Nokia 2015 Annual Report Download - page 168

Download and view the complete annual report

Please find page 168 of the 2015 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

166 NOKIA IN 2015

Notes to consolidated nancial statements continued

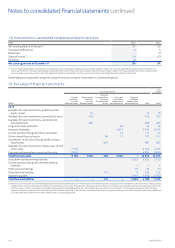

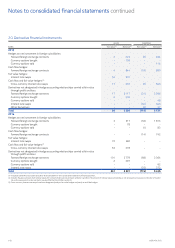

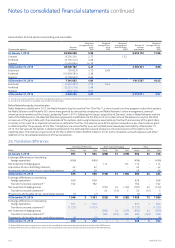

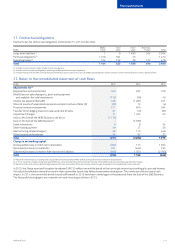

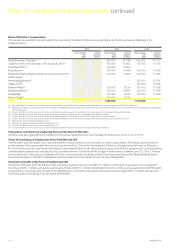

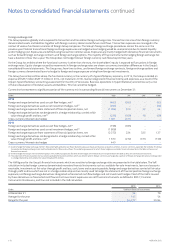

Reconciliation of stock options outstanding and exercisable:

Shares under option(1)

Number

of shares

Weighted

average exercise

price

EUR

Weighted

average share

price

EUR

Weighted

average grant

date fair value

EUR(2)

Number of

options

exercisable

Weighted

average exercise

price

EUR

At January 1, 2013 25 846 368 5.95 5 616 112 11.96

Granted 8 334 200 2.77 1.23

Forfeited (3 705 512) 4.06

Expired (2 474 864) 14.78

At December 31, 2013 28 000 192 4.47 4 339 341 9.66

Exercised (56 623) 5.75 6.69

Forfeited (16 839 593) 3.39

Expired (3 759 953) 9.94

At December 31, 2014 7 344 023 4.81 1 913 537 10.43

Exercised (1 242 381) 3.79 6.44

Forfeited (2 215 216) 2.48

Expired (246 140) 8.07

At December 31, 2015 3 640 286 4.67 2 318 911 5.97

(1) Includes stock options granted under other than global equity plans, excluding the Nokia Networks Equity Incentive Plan.

(2) Fair value of stock options is calculated using the Black-Scholes model.

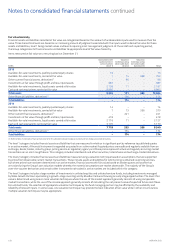

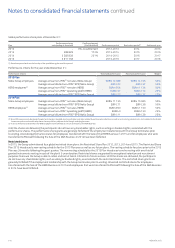

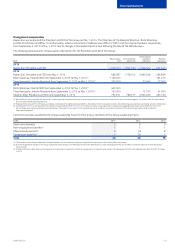

Nokia Networks equity incentive plan

Nokia Networks established in 2012 the Nokia Networks Equity Incentive Plan (”the Plan”), a share-based incentive program under which options

for Nokia Solutions and Networks B.V. shares were granted to selected key employees and Nokia Networks’ senior management, some of

whombecame members of the Group Leadership Team in 2014. Following the Group’s acquisition of Siemens’ stake in Nokia Networks and the

Sale of the D&S Business, the Board of Directors approved a modication to the Plan in 2014 to allow 30% of the options to vest on the third

anniversary of the grant date, with the remainder of the options continuing to become exercisable on the fourth anniversary of the grant date,

or earlier, in the event of a corporate transaction as dened in the Plan. The exercise price of the options is based on a per share value on grant

as determined for the purposes of the Plan. The options are accounted for as a cash-settled share-based payment liability at December 31,

2015. The fair value of the liability is determined based on the estimated fair value of shares less the exercise price of the options on the

reporting date. The total carrying amount of the Plan is EUR 73 million (EUR 80 million in 2014) and is included in accrued expenses and other

liabilities in the consolidated statement of nancialposition.

