Nokia 2015 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2015 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

150 NOKIA IN 2015

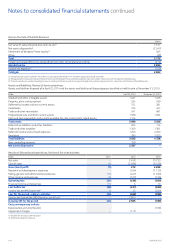

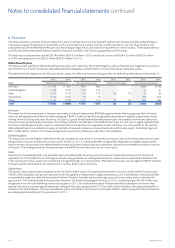

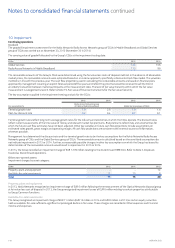

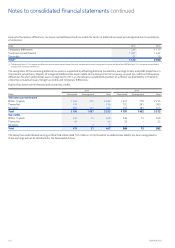

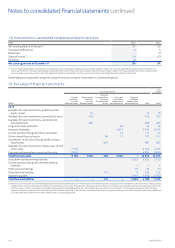

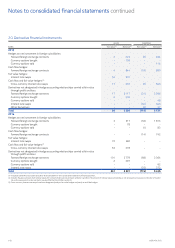

12. Financial income and expenses

EURm 2015 2014 2013

Continuing operations

Interest income on investments and loans receivable 31 50 107

Net interest expense on derivatives not under hedge accounting (4) (4) (4)

Interest expense on nancial liabilities carried at amortized cost(1) (135) (387) (319)

Net realized gains on disposal of xed income available-for-sale nancial investments 2 1 2

Net fair value (losses)/gains on investments at fair value through prot and loss (2) 20 (29)

Net (losses)/gains on other derivatives designated at fair value through prot and loss (5) (20) 32

Net fair value gains/(losses) on hedged items under fair value hedge accounting 7 (18) 69

Net fair value (losses)/gains on hedging instruments under fair value hedge accounting (12) 17 (62)

Net foreign exchange gains/(losses):

From foreign exchange derivatives designated at fair value through prot and loss 239 162 (28)

From the revaluation of statement of nancial position (315) (223) (73)

Other nancial income(2) 31 15 48

Other nancial expenses (14) (14) (20)

Total (177) (401) (277)

(1) In 2014, interest expense includes a one-time non-cash charge of EUR 57 million relating to the repayment of the EUR 1.5 billion convertible bonds issued to Microsoft when the Sale of the D&S

Business was completed and one-time expenses of EUR 123 million relating to the redemption of materially all Nokia Networks borrowings.

(2) Includes distributions of EUR 25 million (EUR 14 million in 2014 and EUR 44 million in 2013) from private venture funds held as non-current available-for-sale investments.

