Nokia 2015 Annual Report Download - page 154

Download and view the complete annual report

Please find page 154 of the 2015 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216

|

|

152 NOKIA IN 2015

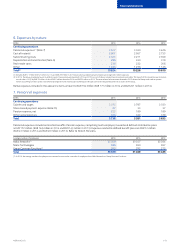

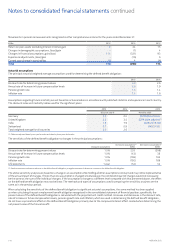

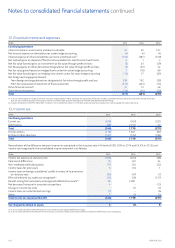

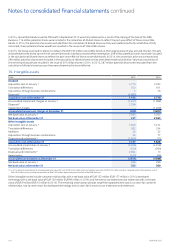

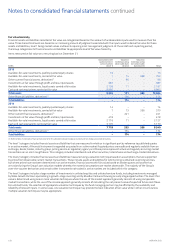

Amount of temporary dierences, tax losses carried forward and tax credits for which no deferred tax asset was recognized due to uncertainty

of utilization:

EURm 2015 2014

Temporary dierences 334 1 115

Tax losses carried forward 1 057 1 422

Tax credits 21 13

Total(1) 1 412 2 550

(1) The decrease from 2014 in temporary dierences and tax losses carried forward for which no deferred tax asset is recognized is due to the Sale of the HERE Business. 2014 comparative corrected to

include certain temporary dierences.

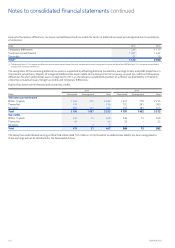

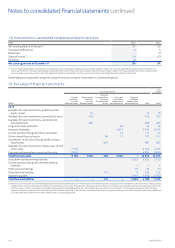

The recognition of the remaining deferred tax assets is supported by osetting deferred tax liabilities, earnings history and prot projections in

the relevant jurisdictions. Majority of recognized deferred tax assets relate to the Group’s Finnish tax losses, unused tax credits and temporary

dierences for which deferred tax was re-recognized in 2014, as the Group re-established a pattern of sucient tax protability in Finland to

utilize the cumulative losses, foreign tax credits and temporary dierences.

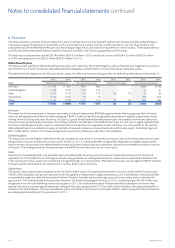

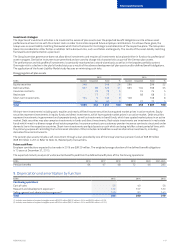

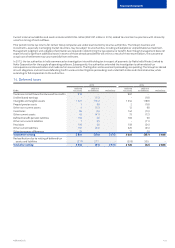

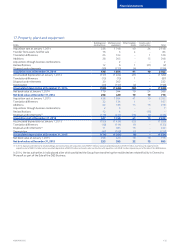

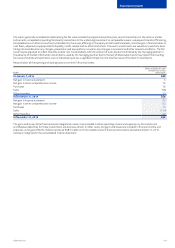

Expiry of tax losses carried forward and unused tax credits:

EURm

2015 2014

Recognized Unrecognized Total Recognized Unrecognized Total

Tax losses carried forward

Within 10 years 1 742 740 2 482 1 437 778 2 215

Thereafter 174 – 174 122 261 383

No expiry 280 317 597 232 383 615

Total 2 196 1 057 3 253 1 791 1 422 3 213

Tax credits

Within 10 years 434 14 448 536 13 549

Thereafter 42 – 42 33 – 33

No expiry – 7 7 – – –

Total 476 21 497 569 13 582

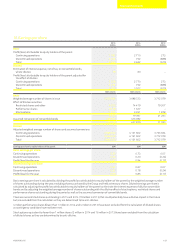

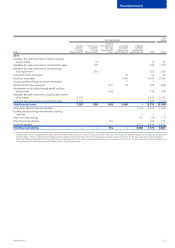

The Group has undistributed earnings of EUR769million (EUR732million in 2014) for which no deferred tax liability has been recognized as

these earnings will not be distributed in the foreseeable future.

Notes to consolidated nancial statements continued