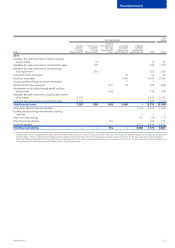

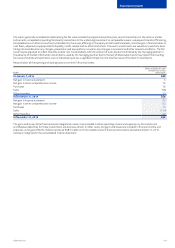

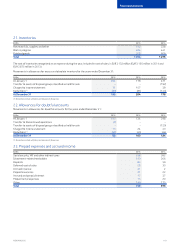

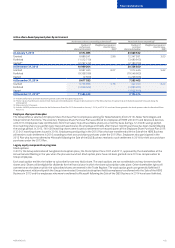

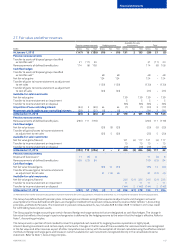

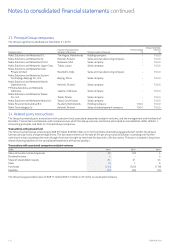

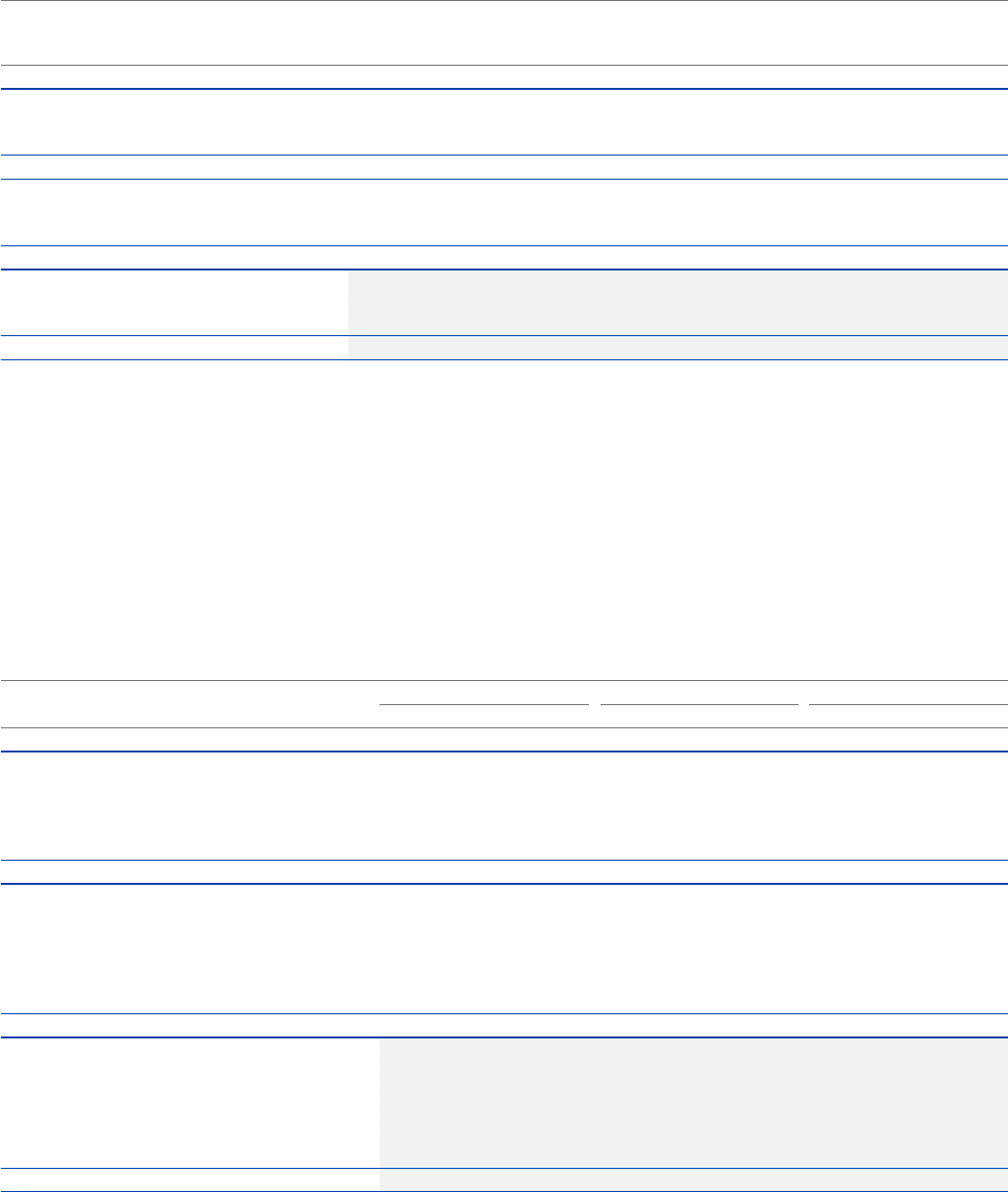

26. Translation dierences

EURm

Translation differences Net investment hedging Total

Gross Tax Net Gross Tax Net Gross Tax Net

At January 1, 2013 961 3964 (269) 51 (218) 692 54 746

Exchange dierences on translating

foreignoperations (496) (496) –(496) –(496)

Net investment hedging gains –114 114 114 –114

Acquisition of non-controlling interests 42 42 –42 –42

Movements attributable to non-controlling interests 28 28 –28 –28

At December 31, 2013 535 3538 (155) 51 (104) 380 54 434

Exchange dierences on translating

foreignoperations 628 628 –628 –628

Transfer to income statement(1) 192 192 –192 –192

Net investment hedging losses –(187) 34 (153) (187) 34 (153)

Transfer to income statement(1) –20 (15) 5 20 (15) 5

Movements attributable to non-controlling interests (7) (7) –(7) –(7)

At December 31, 2014 1 348 31 351 (322) 70 (252) 1 026 73 1 099

Exchange dierences on translating

foreignoperations 671 1 672 – 671 1 672

Transfer to income statement(2) (1 727) (1 727) – (1 727) – (1 727)

Net investment hedging losses –(260) 53 (207) (260) 53 (207)

Transfer to income statement(2) – 582 (123) 459 582 (123) 459

Movements attributable to non-controlling interests (4) (4) –(4) –(4)

At December 31, 2015 288 4 292 – – – 288 4 292

(1) Reclassied from other comprehensive income to the consolidated income statement primarily due to the Sale of the D&S Business.

(2) Reclassied from other comprehensive income to the consolidated income statement primarily due to the Sale of the HERE Business.