Nokia 2015 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2015 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

Board review

NOKIA IN 2015

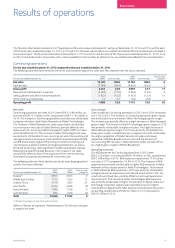

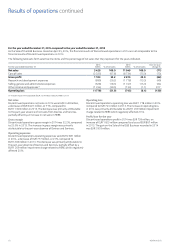

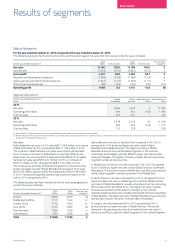

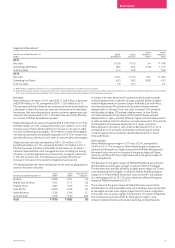

For the year ended December 31, 2014 compared to the year ended December 31, 2013

The following table sets forth selective line items and the percentage of net sales that they represent for the years indicated.

For the year ended December 31

2014

EURm % of net sales

2013

EURm % of net sales

Year-on-year

change %

Net sales 578 100.0 529 100.0 9

Cost of sales (8) (1.4) (14) (2.6) (43)

Gross prot 570 98.6 515 97.4 11

Research and development expenses (161) (27.9) (147) (27.8) 10

Selling, general and administrative expenses (65) (11.2) (56) (10.6) 16

Other income and expenses (1) (0.2) (2) (0.4) (50)

Operating prot 343 59.3 310 58.6 11

Net sales

Nokia Technologies net sales in 2014 were EUR 578 million, an

increase of EUR 49 million, or 9%, compared to EUR 529 million in

2013. The increase in Nokia Technologies net sales was primarily

attributable to higher intellectual property licensing income from

certain licensees, including Microsoft becoming a more signicant

intellectual property licensee in connection with the Sale of the D&S

Business. The increase was partially oset by decreases in licensing

income from certain other licensees that experienced lower levels of

business activity, as well as lower levels of non-recurring IPR income

compared to 2013.

Gross margin

Nokia Technologies gross margin in 2014 was 98.6%, compared to

97.4% in 2013. The increase in Nokia Technologies gross margin was

primarily attributable to the absence of a one-time cost related to a

patent divestment transaction which negatively aected gross margin

in 2013.

Operating expenses

Nokia Technologies R&D expenses in 2014 were EUR 161 million, an

increase of EUR 14 million, or 10%, compared to EUR 147 million in

2013. The increase in R&D expenses was primarily attributable to

investments in business activities, such as building the technology

andbrand licensing units, which target new and signicant long-term

growth opportunities.

Nokia Technologies selling, general and administrative expenses

in2014 were EUR 65 million, an increase of EUR 9 million, or 16%,

compared to EUR 56 million in 2013. The increase in selling, general

and administrative expenses was primarily attributable to increased

activities, such as building the technology and brand licensing units

related to anticipated and ongoing patent licensing cases, as well as

higher business support costs.

Nokia Technologies other income and expense in 2014 was a net

expense of EUR 1 million, a decrease of EUR 1 million, compared to

anet expense of EUR 2 million in 2013.

Operating prot

Nokia Technologies operating prot in 2014 was EUR 343 million, an

increase of EUR 33 million, or 11%, compared to an operating prot of

EUR 310 million in 2013. The increase in operating prot was primarily

attributable to an increase in gross prot. The increase was partially

oset by higher operating expenses. Nokia Technologies operating

margin in 2014 was 59.3% compared to 58.6% in 2013.

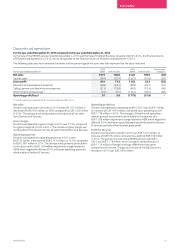

Group Common Functions

For the year ended December 31, 2015 compared to the year ended

December 31, 2014

Group Common Functions operating loss in 2015 was EUR 127 million,

a decrease of EUR 15 million, or 11%, compared to an operating loss

of EUR 142 million in 2014. The decrease in Group Common Functions

operating loss was primarily attributable to change in other income

and expense, partially oset by an increase in selling, general and

administrative expenses. Other income and expense in 2015 included

net income of approximately EUR 100 million related to investments

made through unlisted venture funds, a signicant portion of which

resulted from Nokia Growth Partners selling its holdings in Ganji.com

to 58.com for a combination of cash and shares. The increase in

selling, general and administrative expenses was primarily attributable

to transaction and other related costs. In 2015, Group Common

Functions included transaction-related costs of EUR 99 million

compared to EUR 25 million in 2014.

For the year ended December 31, 2014 compared to the year ended

December 31, 2013

Group Common Functions operating loss in 2014 was EUR 142 million,

an increase of EUR 85 million, or 149%, compared to an operating loss

of EUR 57 million in 2013. The increase in operating loss was primarily

attributable to the absence of a distribution from an unlisted venture

fund-related to the disposal of the fund’s investment in Waze Ltd of

EUR 59 million that beneted Group Common Functions in 2013. In

2014, Group Common Functions included transaction-related costs

ofEUR 25 million. In 2013, Group Common Functions included

restructuring charges and associated impairments of EUR 10 million,

as well as transaction-related costs ofEUR 18 million related to the

Sale of the D&S Business.