Nokia 2015 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2015 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59

Board review

NOKIA IN 2015

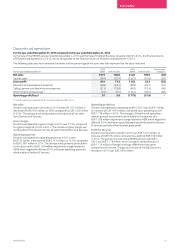

In 2014, our cash ow used in nancing activities equaled EUR 4 576

million, an increase of EUR 4 099 million, as compared to EUR 477

million in 2013. Cash outows from nancing activities were primarily

attributable to the repayment of EUR 2 791 million in interest-bearing

liabilities, payment of EUR 0.11 per share in dividends equaling

EUR408 million and EUR 0.26 per share in special dividends equaling

EUR 966 million, as well as EUR 427 million in cash outows relating

toshare repurchases. We also acquired subsidiary shares from a

non-controlling interest holder and paid dividends to non-controlling

interest holders in 2014 equaling approximately EUR 60 million.

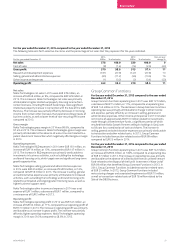

Financial assets and debt

At December 31, 2015 our net cash and other liquid assets equaled

EUR 7 775 million and consisted of EUR 9 849 million in total cash and

other liquid assets and EUR 2 074 million of long-term interest-bearing

liabilities and short-term borrowings.

We hold our cash and other liquid assets predominantly in euro. Our

liquid assets are mainly invested in high-quality money market and

xed income instruments with strict maturity limits. We also have

aEUR 1 500 million undrawn revolving credit facility available for

liquidity purposes.

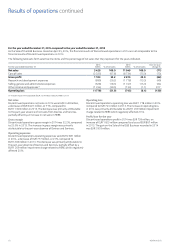

Our interest-bearing liabilities consisted of a EUR 500 million bond

duein 2019, a USD 1 000 million bond due in 2019, a USD 500 million

bond due in 2039 and EUR 196 million of other liabilities. Refer to

Note35, Risk management, of our consolidated nancial statements

included in this annual report for further information regarding our

interest-bearing liabilities.

In 2015, we exercised our option to redeem our EUR 750 million

convertible bonds due in 2017. The redemption led to materially all

convertible bonds being converted into Nokia shares. Additionally,

werenanced our undrawn EUR 1 500 million revolving credit facility

maturing in March 2016 with a new similar size facility maturing in

June2018. The new facility has two one-year extension options,

nonancial covenants and it remains undrawn. We believe with

EUR9849 million cash and other liquid assets, as well as a EUR 1 500

million revolving credit facility, we have sucient funds available to

satisfy our future working capital needs, capital expenditure, R&D,

acquisitions and debt service requirements at least through 2016.

Wealso believe that with our current credit ratings of BB+ by Standard

& Poor’s and Ba2 by Moody’s, we have access to the capital markets

should any funding needs arise in 2016. Nokia aims to re-establish

itsinvestment grade credit rating.

O-balance sheet arrangements

There are no material o-balance sheet arrangements that have or

arereasonably likely to have a current or future eect on our nancial

condition, changes in nancial condition, revenues or expenses,

results of operations, liquidity, capital expenditures or capital

resources that are material to investors.

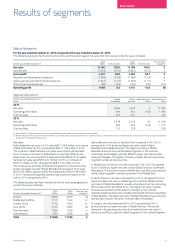

Capital structure optimization program

In 2015, we announced plans for a two-year, EUR 7 billion program

tooptimize the eciency of our capital structure. The program was

subject to the closing of the Alcatel Lucent and HERE transactions,

aswell as the conversion of all Nokia and Alcatel Lucent convertible

bonds. This comprehensive capital structure optimization program

focuses on shareholder distributions and de-leveraging, while

maintaining our nancial strength.

The program consists of the following components:

■Shareholder distributions of approximately EUR 4 billion, calculated

assuming ownership of all outstanding shares of Alcatel Lucent

andconversion of all Nokia and Alcatel Lucent convertible bonds:

– Planned ordinary dividend payments, as follows:

– A planned ordinary dividend for 2015 of at least EUR 0.15 per

share, subject to shareholder approval in 2016; and

– A planned ordinary dividend for 2016 of at least EUR 0.15 per

share, subject to shareholder approval in 2017;

– A planned special dividend of EUR 0.10 per share, subject to

shareholder approval in 2016; and

– A planned two-year, EUR 1.5 billion share repurchase program,

subject to shareholder approval in 2016.

■De-leveraging of approximately EUR 3 billion:

– Planned reduction of interest-bearing liabilities of the combined

company by approximately EUR 2 billion; and

– Planned reduction of debt-like items of the combined company

by approximately EUR 1 billion in 2016.

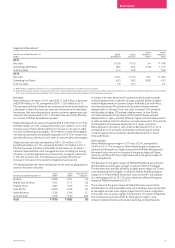

Refer to “—Dividend” below for the Board of Director’s dividend

proposal for 2015.

In January 2016, as part of the capital structure optimization program,

Alcatel Lucent S.A., a company controlled by us, repaid its EUR 190

million 8.50% senior notes. In February, 2016, Alcatel Lucent USA Inc.,

a subsidiary of Alcatel Lucent S.A., redeemed its USD 650 million

4.625% notes due July 2017, USD 500 million 8.875% notes due

January 2020 and USD 700 million 6.750% notes due November 2020

in accordance with their respective terms and conditions. In February

2016, Alcatel Lucent S.A. terminated its EUR 504 million revolving

credit facility.