Nokia 2015 Annual Report Download - page 174

Download and view the complete annual report

Please find page 174 of the 2015 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

172 NOKIA IN 2015

Notes to consolidated nancial statements continued

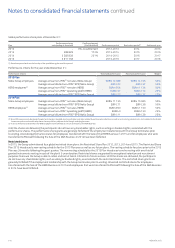

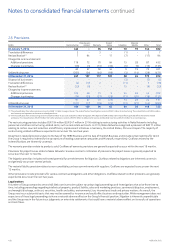

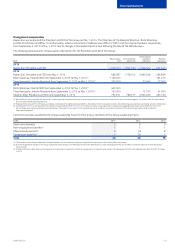

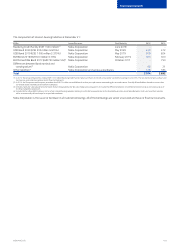

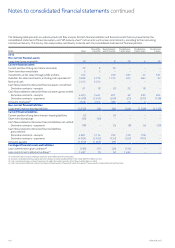

33. Principal Group companies

The Group’s signicant subsidiaries at December 31, 2015:

Company name

Country of incorporation

and place of business Primary nature of business

Parent holding

%

Group ownership

interest

%

Nokia Solutions and Networks B.V. The Hague, Netherlands Holding company –100.0

Nokia Solutions and Networks Oy Helsinki, Finland Sales and manufacturing company –100.0

Nokia Solutions and Networks US LLC Delaware, USA Sales company –100.0

Nokia Solutions and Networks Japan Corp. Tokyo, Japan Sales company –100.0

Nokia Solutions and Networks India

Private Limited New Delhi, India Sales and manufacturing company –100.0

Nokia Solutions and Networks System

Technology (Beijing) Co., Ltd. Beijing, China Sales company –100.0

Nokia Solutions and Networks Branch

Operations Oy Helsinki, Finland Sales company –100.0

PT Nokia Solutions and Networks

Indonesia Jakarta, Indonesia Sales company –100.0

Nokia Solutions and Networks Taiwan

Co.,Ltd. Taipei, Taiwan Sales company –100.0

Nokia Solutions and Networks Korea Ltd. Seoul, South Korea Sales company –100.0

Nokia Finance International B.V. Haarlem, Netherlands Holding company 100.0 100.0

Nokia Technologies Oy Helsinki, Finland Sales and development company 100.0 100.0

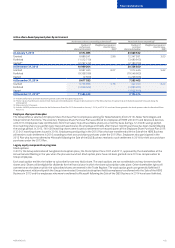

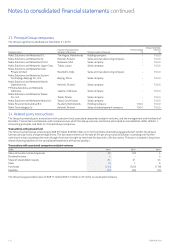

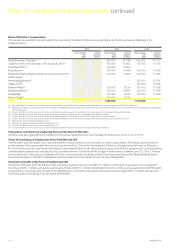

34. Related party transactions

The Group has related party transactions with a pension fund, associated companies and joint ventures, and the management and the Board of

Directors. Transactions and balances with companies over which the Group exercises control are eliminated on consolidation. Refer to Note 1,

Accounting principles, and Note 33, Principal Group companies.

Transactions with pension fund

The Group has borrowings amounting to EUR69million (EUR69million in 2014) from Nokia Unterstützungsgesellschaft GmbH, the Group’s

German pension fund, a separate legal entity. The loan bears interest at the rate of 6%per annum and its duration is pending until further

notice by the loan counterparties even though they have the right to terminate the loan with a 90-day notice. The loan is included in long-term

interest-bearing liabilities in the consolidated statement of nancial position.

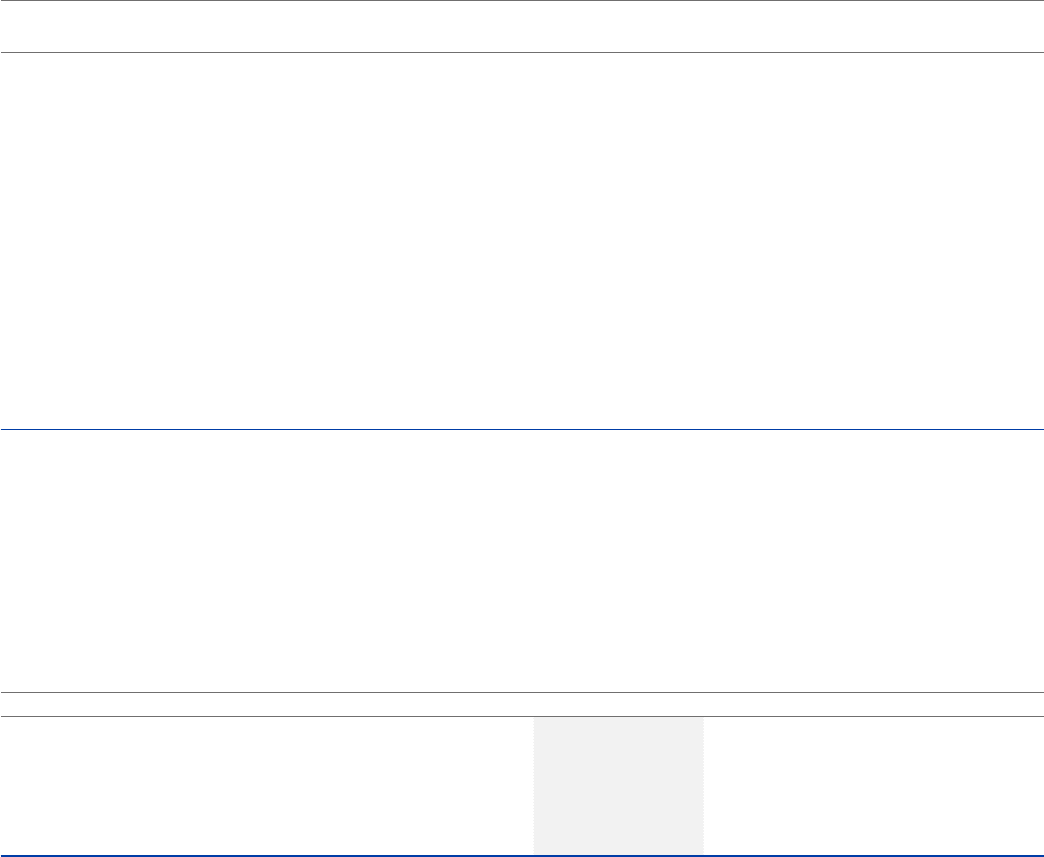

Transactions with associated companies and joint ventures

EURm 2015 2014 2013

Share of results income/(expense) 29 (12) 4

Dividend income 2 – 5

Share of shareholders' equity 84 51 53

Sales (1) 1 6

Purchases (233) (305) (178)

Payables (37) (35) (12)

The Group has guaranteed a loan of EUR15million (EUR13million in 2014) for an associated company.