Nokia 2015 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2015 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

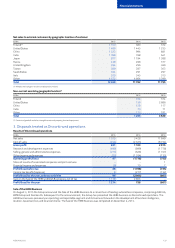

144 NOKIA IN 2015

8. Pensions

The Group operates a number of post-employment plans in various countries including both dened contribution and dened benet plans.

These plans expose the Group to actuarial risks such as investment risk, interest rate risk, and life expectancy risk. The characteristics and

associated risks of the dened benet plans vary depending on legal, scal, and economic requirements in each country. These characteristics

and risks are further described below and relate to the plans included in the Continuing operations of the Group.

The total net accrued pension cost of EUR 398 million (EUR 500 million in 2014) consists of an accrual of EUR 423 million (EUR 530 million

in2014) and a prepayment of EUR 25 million (EUR 30 million in 2014).

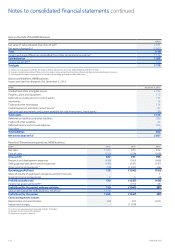

Dened benet plans

The Group’s most signicant dened benet pension plans are in Germany, the United Kingdom, India and Switzerland. Together they account

for 91% (91% in 2014) of the Group’s total dened benet obligation and 92% (92% in 2014) of the Group’s total plan assets.

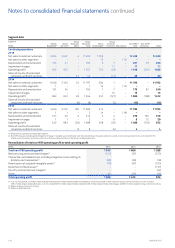

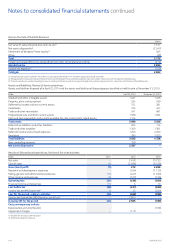

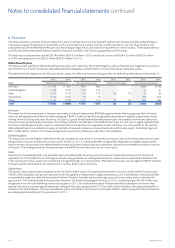

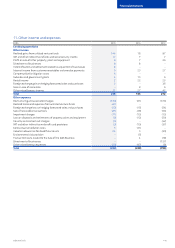

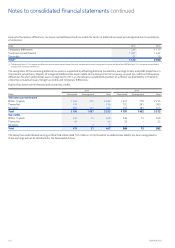

The dened benet obligations, the fair value of plan assets, the eects of the asset ceiling and the net dened benet balance at December 31:

EURm

2015 2014 2015 2014 2015 2014 2015 2014

Defined benefit obligation Fair value of plan assets Effects of asset ceiling Net defined benefit balance

Germany (1 279) (1 381) 980 965 (299) (416)

United Kingdom (128) (122) 136 130 8 8

India (147) (117) 144 112 (4) (1) (7) (6)

Switzerland (112) (102) 76 70 (36) (32)

Other (174) (162) 115 110 (5) (2) (64) (54)

Total (1 840) (1 884) 1 451 1 387 (9) (3) (398) (500)

Germany

The majority of active employees in Germany participate in the cash balance plan BAP (Beitragsorientierter Alterversorgungs Plan), formerly

known as Beitragsorientierte Siemens Alterversorgung (“BSAV”). Individual benets are generally dependent on eligible compensation levels,

ranking within the Group and years of service. This plan is a partly funded dened benet pension plan, the benets of which are subject to a

minimum return guaranteed by the Group. The funding vehicle for the BAP plan is the NSN Pension Trust e.V. The Trust is legally separate from

the Group and manages the plan assets in accordance with the respective trust agreements with the Group. The risks specic to the German

dened benet plans are related to changes in mortality of covered members and investment return of the plan assets. Curtailment gains of

EUR 1 million (EUR 4 million in 2013) were recognized in service costs following a reduction inthe workforce.

United Kingdom

The Group has a United Kingdom dened benet plan divided into two sections: the money purchase section and the nal salary section, both

being closed to future contributions and accruals as of April 30, 2012. Individual benets are generally dependent on eligible compensation

levels and years of service for the dened benet section of the plan and on individual investment choices for the dened contribution section

of the plan. The funding vehicle for the pension plan is the NSN Pension Plan that is run on a trust basis.

India

Government-mandated gratuity and provident plans provide benets based on years of service and projected salary levels at the date of

separation for the Gratuity Plan and through an interest rate guarantee on existing investments in a Government-prescribed Provident Fund

Trust. Gratuity Fund plan assets are invested and managed through an insurance policy. Provident Fund assets are managed by NSN PF Trustees

through a pattern prescribed by the Government in various xed-income securities.

Switzerland

The Group’s Swiss pension plans are governed by the Swiss Federal Law on Occupational Retirements, Survivors’ and Disability Pension plans

(“BVG”), which stipulates that pension plans are to be managed by an independent, legally autonomous unit. In Switzerland, individual benets

are provided through the collective foundation Profond. The plan’s benets are based on age, years of service, salary and an individual old

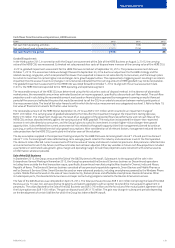

ageaccount. The funding vehicle for the pension scheme is the Profond Vorsorgeeinrichtung. In 2015, a curtailment gain of EUR 4 million was

recognized in service costs following a restructuring plan. In 2013, the collective foundation Profond decided to decrease conversion rates

(pension received as a percentage of retirement savings) in ve years gradually from 7.2% to 6.8%, which will reduce the expected benets at

retirement for all employees. This event qualied as a plan amendment and the past service gain of EUR 1 million arising from this amendment

was recognized immediately in the service cost in 2013.

Notes to consolidated nancial statements continued