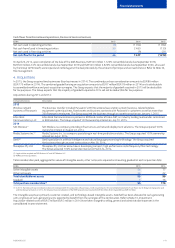

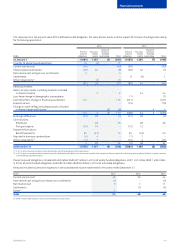

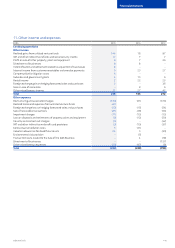

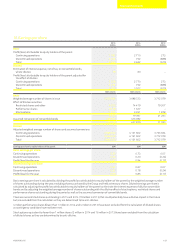

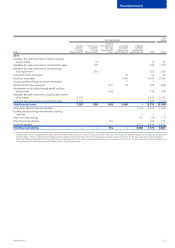

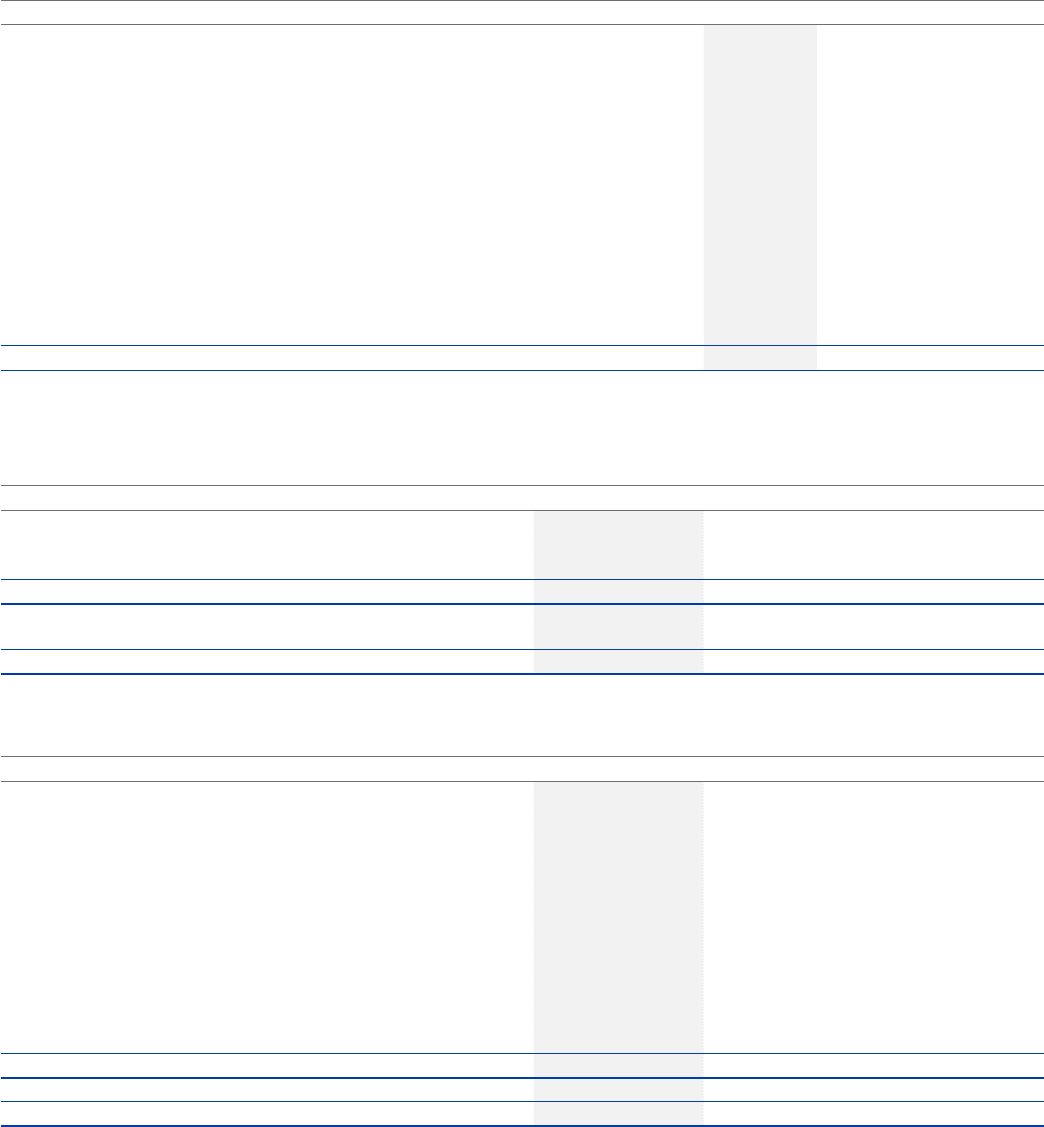

13. Income tax

EURm 2015 2014 2013

Continuing operations

Current tax (258) (300) (321)

Deferred tax (88) 2 019 50

Total (346) 1 719 (271)

Finnish entities (179) 1 841 (87)

Entities in other countries (167) (122) (184)

Total (346) 1 719 (271)

Reconciliation of the dierence between income tax computed at the statutory rate in Finland of 20% (20% in 2014 and 24.5% in 2013) and

income tax recognized in the consolidated income statement is as follows:

EURm 2015 2014 2013

Income tax expense at statutory rate (308) (200) (98)

Permanent dierences 16 (41) 34

Non-creditable withholding taxes (17) (31) (35)

Income taxes for prior years 6 (14) 1

Income taxes on foreign subsidiaries’ prots in excess of income taxes

atstatutory rate (50) (47) (7)

Eect of deferred tax assets not recognized(1) (35) (26) (137)

Benet arising from previously unrecognized deferred tax assets(2) 38 2 081 –

Net decrease/(increase) in uncertain tax positions 4 – (13)

Change in income tax rates – (1) (7)

Income taxes on undistributed earnings (7) – (6)

Other 7 (2) (3)

Total income tax (expense)/benet (346) 1 719 (271)

Tax charged/(credited) to equity 5 (7) 6

(1) In 2013, relates primarily to Nokia Networks’ Finnish and German unrecognized deferred tax assets.

(2) In 2014, relates primarily to the Group’s Finnish tax losses, unused tax credits and temporary dierences for which deferred tax was re-recognized.

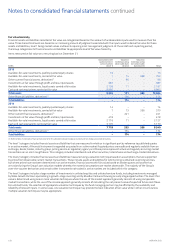

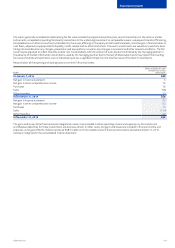

Notes to consolidated nancial statements continued