Nokia 2015 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2015 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

92 NOKIA IN 2015

To ensure alignment with shareholders’ interests and the culture

ofdeveloping long-term sustainable success, we have two policies

inplace which apply to variable compensation:

Clawback policy: In the event that there is any error or misstatement

of nancial results which, had it been known at the time of the

determination of the incentive, would have resulted in a lower

payment, the Board has an option to claw back any excessive payment

within three years from such event. In a bad faith event, the Board

hasdiscretion to claw back remuneration from previous years, if it is

deemed appropriate.

Share ownership policy: To align the interests of the President and

CEO and the Group Leadership Team with shareholders’ interests,

wehave ashareholding policy requiring that a minimum number of

shares must be held by the executive. For the President and CEO,

therequirement istohold shares to a value equaling three times

hisbase salary. For the current Group Leadership Team members,

therequirement is to hold shares to a value equaling two times the

member’s base salary. The share ownership policy, which is eective

from January 1, 2015, requires these executives to amass the

requisite shareholding within ve years of becoming subject to

thepolicy. They are not permitted to sell any vesting equity awards,

other than for the purposes of meeting associated tax and social

security liabilities, until the shareholding requirement issatised.

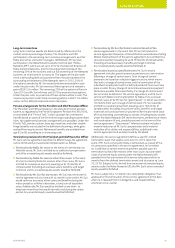

Short-term incentives

The 2015 short-term incentive for the President and CEO is

determined by the achievement against key nancial targets and other

strategic objectives, as dened below. Performance against these

dened targets are then multiplied by a business results multiplier,

which acts as a funding factor for the incentive plan for most

employees, to determine the nal payment.

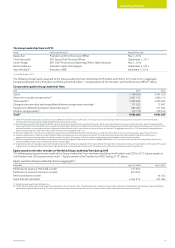

% of base salary

Measurement criteria

Minimum

performance

Target

performance

Maximum

performance

0% 125% 281.25% 80% of the incentive is based on performance against the Nokia scorecard:

■Non-IFRS revenue (⅓);

■Non-IFRS operating profit (⅓); and

■Net cash flow (⅓).

The nal 20% of the incentive is based on the achievement of personal strategic objectives given to

the President and CEO bythe Board.

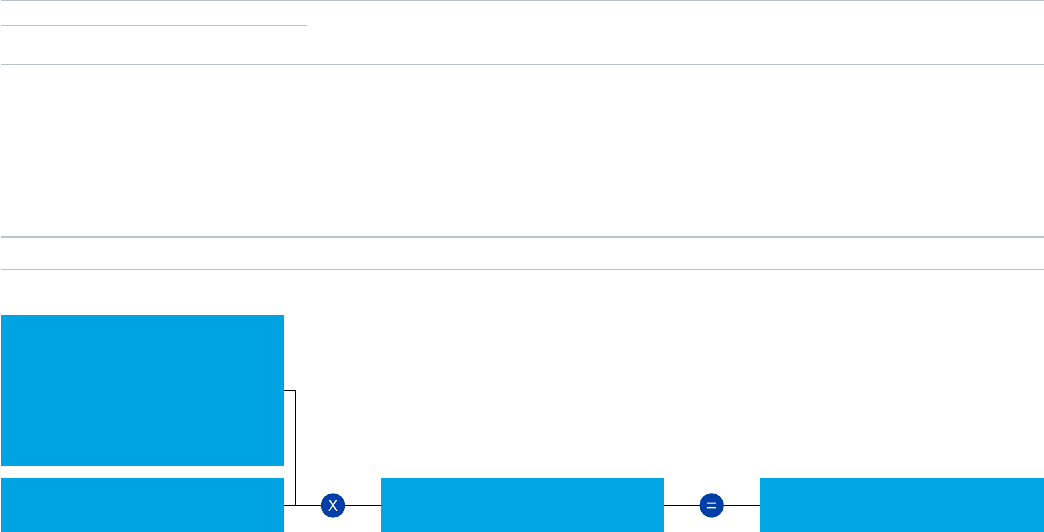

2015 Short-term incentive

Personal strategic objectives (20%)

Nokia Scorecard (80%)

⅓ Nokia non-IFRS revenue

⅓ Nokia non-IFRS operating prot

⅓ Net Nokia cash ow

Business Results Multiplier

(Nokia non-IFRS operating prot) Annual incentive

The 2015 short-term incentive for Mr. Suri will be paid at 153.77% of the target incentive amount, which reects the performance of Nokia

across the metrics used in the plan, including Nokia’s continued progress and transformation, as reected in his personal strategic objectives.

Mr. Suri’s short-term incentive in 2014 was at a similar achievement level, albeit with a lower target incentive for the period between January and

April 2014 before he became President and CEO.

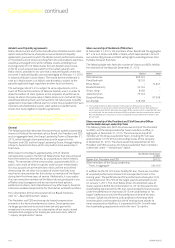

Compensation continued