Nokia 2015 Annual Report Download - page 172

Download and view the complete annual report

Please find page 172 of the 2015 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

170 NOKIA IN 2015

Notes to consolidated nancial statements continued

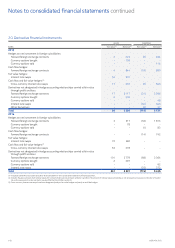

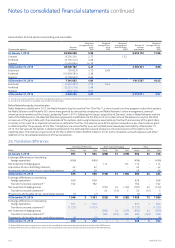

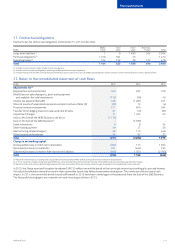

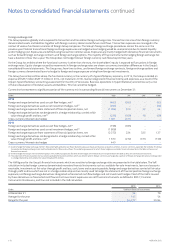

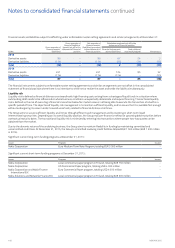

29. Accrued expenses, deferred revenue and other liabilities

Non-current liabilities

EURm 2015 2014

Advance payments and deferred revenue(1)(2) 1 235 1 632

Other(2) 19 35

Total 1 254 1 667

(1) Includes a prepayment of EUR 1 235 million (EUR 1 390 million in 2014) relating to a ten-year mutual patent license agreement with Microsoft. Refer to Note 3, Disposals treated as Discontinued

operations.

(2) In 2014, EUR 59 million has been reclassied from other to advance payments and deferred revenue to conform to current year presentation.

Current liabilities

EURm 2015 2014

Deferred revenue(1) 1 286 1 093

Salaries and wages 741 807

Advance payments(1) 571 736

Social security, VAT and other indirect taxes 314 282

Expenses related to customer projects 184 202

Other 299 512

Total 3 395 3 632

(1) In 2014, EUR 133 million has been reclassied from advance payments to deferred revenue to conform to current year presentation.

Other accruals include accrued discounts, royalties, research and development expenses, marketing expenses and interest expenses, as well as

various amounts which are individually insignicant.

