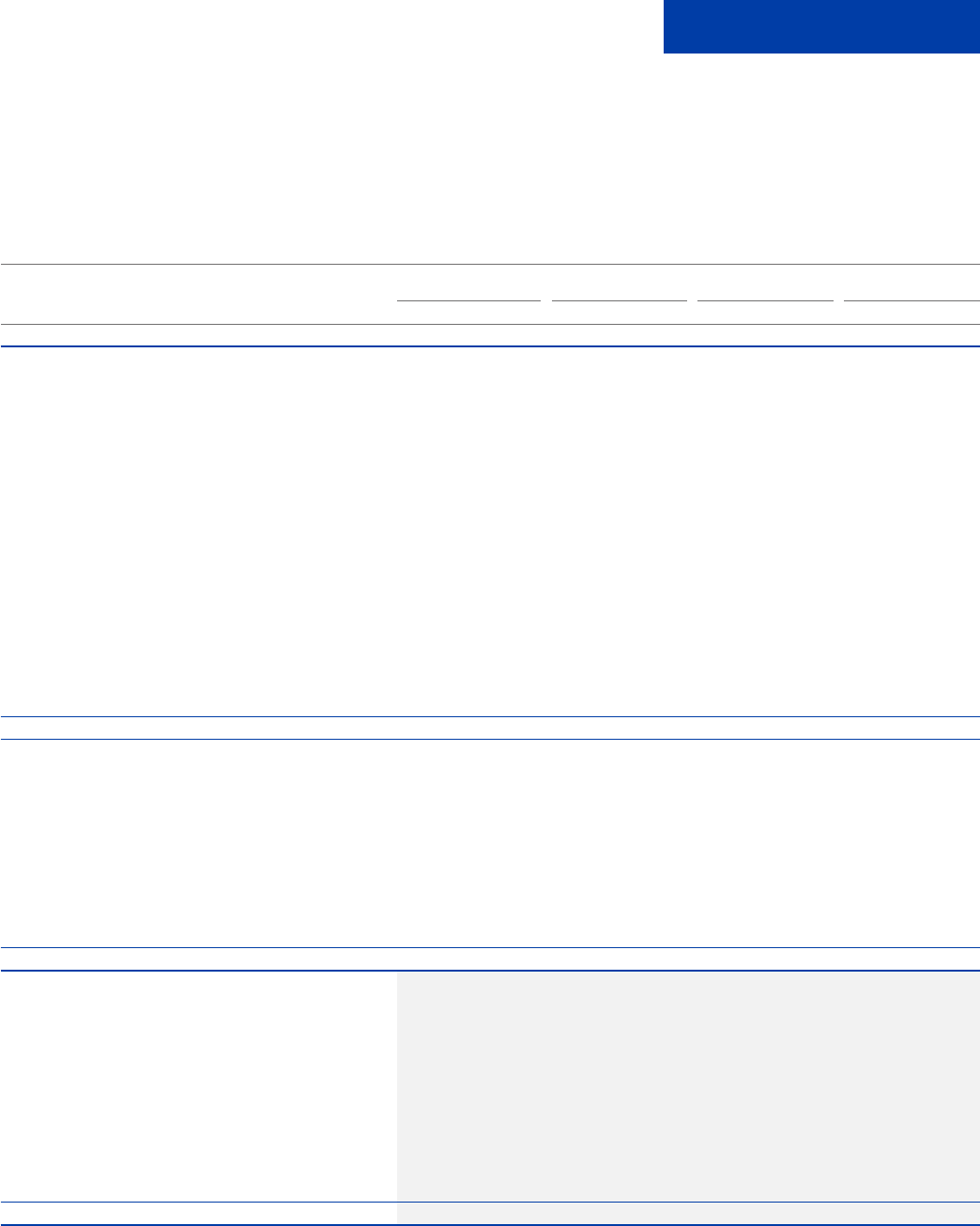

27. Fair value and other reserves

EURm

Pension remeasurements Hedging reserve

Available-for-sale

investments Total

Gross Tax Net Gross Tax Net Gross Tax Net Gross Tax Net

At January 1, 2013 (147) 19 (128) (10) –(10) 131 2133 (26) 21 (5)

