Nokia 2015 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2015 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.58 NOKIA IN 2015

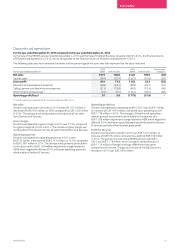

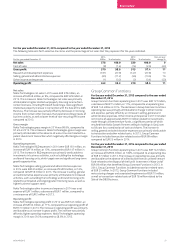

Liquidity and

capital resources

Financial position

At December 31, 2015, our total cash and other liquid assets (dened

as cash and cash equivalents; available-for-sale investments, liquid

assets; and investments at fair value through prot and loss, liquid

assets) equaled EUR 9 849 million, an increase of EUR 2 134 million,

compared to EUR 7 715 million at December 31, 2014. The increase

was primarily attributable to drivers aecting our net cash as

described below. At December 31, 2013, our total cash and other

liquid assets equaled EUR 8 971 million.

At December 31, 2015, our net cash and other liquid assets (dened

as total cash and other liquid assets less long-term interest-bearing

liabilities and short-term borrowings) equaled EUR 7 775 million,

anincrease of EUR 2 752 million, compared to EUR 5 023 million at

December 31, 2014. The increase was primarily attributable to cash

proceeds of EUR 2 536 million from the Sale of the HERE Business,

netcash ow of EUR 507 million from operating activities, as well

asanincrease in net cash resulting from the conversion of the

NokiaEUR750 million convertible bond into shares. This increase

waspartially oset by costs associated with our capital structure

optimization program, which included the payment of a dividend of

EUR 512 million, as well as the repurchase of shares of EUR 173 million.

Our net cash and other liquid assets was also adversely impacted by

cash outows related to acquisitions of EUR 98 million and capital

expenditures of EUR 314 million. At December 31, 2013, our net

cashand other liquid assets equaled EUR 2 309 million.

At December 31, 2015, our cash and cash equivalents equaled

EUR 6 995 million, an increase of EUR 1 825 million, compared to

EUR5170 million at December 31, 2014. Our cash and cash

equivalents equaled EUR 7 633 million at December 31, 2013.

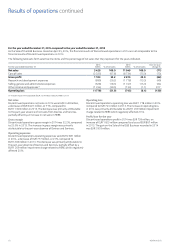

Cash ow

In 2015, our cash ow from operating activities equaled EUR 507

million, a decrease of EUR 768 million, as compared to EUR 1 275

million in 2014. The decrease was primarily attributable to EUR 998

million cash being tied up in net working capital in 2015 as compared

to EUR 1 153 million cash release in 2014, partly oset by an increase

in net prot, adjusted for non-cash items of EUR 993 million. The

primary drivers for the increase in net working capital were higher

accounts receivables, mainly relating to the Samsung patent license

receivables and lower accounts payable.

In 2015, we had cash outows of EUR 702 million related to net

nancial income and expenses and income taxes, a decrease of

EUR390 million, as compared to EUR 1 092 million in 2014. The

decrease was primarily attributable to lower net income taxes paid.

Paid taxes in2014 included approximately EUR 300 million cash

outows relating to Discontinued operations.

In 2014, our cash ow from operating activities equaled EUR 1 275

million, an increase of EUR 1 203 million, as compared to EUR 72

million in 2013. The increase was primarily attributable to EUR 1 214

million net prot, adjusted for non-cash items and a EUR 1 153 million

cash release from net working capital. The primary driver for the

cashrelease from net working capital was a EUR 1 650 million cash

inow relating to the upfront payment on a ten-year patent license

agreement and related option to extend the license in perpetuity

withMicrosoft, partially oset by approximately EUR 320 million

restructuring-related cash outows in Continuing operations and

approximately EUR 210 million net working capital-related cash

outows in Discontinued operations.

In 2014, we had cash outows of EUR 1 092 million related to net

nancial income and expenses and income taxes, an increase of

EUR935 million, as compared to EUR 157 million in 2013. The increase

was primarily attributable to the early redemption of Nokia Networks’

borrowings of approximately EUR 84 million, foreign exchange hedging

of approximately EUR 180 million and income taxes of EUR 636 million,

of which approximately EUR 300 million were cash outows relating to

discontinued operations.

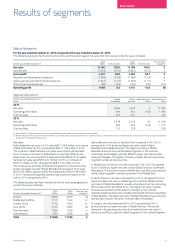

In 2015, our cash ow from investing activities equaled EUR 1 896

million, an increase of EUR 1 010 million, as compared to EUR 886

million cash received from investing activities in 2014. Cash inow

from investing activities was primarily driven by gross proceeds

attributable to the Sale of the HERE Business of approximately

EUR2540 million, and the increase in proceeds from maturities and

sale of current available-for-sale investments, liquid assets. The

increase was partially oset by an increase in purchases of current

available-for-sale investments, liquid assets, purchases of investments

at fair value through prot and loss, liquid assets and cash outows

related to capital expenditure of EUR 314 million and acquisitions of

EUR 98 million.

In 2015, our capital expenditure equaled EUR 314 million, an increase

of EUR 3 million, as compared to EUR 311 million in 2014. Major items

of capital expenditure in 2015 included investments in production

lines, test equipment and computer hardware used primarily in R&D,

oce and manufacturing facilities as well as services and software

related intangible assets.

In 2014, our cash ow from investing activities equaled EUR 886

million, an increase of EUR 1 577 million, as compared to EUR 691

million cash used in investing activities in 2013. Cash inows from

investing activities was primarily driven by gross proceeds attributable

to the Sale of the D&S Business of approximately EUR 4 010 million,

which included the proceeds used to repay the convertible bonds

issued to Microsoft and the increase in proceeds from maturities

andsale of current available-for-sale investments, liquid assets.

Theincrease was oset by an increase in purchases of current

available-for-sale investments, liquid assets. Cash inows from

investing activities also beneted EUR 44 million from the sale of

property, plant and equipment. The increase was partially oset by

cash outows related to capital expenditure of EUR 311 million and

acquisitions of EUR 175 million.

In 2014, our capital expenditure equaled EUR 311 million, a decrease

of EUR 96 million, as compared to EUR 407 million in 2013. Major items

of capital expenditure in 2014 included investments in production

lines, test equipment and computer hardware used primarily in R&D,

oce and manufacturing facilities as well as services and software-

related intangible assets.

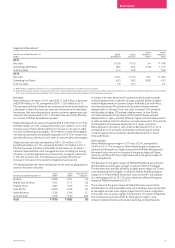

In 2015, our cash ow used in nancing activities equaled EUR 584

million, a decrease of EUR 3 992 million, as compared to EUR 4 576

million in 2014. Cash outows from nancing activities were primarily

attributable to the payment of EUR 0.14 per share in dividends

equaling EUR 507 and EUR 173 million in cash outows relating to

share repurchases. Cash outows from nancing activities also

included payments to non-controlling interest holders to acquire

subsidiary shares and pay dividends equaling EUR 57 million.