Nokia 2015 Annual Report Download - page 201

Download and view the complete annual report

Please find page 201 of the 2015 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

199

Financial statements

NOKIA IN 2015

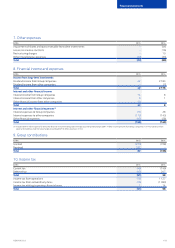

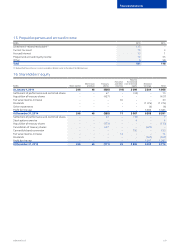

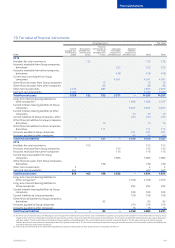

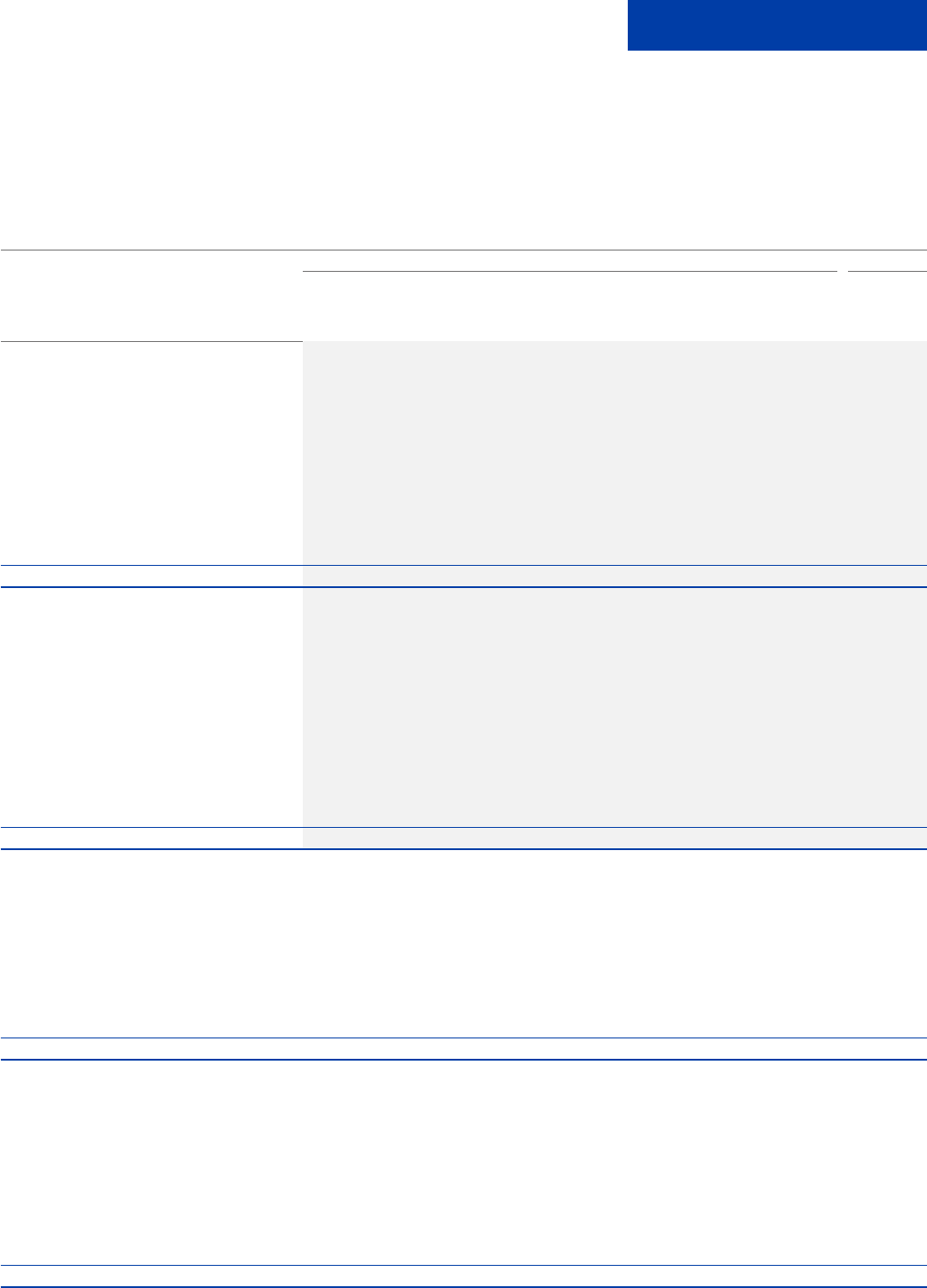

19. Fair value of nancial instruments

EURm

Carrying amounts Fair value(1)

Current

available-for-

sale financial

assets

Non-current

available-for-

sale financial

assets

Financial

instruments at

fair value

through profit

or loss

Loans and

receivables

measured at

amortized cost

Financial

liabilities

measured at

amortized cost Total Total

2015

Available-for-sale investments 132 132 132

Accounts receivable from Group companies,

derivatives 252 252 252

Accounts receivable from other companies,

derivatives 478 478 478

Current loans receivable from Group

companies 4 541 4 541 4 541

Other nancial assets from Group companies 12 12 12

Other nancial assets from other companies 96 96 96

Short-term investments 2 126 687 2 813 2 813

Cash and cash equivalents 6 033 6 033 6 033

Total nancial assets 8 159 132 795 5 271 –14 357 14 357

Long-term interest-bearing liabilities to

other companies(2) 1 946 1 946 2 017

Current interest-bearing liabilities to Group

companies 6 937 6 937 6 937

Current interest-bearing liabilities to other

companies 30 30 30

Current liabilities to Group companies, other 270 270 270

Other nancial liabilities to Group companies,

derivatives 16 16 16

Other nancial liabilities to other companies,

derivatives 111 111 111

Accounts payable to Group companies 201 201 201

Accounts payable to other companies 45 45 45

Total nancial liabilities – – 127 –9 429 9 556 9 627

2014

Available-for-sale investments 105 105 105

Accounts receivable from Group companies 150 150 150

Accounts receivable from other companies 116 116 116

Current loans receivable from Group

companies 3 986 3 986 3 986

Other nancial assets from Group companies,

derivatives 168 168 168

Short-term investments 2 2 2

Cash and cash equivalents 347 347 347

Total nancial assets 349 105 168 4 252 – 4 874 4 874

Long-term interest-bearing liabilities to

other companies(2) 2 558 2 558 3 976

Long-term interest-bearing liabilities to

Group companies 283 283 283

Current interest-bearing liabilities to Group

companies 939 939 939

Current liabilities to Group companies 728 728 728

Other nancial liabilities to Group companies,

derivatives 63 63 63

Accounts payable to Group companies 216 216 216

Accounts payable to other companies 16 16 16

Total nancial liabilities – – 63 – 4 740 4 803 6 221

(1) For items not carried at fair value, the following fair value measurement methods are used. The fair value is estimated to equal the carrying amount for available-for-sale investments carried at cost less

impairment for which it is not possible to estimate fair value reliably as there is no active market for these private fund investments. These assets are tested for impairment annually using a discounted

cash ow analysis. The fair value of loans receivable and loans payable is estimated based on the current market values of similar instruments (level 2). The fair values of long-term interest bearing

liabilities are based on discounted cash ow analysis (level 2) or quoted prices (level 1). The fair value is estimated to equal the carrying amount for short-term nancial assets and nancial liabilities due

to limited credit risk and short time to maturity.

(2) The fair values of other long-term interest-bearing liabilities are based on discounted cash ow analysis (level 2) or quoted prices (level 1).