Pension remeasurements:

Transfer to assets of disposal groups classied

as held for sale(1) 31 (11) 20 31 (11) 20

Remeasurements of dened benet plans 114 (6) 108 114 (6) 108

Cash ow hedges:

Transfer to assets of disposal groups classied

as held for sale(1) 48 48 48 – 48

Net fair value gains 124 124 124 – 124

Transfer of gains to income statement as adjustment

tonet sales (130) (130) (130) –(130)

Transfer of gains to income statement as adjustment

tocost of sales (23) (23) (23) –(23)

Available-for-sale investments:

Net fair value gains 139 139 139 – 139

Transfer to income statement on impairment 5 5 5 – 5

Transfer to income statement on disposal (95) (95) (95) –(95)

Acquisition of non-controlling interest (63) 3 (60) 44 44 (1) (1) (20) 3 (17)

Movements attributable to non-controlling interests (28) 3 (25) (6) (6) (34) 3 (31)

At December 31, 2013 (93) 8 (85) 47 – 47 179 2 181 133 10 143

Pension remeasurements:

Remeasurements of dened benet plans (290) 111 (179) (290) 111 (179)

Cash ow hedges:

Net fair value losses (20) (5) (25) (20) (5) (25)

Transfer of (gains)/losses to income statement

asadjustment to net sales (25) 5 (20) (25) 5 (20)

Available-for-sale investments:

Net fair value gains/(losses) 121 (4) 117 121 (4) 117

Transfer to income statement on impairment 15 15 15 – 15

Transfer to income statement on disposal (29) (29) (29) –(29)

At December 31, 2014 (383) 119 (264) 2 – 2 286 (2) 284 (95) 117 22

Pension remeasurements:

Disposal of businesses(1) 11 (3) 8 11 (3) 8

Remeasurements of dened benet plans 109 (25) 84 109 (25) 84

Cash ow hedges:

Net fair value (losses)/gains (66) 13 (53) (66) 13 (53)

Transfer of losses/(gains) to income statement

asadjustment to net sales 61 (12) 49 61 (12) 49

Available-for-sale investments:

Net fair value gains/(losses) 246 (21) 225 246 (21) 225

Transfer to income statement on impairment 11 11 11 – 11

Transfer to income statement on disposal (144) 2 (142) (144) 2 (142)

At December 31, 2015 (263) 91 (172) (3) 1 (2) 399 (21) 378 133 71 204

(1) Movements after transfer to Discontinued operations represent movements for Continuing operations. The balance at December 31, 2013 represents the balance for Continuingoperations.

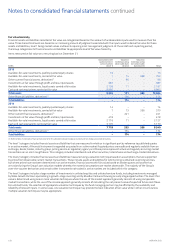

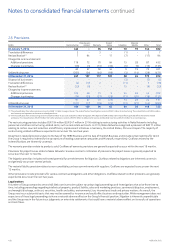

The Group has dened benet pension plans. Actuarial gains and losses arising from experience adjustments and changes in actuarial

assumptions for these dened benet plans are charged or credited to the pension remeasurements reserve. Refer to Note 1, Accounting

principles, and Note 8, Pensions. The movement in pension remeasurements, tax, includes EUR 6 million (EUR 10 million in 2014) tax credit

forwithholding taxes on plan assets.

The Group applies hedge accounting on certain forward foreign exchange contracts that are designated as cash ow hedges. The change in

fairvalue that reects the change in spot exchange rates is deferred to the hedging reserve to the extent that the hedge is eective. Refer to

Note1, Accounting principles.

The Group invests a portion of cash needed to cover the projected cash needs of its ongoing business operations in highly liquid,

interest-bearing investments and certain equity instruments. Changes in the fair value of these available-for-sale investments are recognized

inthe fair value and other reserves as part of other comprehensive income, with the exception of interest calculated using the eective interest

method and foreign exchange gains and losses on current available-for-sale investments recognized directly in the consolidated income

statement. Refer to Note 1, Accounting principles.