Nokia 2015 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2015 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.60 NOKIA IN 2015

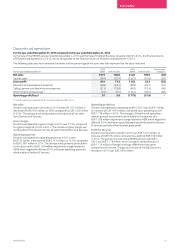

Structured nance

Structured nance includes customer nancing and other third-party

nancing. Network operators occasionally require their suppliers,

including us, to arrange, facilitate or provide long-term nancing

asacondition for obtaining infrastructure projects.

At December 31, 2015, our total customer nancing, outstanding

andcommitted equaled EUR 213 million, an increase of EUR 57 million,

as compared to EUR 156 million in 2014. At December 31, 2013,

ourtotal customer nancing, outstanding and committed ,equaled

EUR 64 million. Customer nancing primarily consisted of nancing

commitments to network operators.

Refer to Note 35, Risk management, of our consolidated nancial

statements included in this annual report for furtherinformation

relating to our committed and outstanding customer nancing.

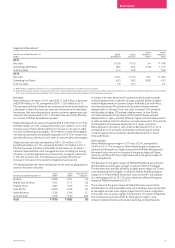

We expect our customer nancing commitments to be nanced mainly

from cash and other liquid assets and through cash ow from operations.

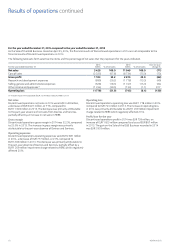

At December 31, 2015, guarantees of our performance consisted

ofEUR 400 million of guarantees that are provided to certain Nokia

Networks customers in the form of bank guarantees or corporate

guarantees issued by Nokia Networks. These instruments entitle the

customer to claim payments as compensation for non-performance

by Nokia Networks of its obligations under network infrastructure

supply agreements. Depending on the nature of the instrument,

compensation is either payable on demand, or is subject to verication

of non-performance.

Financial guarantees and securities pledged that we may give on

behalf of customers, represent guarantees relating to payment by

certain Nokia Networks customers and other third parties under

specied loan facilities between such customers or other third

partiesand their creditors. Our obligations under such guarantees

arereleased upon the earlier of expiration of the guarantee or

earlypayment by the customer or other third party.

Refer to Note 30, Commitments and contingencies, of our

consolidated nancial statements included in this annual report for

further information regarding commitments andcontingencies.

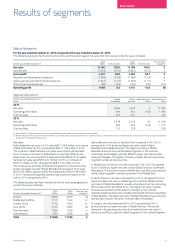

Venture fund investments and commitments

We make nancing commitments to a number of unlisted venture

funds that make technology-related investments. The majority of the

investments are managed by Nokia Growth Partners that specializes

ingrowth-stage investing, seeking companies that are changing the

face of mobility and connectivity.

At December 31, 2015, our unlisted venture fund investments equaled

EUR 953 million, as compared to EUR 778 million at December 31,

2014. Refer to Note 19, Fair value of nancial instruments, of our

consolidated nancial statements included in this annual report

forfurther information regarding fair value of our unlisted venture

fund investments.

At December 31, 2015, our venture fund commitments equaled

EUR230 million, as compared to EUR 274 million at December 31,

2014. As a limited partner in venture funds, we are committed to

capital contributions and entitled to cash distributions according

tothe respective partnership agreements and underlying fund

activities. Refer to Note 30, Commitments and contingencies, of

ourconsolidated nancial statements included in this annual report

for further information regarding commitments andcontingencies.

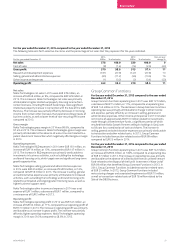

Liquidity and capital resources continued