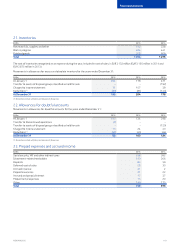

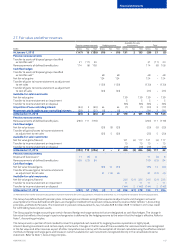

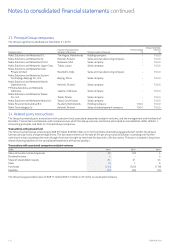

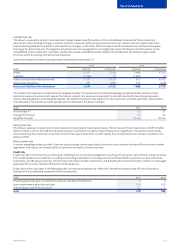

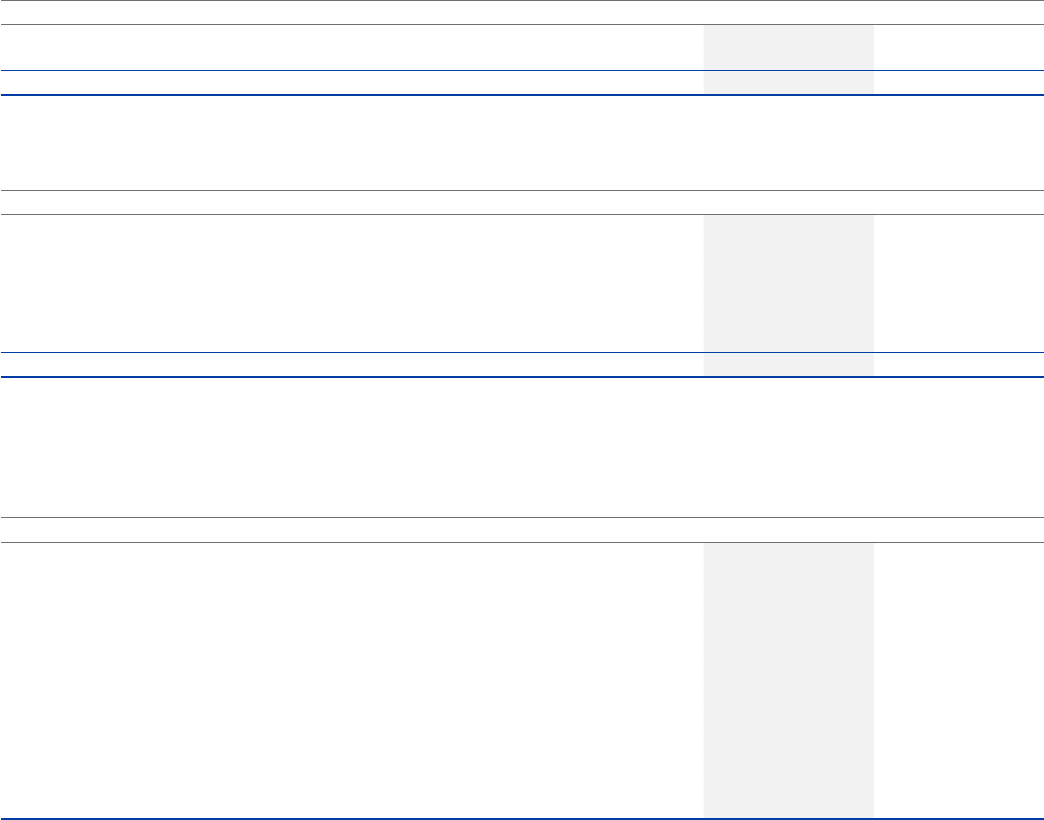

30. Commitments and contingencies

EURm 2015 2014

Collateral for own commitments

Assets pledged 7 10

Contingent liabilities on behalf of Group companies

Other guarantees 601 673

Contingent liabilities on behalf of associated companies and joint ventures

Financial guarantees on behalf of associated companies and joint ventures 15 13

Contingent liabilities on behalf of other companies

Financial guarantees on behalf of third parties(1) 6 6

Other guarantees 137 165

Financing commitments

Customer nance commitments(1) 180 155

Venture fund commitments 230 274

(1) Refer to Note 35, Risk management.

The amounts represent the maximum principal amount for commitments and contingencies.

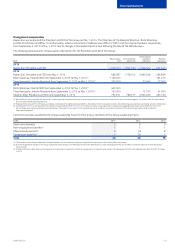

Other guarantees on behalf of Group companies include commercial guarantees of EUR 400 million (EUR 465 million in 2014) provided to

certainNokia Networks customers in the form of bank guarantees or corporate guarantees. These instruments entitle the customer to claim

compensation from the Group for the non-performance of its obligations under network infrastructure supply agreements. Depending on

thenature of the guarantee, compensation is either payable on demand or subject to verication of non-performance. Total value of other

guarantees has decreased mainly due to expired guarantees.

Contingent liabilities on behalf of other companies, Other guarantees, are EUR 137 million (EUR 165 million in 2014). The balance mainly relates

to the guarantees transferred in connection with the disposal of certain businesses where contractual risks and revenues have been transferred

but some of the commercial guarantees remain to be re-assigned legally.

Customer nancing commitments of EUR 180 million (EUR 155 million in 2014) are available under loan facilities negotiated mainly with

NokiaNetworks’ customers. Availability of the facility is dependent upon the borrower’s continuing compliance with the agreed nancial and

operational covenants and compliance with other administrative terms of the facility. The loan facilities are primarily available to fund capital

expenditure relating to purchases of network infrastructure equipment and services.

Venture fund commitments of EUR 230 million (EUR 274 million in 2014) are nancing commitments to a number of funds making

technology-related investments. As a limited partner in these funds, the Group is committed to capital contributions and entitled to cash

distributions according to the respective partnership agreements and underlying fund activities.