Nokia 2015 Annual Report Download - page 177

Download and view the complete annual report

Please find page 177 of the 2015 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

175

Financial statements

NOKIA IN 2015

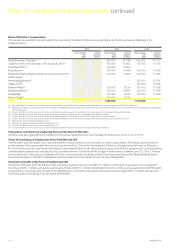

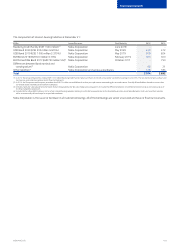

35. Risk management

General risk management principles

The Group has a systematic and structured approach to risk management across business operations and processes. Key risks and

opportunities are identied primarily against business targets either in business operations or as an integral part of long- and short-term

planning. Keyrisks and opportunities are analyzed, managed, monitored and identied as part of business performance management with the

support ofrisk management personnel. The Group’s overall risk management concept is based on managing the key risks that would prevent

the Group from meeting its objectives, rather than solely focusing on eliminating risks. The principles documented in the Nokia Risk Management

Policy, which is approved by the Audit Committee of the Board of Directors, require risk management, and its elements to be integrated into

keyprocesses. One of the main principles is that the business or function head is also the risk owner, although all employees are responsible

foridentifying, analyzing and managing risks as appropriate to their roles and duties. Risk management covers strategic, operational, nancial

and hazard risks. Key risks and opportunities are reviewed by the Group Leadership Team and the Board of Directors in order to create visibility

onbusiness risks as well as to enable prioritization of risk management activities. In addition to the principles dened in the Nokia Risk Management

Policy, specic risk management implementation is reected in other key policies.

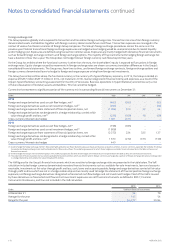

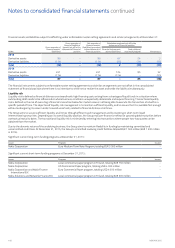

Financial risks

The objective for treasury activities is to guarantee sucient funding at all times and to identify, evaluate and manage nancial risks. Treasury

activities support this aim by mitigating the adverse eects on the protability of the underlying business caused by uctuations in the nancial

markets, and by managing the capital structure of the Group by balancing the levels of liquid assets and nancial borrowings. Treasury activities

are governed by the Nokia Group Treasury Policy approved by the Group CEO which provides principles for overall nancial risk management and

determines the allocation of responsibilities for nancial risk management activities. Operating procedures approved by the Group CFO cover

specic areas such as foreign exchange risk, interest rate risk, credit and liquidity risk as well as the use of derivative nancial instruments in

managing these risks. The Group is risk-averse in its treasury activities.

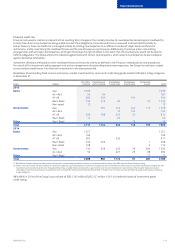

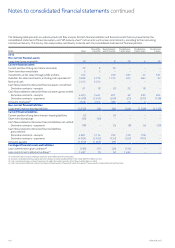

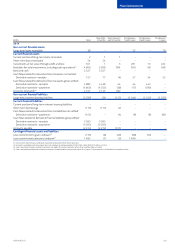

Financial risks are divided into market risk covering foreign exchange risk, interest rate risk and equity price risk; credit risk covering

business-related credit risk and nancial credit risk; and liquidity risk.

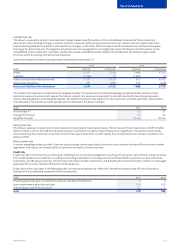

Market risk

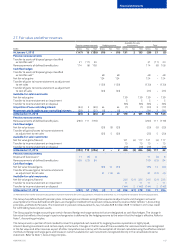

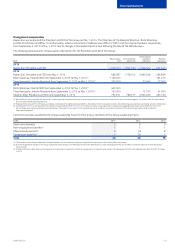

Methodology for assessing market risk exposures: Value-at-Risk

The Group uses the Value-at-Risk (“VaR”) methodology to assess exposures to foreign exchange, interest rate, and equity price risks.

The VaR-based methodology provides estimates of potential fair value losses in market risk-sensitive instruments as a result of adverse

changes in specied market factors, at a specied condence level over a dened holding period. The Group calculates the foreign exchange

VaR using theMonte Carlo method which simulates random values for exchange rates in which the Group has exposures and takes the

non-linear price function of certain foreign exchange derivative instruments into account.

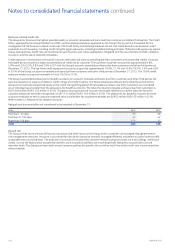

The VaR is determined using volatilities and correlations of rates and prices estimated from a sample of historical market data, at a 95%

condence level, using a one-month holding period. To put more weight on recent market conditions, an exponentially weighted moving

average is performed on the data with an appropriate decay factor. This model implies that within a one-month period, the potential loss will not

exceed the VaR estimate in 95% of possible outcomes. In the remaining 5% of possible outcomes the potential loss will be at minimum equal

tothe VaR gure and, on average, substantially higher. The VaR methodology relies on a number of assumptions which include the following:

risks are measured under average market conditions, changes in market risk factors follow normal distributions, future movements in market

risk factors are in line with estimated parameters and the assessed exposures do not change during the holding period. Thus, it is possible that,

for any given month, the potential losses at a 95% condence level are dierent and could be substantially higher than the estimated VaR.