Nokia 2015 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2015 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

133

Financial statements

NOKIA IN 2015

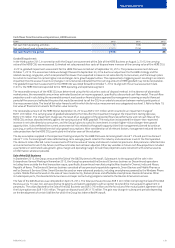

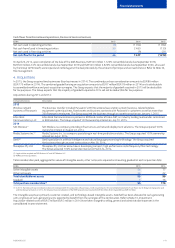

Estimation and judgment are required in determining the fair value of

the acquisition, including the discount rate, the terminal growth rate,

the number of years on which to base the cash ow projections, and

the assumptions and estimates used to determine the cash inows

and outows. The discount rate reects current assessments of the

time value of money, relevant market risk premiums, and industry

comparisons. Risk premiums reect risks and uncertainties for which

the future cash ow estimates have not been adjusted. Terminal

values are based on the expected life of products and forecasted life

cycle, and forecasted cash ows over that period. The assumptions are

based on information available at the date of acquisition; actual results

may dier materially from the forecast as more information becomes

available. Refer to Note 4, Acquisitions.

Judgment is required in determining the date on which the Group

obtains control of the acquiree (acquisition date). On April 15, 2015,

the Group and Alcatel Lucent announced their intention to combine

through a Public Exchange Oer (the “Exchange Oer”) in France and

in the United States. As part of the Exchange Oer, all holders of

Alcatel Lucent ordinary shares, Alcatel Lucent American Depositary

Shares (“ADS”) and OCEANE convertible bonds (collectively, the

“Alcatel Lucent Equity Securities”) could exchange their Alcatel Lucent

Equity Securities for Nokia shares on the basis of 0.55 of a new

Nokiashare for every Alcatel Lucent share.

The initial Exchange Oer period closed in December 2015. On

January 7, 2016 the Exchange Oer was completed and shares were

exchanged, which created legal standing for the acquisition. Under

IFRS 3, however, the Group concluded that it was already the public

announcement of the interim results of the successful initial Exchange

Oer by the French stock market authority, Autorité des Marchés

Financiers (“AMF”) on January 4, 2016 that established a shared

understanding between the Group, Alcatel Lucent and Alcatel Lucent

shareholders that control of Alcatel Lucent had passed to the Group,

and therefore the results of operations will be consolidated from

January 4, 2016. Refer to Note 36, Subsequent events.

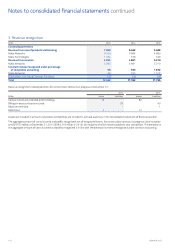

Revenue recognition

The Group enters into transactions involving multiple components

consisting of any combination of hardware, services and software

where the Group identies the separate components and estimates

their relative fair values, considering the economic substance of

theentire arrangement. The fair value of each component is

determined by taking into consideration factors such as the price

ofthe component when sold separately and the component cost

plusa reasonable margin when price references are not available.

Thedetermination of the fair value and allocation thereof to each

separately identiable component requires the use of estimates

andjudgment which may have a signicant impact on the timing

andamount of revenue recognized.

Net sales includes revenue from all licensing negotiations, litigations

and arbitrations to the extent that the criteria for revenue recognition

have been met. The nal outcome may dier from the current

estimate. Refer to Note 5, Revenue recognition.

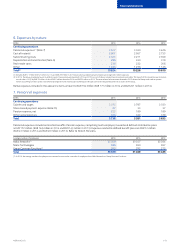

Pension benet obligations and expenses

The determination of pension benet obligations and expenses for

dened benet pension plans is dependent on a number of estimates

and assumptions, including the discount rate, future mortality rate,

and annual rate of increase in future compensation levels. A portion of

plan assets is invested in debt and equity securities, which are subject

to market volatility. Changes in assumptions and actuarial estimates

may materially aect the pension benet obligation and future

expense. Based on these estimates and assumptions, pension benet

obligations amount to EUR 1 840 million (EUR 1 884 million in 2014)

and the fair value of plan assets amounts to EUR 1 451 million

(EUR1387 million in 2014). Refer to Note 8, Pensions.

Income taxes

The Group is subject to income taxes in both Finland and a number

ofother jurisdictions. Judgment is required in determining current

taxexpense, uncertain tax positions, deferred tax assets and deferred

tax liabilities; and the extent to which deferred tax assets can be

recognized. Estimates related to the recoverability of deferred

taxassets are based on forecasted future taxable incomeand tax

planning strategies. Based on these estimates and assumptions,

taxlosses carry forward, temporary dierences and taxcredits for

which no deferred tax assets are recognized due to uncertainty are

EUR 1 412 million (EUR 2 550 million in 2014).

The utilization of deferred tax assets is dependent on future taxable

prot in excess of the prot arising from the reversal of existing

taxable temporary dierences. The recognition of deferred tax assets

is based on the assessment of whether it is more likely than not that

sucient taxable prot will be available in the future to utilize the

reversal of deductible temporary dierences, unused tax losses and

unused tax credits before the unused tax losses and unused tax

credits expire. Recognition of deferred tax assets involves judgment

regarding the future nancial performance of the particular legal

entity or tax group that has recognized the deferred tax asset.

Liabilities for uncertain tax positions are recorded based on estimates

and assumptions of the amount and likelihood of outow of economic

resources when it is more likely than not that certain positions will be

challenged and may not be fully sustained upon review by local tax

authorities. Currently, the Group has ongoing tax investigations in

multiple jurisdictions, including India. Due to the inherently uncertain

nature of tax investigations, the ultimate outcome or actual cost of

settlement may vary materially from estimates. Refer to Note 13,

Income tax, and Note 14, Deferred taxes.

Carrying value of cash-generating units (“CGUs”)

The recoverable amounts of the Group’s CGUs are determined using

the fair value less costs of disposal method. Estimation and judgment

are required in determining the components of the recoverable

amount calculation, including the discount rate, the terminal growth

rate, estimated revenue growth rates, prot margins, costs of disposal

and the cost level of operational and capital investment. The discount

rate reects current assessments of the time value of money, relevant

market risk premiums, and industry comparisons. Risk premiums

reect risks and uncertainties for which the future cash ow estimates

have not been adjusted. Terminal values are based on the expected

life of products and forecasted life cycle, and forecasted cash ows

over that period. Based onthese estimates and assumptions, goodwill

amounts to EUR 237 million (EUR 2 563 million in 2014). Refer to

Note10, Impairment.

Allowances for doubtful accounts

Allowances for doubtful accounts are recognized for estimated losses

resulting from customers’ inability to meet payment obligations.

Estimation and judgment are required in determining the value of

allowances for doubtful accounts at each statement of nancial

position date. Management specically analyzes account receivables

and historical bad debt; customer concentrations; customer

creditworthiness; past due balances; current economic trends; and

changes in customer payment terms when determining allowances

fordoubtful accounts. Additional allowances may be required in future

periods if nancial positions of customers deteriorate, reducing their

ability to meet payment obligations. Based on these estimates and

assumptions, allowances for doubtful accounts are EUR 62 million

(EUR103 million in 2014), representing 2% of accounts receivable

(3%in 2014). Refer to Note 22, Allowances for doubtful accounts.