Nokia 2015 Annual Report Download - page 52

Download and view the complete annual report

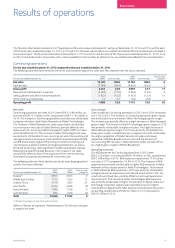

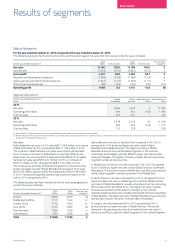

Please find page 52 of the 2015 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.50 NOKIA IN 2015

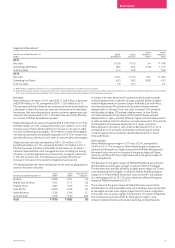

Results of operations continued

In 2014, our selling, general and administrative expenses were

EUR1453 million, a decrease of EUR 30 million or 2%, compared

toEUR 1483 million in 2013. Selling, general and administrative

expenses represented 12.4% of our net sales in 2014 compared to

12.6% in 2013. The decrease in selling, general and administrative

expenses was primarily attributable to the decrease in selling, general

and administrative expenses in Nokia Networks. The decrease was

partially oset by an increase in selling, general and administrative

expenses in Group Common Functions and Nokia Technologies.

Thedecrease in selling, general and administrative expenses in Nokia

Networks was primarily attributable to structural cost savings from

Nokia Networks global restructuring program. The decrease was

partially oset by headcount increases related to an increased

focuson growth. The increase in selling, general and administrative

expenses in Group Common Functions was primarily attributable to

transaction-related costs resulting from the Sale of the D&S Business.

The increase inselling, general and administrative expenses in

NokiaTechnologies was primarily attributable to increased activities,

such as building the technology and brand licensing units, related

toanticipated and ongoing patent licensing cases, as well as higher

business support costs. In 2014, selling, general and administrative

expenses included EUR 30 million of transaction-related costs.

Selling,general and administrative expenses included purchase price

accounting-related items of EUR 35 million in 2014 compared to

EUR80 million in 2013.

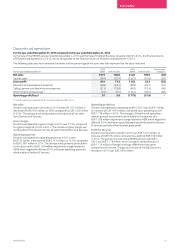

Other income and expenses was a net expense of EUR 94 million in

2014, compared to a net expense of EUR 513 million in 2013. The

change in other income and expenses was primarily attributable to

Nokia Networks, partially oset by Group Common Functions. In 2014,

Nokia Networks other income and expenses included restructuring

andassociated charges of EUR 57 million and anticipated contractual

remediation costs of EUR 31 million. In 2013, Nokia Networks other

income and expenses included restructuring andassociated charges

of EUR 570 million.

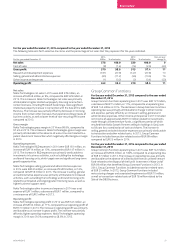

Operating prot

Our operating prot in 2014 was EUR 1 412 million, an increase

ofEUR740 million, or 110%, compared to an operating prot of

EUR 672 million in 2013. The increase in operating prot was

attributable to both Nokia Networks and Nokia Technologies. Our

operating prot in 2014 included purchase price accounting-related

items, restructuring charges and other special items of EUR 188 million

compared to EUR 716 million in 2013. Our operating margin in 2014

was 12.0% compared to5.7% in 2013.

Financial income and expenses

Financial income and expenses in 2014 was a net expense of

EUR 401 million, compared to a net expense of EUR 277 million

in2013. The higher net nancial expense in 2014 was primarily

attributable to aEUR 123 million one–time charge related to the

redemption of materially all of Nokia Networks’ borrowings, and

anon-cash charge ofEUR 57 million related to the repayment

ofEUR1500 million convertible bond issued to Microsoft.

Thesecharges were partially oset by reduced interest expenses

andlowernet foreign exchange losses.

Refer to “—Liquidity and capital resources” below.

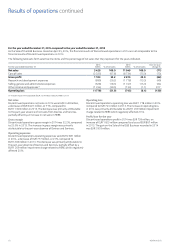

Prot before tax

Continuing operations’ prot before tax was EUR 999 million in 2014,

compared to EUR 399 million in 2013.

Income tax

Income taxes for Continuing operations was a net benet of

EUR 1 719 million in 2014, a change of EUR 1 990 million compared

toa net expense of EUR 271 million in 2013. The net income tax

benet was primarily attributable to the recognition of EUR 2 126

million deferred tax assets from the reassessment of recoverability

oftax assets in Finland and Germany in 2014, which resulted in a

EUR 2 034 million non-cash tax benet in the third quarter 2014.

Following the global restructuring actions taken primarily in 2012

and2013 to reduce annualized operating expenses and production

overheads; andthe recent protability of Nokia Networks, the

divestment of thepreviously loss-making Devices & Services business;

and forecasts of future protability for Continuing operations, we were

able to re-establish a pattern of sucient protability in Finland and

Germanyto utilize the cumulative losses, foreign tax credits and

othertemporary dierences. A signicant portion of our Finnish

andGerman deferred tax assets are indenite in nature and available

against future Finnish and German tax liabilities.

Non-controlling interests

Prot for Continuing operations attributable to non-controlling

interests was EUR 8 million in 2014, compared to a loss attributable to

non-controlling interests of EUR 145 million in 2013. The change was

primarily attributable to our acquisition of Siemens’ stake in Nokia

Networks (formerly Nokia Siemens Networks) in August 2013, which

signicantly reduced non-controlling interests in that business.

Prot/loss attributable to equity holders of the parent and

earningsper share

Prot attributable to equity holders of the parent in 2014 equaled

EUR3 462 million, compared to a loss of EUR 615 million in 2013.

Continuing operations generated a prot attributable to equity

holders of the parent in 2014, equaling EUR 2 710 million, compared

to EUR 273 million in 2013. Prot attributable to equity holders of

theparent in 2014 was favorably impacted by the recognition of

EUR 2 126 million deferred tax assets. Nokia Group’s total EPS in 2014

increased to EUR 0.94 (basic) and EUR 0.85 (diluted), compared to EUR

(0.17) (basic) and EUR (0.17) (diluted) in 2013. FromContinuing

operations, EPS in 2014 increased to EUR 0.73 (basic) and EUR 0.67

(diluted), compared to EUR 0.07 (basic) and EUR 0.07 (diluted) in 2013.