Nokia 2015 Annual Report Download - page 204

Download and view the complete annual report

Please find page 204 of the 2015 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

202 NOKIA IN 2015

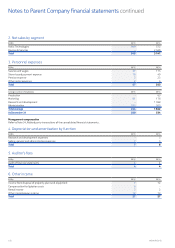

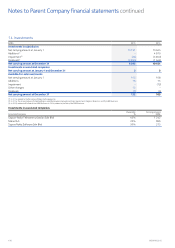

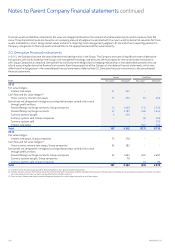

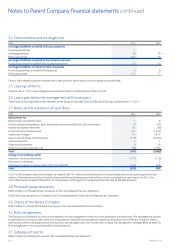

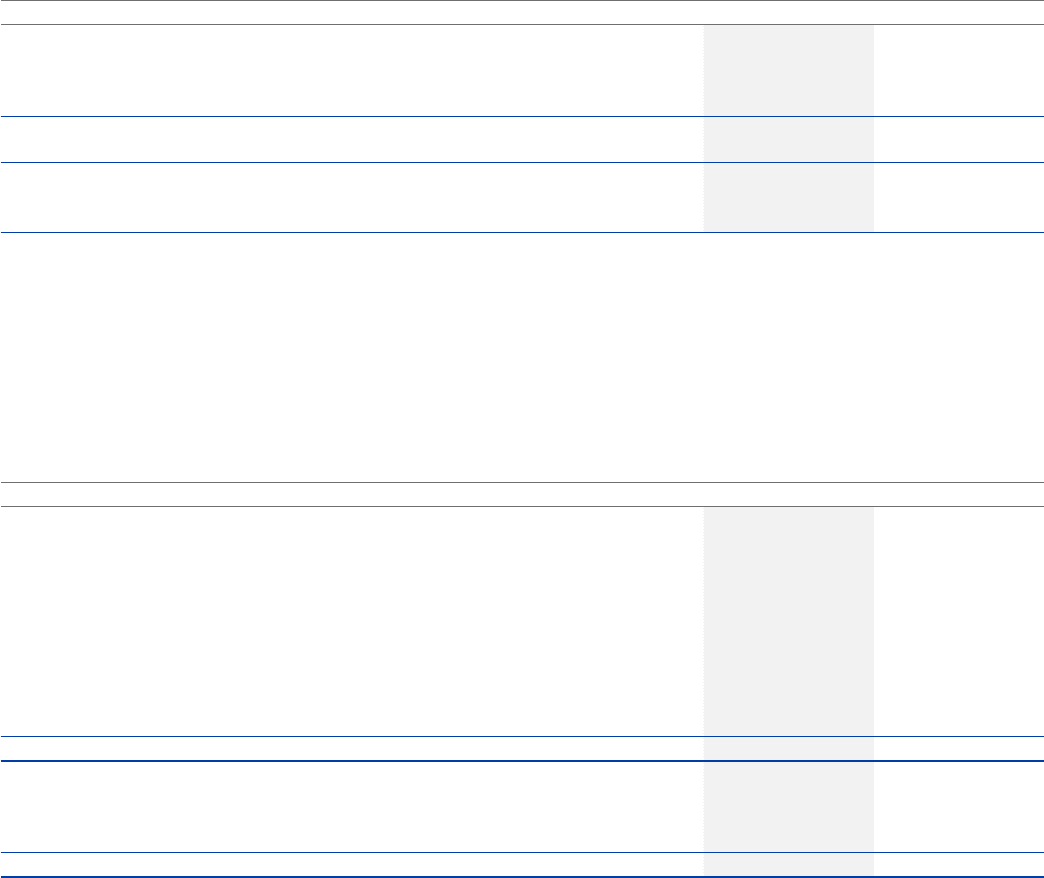

24. Commitments and contingencies

EURm 2015 2014

Contingent liabilities on behalf of Group companies

Financial guarantees 7 –

Leasing guarantees 68 79

Other guarantees 404 16

Contingent liabilities on behalf of associated companies

Financial guarantees on behalf of associated companies 15 13

Contingent liabilities on behalf of other companies

Financial guarantees on behalf of third parties 6 6

Other guarantees 133 17

Certain India related accounts receivable are under payment restrictions due to on-going tax proceedings.

25. Leasing contracts

At December 31, 2015 lease obligations amounted to EUR 0.4 million (EUR 5 million in 2014).

26. Loans granted to the management of the company

There were no loans granted to the members of the Group Leadership Team and Board of Directors at December 31, 2015.

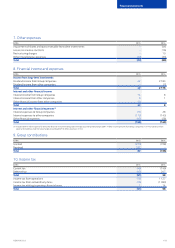

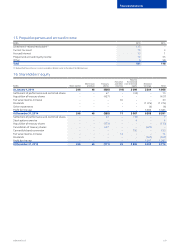

27. Notes to the statement of cash ows

EURm 2015 2014

Adjustments for

Depreciation and amortization 7 8

Prot on disposal of property, plant and equipment and available-for-sale investments (7) (14)

Income tax expense/(benet) 91 (58)

Financial income and expenses 340 (1 850)

Impairment charges 24 3 812

Gain on sale of shares and businesses (718) (8 483)

Asset retirements 4 1

Share-based payment 8 26

Other income and expenses, net (96) 1 495

Total (347) (5 063)

Change in net working capital

Increase in accounts receivable (417) (129)

Decrease in inventories –2

(Decrease)/increase in interest-free short-term liabilities (402) 959

Total (819) 832

In 2015, the Company exercised its option to redeem EUR 750 million convertible bonds at their principal amount outstanding plus accrued

interest. The redemption led to materially all convertible bonds being converted to Nokia shares, resulting in no cash impact. In 2014, the

convertible bonds issued to Microsoft in 2013 have been netted against the proceeds from the Sale of the D&S Business.

28. Principal Group companies

Refer to Note 33, Principal Group companies of the consolidated nancial statements.

Full list of Group companies is included in the Financial statements led with the Registrar of Companies.

29. Shares of the Parent Company

Refer to Note 24, Shares of the Parent Company in the consolidated nancial statements.

30. Risk management

The Group has a systematic and structured approach to risk management across business operations and processes. Risk management policies

and procedures are Group-wide, there are no separate or individual risk management policies or procedures for the Parent Company. Hence,

internal and external risk exposures and transactions are managed only in the context of the Group risk management strategy. Refer to Note 35,

Risk management in the consolidated nancial statements.

31. Subsequent events

Refer to Note 36, Subsequent events in the consolidated nancial statements.

Notes to Parent Company nancial statements continued