Nokia 2015 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2015 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

93

Corporate governance

NOKIA IN 2015

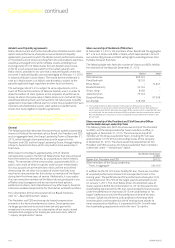

Long-term incentives

Long-term incentive awards are determined by reference to the

market and as a percentage of salary. The President and CEO

participates in thesame long-term incentive arrangements as other

Nokia executives and senior managers. Additionally, Mr. Suri also

participates in the Nokia Networks equity incentive plan (“Nokia

Networks EIP”), which was set up in 2012 by the board of directors of

Nokia Siemens Networks, prior to the acquisition by Nokia of the

remaining 50% of the business and our full ownership of the Networks

business, to incentivize its turnaround. The targets of the plan were

set at a demanding level and payments from the plan represent the

outstanding achievement of the Networks team. In 2015, 30% of

theoptions awarded to Mr. Suri vested and were exercisable in cash

under the plan rules. Mr. Suri exercised these options and realized a

gain of EUR 3.24 million. The remaining 70% of the options will vest in

June 2016 and Mr. Suri will have until 2018 to exercise these options.

Under the plan rules, any exercise of these options will be in cash. The

maximum payment under these remaining options is EUR7.56 million,

unless certain dened corporate events take place.

Pension arrangements for the President and Chief Executive Ocer

The President and CEO participates in the statutory Finnish pension

system, as regulated by the Finnish Employees’ Pension Act (395/2006,

asamended) (the “Finnish TyEL”), which provides for a retirement

benet based on years of service and earnings according to prescribed

rules. No supplemental pension arrangements are provided. Under the

Finnish TyEL pension system, base pay, incentives and other taxable

fringe benets are included in the denition of earnings, while gains

realized from equity are not. Retirement benets are available from

age 63 to 68, according to an increasing scale.

Termination provisions for the President and Chief Executive Ocer

Mr. Suri’s service agreement species the dierent ways the agreement

can be terminated and associated compensation as follows:

■Termination by Nokia for cause: In the event of a termination by

Nokia for cause, Mr. Suri is entitled to no additional compensation

and all his unvested equity awards would be forfeited;

■Termination by Nokia for reasons other than cause: In the event

ofa termination by Nokia for reasons other than cause, Mr. Suri is

entitled to a severance payment equaling up to 18 months of

compensation (including annual base salary, benefits, and target

incentive) and his unvested equity awards would be forfeited;

■Termination by Mr. Suri for any reason: Mr. Suri may terminate his

service agreement at any time with six months’ prior notice. Mr. Suri

would continue to receive either salary and benefits during the

notice period or, at Nokia’s discretion, a lump sum of equivalent

value. Additionally, Mr. Suri would be entitled to any short- or

long-term incentives that would normally vest during the notice

period. Any unvested equity awards would be forfeited;

■Termination by Mr. Suri for Nokia’s material breach of the

serviceagreement: In the event that Mr. Suri terminates his

serviceagreement based on a final arbitration award demonstrating

Nokia’s material breach of the service agreement, he is entitled to a

severance payment equaling to up to 18 months of compensation

(including annual base salary, benefits and target incentive).

Anyunvested equity awards would beforfeited; or

■Termination based on specified events: Mr. Suri’s service

agreement includes special severance provisions on a termination

following a change of control event. Such change of control

provisions are based on a double trigger structure, which means

that both a change of control event and the termination of the

individual’s employment within a defined period of time must take

place in order for any change of control based severance payment

to become payable. More specifically, if a change of control event

has occurred, as defined in the service agreement, and Mr.Suri’s

service with Nokia is terminated either by Nokia or its successor

without cause, or by Mr. Suri for “good reason”, in either case within

18 months from such change of control event, Mr. Suri would be

entitled to a severance payment equaling up to 18 months of

compensation (including annual base salary, benefits, and target

incentive) and cash payment (or payments) for the pro-rated value

of his outstanding unvested equity awards, including equity awards

under the Nokia Networks EIP, restricted shares, performance shares

and stock options (ifany), payable pursuant to the terms of the

service agreement. “Good reason” referred to above includes a

material reduction of Mr.Suri’s compensation and a material

reduction of his duties and responsibilities, as defined in the

serviceagreement and as determined bythe Board.

Additionally, the service agreement denes a specic, limited

termination event that applies until June 30, 2016. Upon this

event,ifMr. Suri’s service with Nokia is terminated as a result of the

circumstances specied in the service agreement, he is entitled

to,inaddition to normal severance payment payable upon his

terminationby Nokia for reasons other than cause, to a pro-rated

value of unvested equity awards under the Nokia Networks EIP,

provided that the termination of his service takes place within six

months from the dened termination event (and at orprior to June

30, 2016). Subject to this limited time treatment of unvested equity

awards under the Nokia Networks EIP, all of Mr. Suri’s other unvested

equity would be forfeited.

Mr. Suri is subject to a 12-month non-competition obligation that

applies after the termination of the service agreement or the date

when he isreleased from his obligations and responsibilities,

whichever occurs earlier.