Nokia 2015 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2015 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

127

Financial statements

NOKIA IN 2015

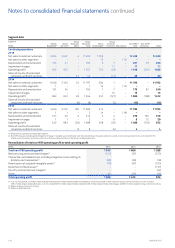

geographical area of operations. Prot or loss from Discontinued

operations is reported separately from income and expenses from

Continuing operations in the consolidated income statement, with

prior periods presented on a comparative basis. Cash ows for

Discontinued operations are presented separately in the notes to the

consolidated nancial statements. Inter-group revenues and expenses

between Continuing and Discontinued operations are eliminated,

except for those revenues and expenses that are considered to

continue after the disposal of the Discontinued operations.

Non-current assets or disposal groups are classied as assets held

forsale if their carrying amounts will be recovered principally through

asale transaction rather than through continuing use. For this to be

the case, the asset or disposal group must be available for immediate

sale in its present condition subject only to terms that are usual and

customary for sales of such assets or disposal groups, and the sale

must be highly probable. These assets, or in the case of disposal

groups, assets and liabilities, are presented separately in the

consolidated statement of nancial position and measured at the

lower of the carrying amount and fair value less costs of disposal.

Non-current assets classied as held for sale, or included in a

disposalgroup classied as held for sale, are not depreciated.

Revenue recognition

Revenue is recognized when the following criteria for the transaction

have been met: signicant risks and rewards of ownership have

transferred to the buyer; continuing managerial involvement and

eective control usually associated with ownership have ceased; the

amount of revenue can be measured reliably; it is probable that the

economic benets associated with the transaction will ow to the

Group; and the costs incurred or to be incurred in respect of the

transaction can be measured reliably. Revenue is measured at the

fairvalue of the consideration received or receivable net of discounts

and excluding taxes and duties.

Recurring service revenue which includes managed services and

maintenance services is generally recognized on a straight-line basis

over the agreed period, unless there is evidence that some other

method better represents the rendering of services.

The Group enters into contracts consisting of any combination of

hardware, services and software. Within these multiple element

arrangements, separate components are identied and accounted for

based on the nature of those components, considering the economic

substance of the entire arrangement. Revenue is allocated to each

separately identiable component based on the relative fair value of

each component. The fair value of each component is determined by

taking into consideration factors such as the price of the component

when sold separately and the component cost plus a reasonable

margin when price references are not available. The revenue allocated

to each component is recognized when the revenue recognition

criteria for that component have been met.

Revenue from contracts involving the construction of an asset

according to customer specications is recognized using the

percentage of completion method. Stage of completion is measured

by reference to cost incurred to date as a percentage of estimated

total project costs for each contract.

Revenue on license fees is recognized in accordance with the

substance of the relevant agreements. Where, subsequent to the

initial licensing transaction, the Group has no remaining obligations to

perform and licensing fees are non-refundable, revenue is recognized

after the customer has been provided access to the underlying asset.

Where the Group retains obligations related to the licensed asset after

the initial licensing transaction, revenue is typically recognized over

aperiod of time during which remaining performance obligations are

satised. In some multiple element licensing transactions, the Group

applies the residual method in the absence of reference information.

Net sales includes revenue from all licensing negotiations, litigations

and arbitrations to the extent that the criteria for revenue recognition

have been met.

Research and development

Research costs are expensed as incurred. Development costs may

berecognized as an intangible asset if the Group has the technical

feasibility to complete the asset; has an ability and intention to use

orsell the asset; can demonstrate that the asset will generate future

economic benets; has resources available to complete the asset;

andhas the ability to measure reliably the expenditure during

development. The intangible asset is carried at cost less accumulated

amortisation and accumulated impairment losses. Amortisation of

theasset begins when development is complete and the asset is

available for use. The asset is amortised over the period of expected

future benet.

Employee benets

Pensions

The Group companies have various pension plans in accordance

withthe local conditions and practices in the countries in which

theyoperate. The plans are generally funded through payments

toinsurance companies or contributions to trustee-administered

funds as determined by periodic actuarial calculations.

In a dened contribution plan, the Group’s legal or constructive

obligation is limited to the amount that it agrees to contribute to

thefund. The Group’s contributions to dened contribution plans,

multi-employer and insured plans are recognized in the consolidated

income statement in the period to which the contributions relate.

Ifapension plan is funded through an insurance contract where the

Group does not retain any legal or constructive obligations, the plan

istreated as a dened contribution plan. All arrangements that do

notfulll these conditions are considered dened benet plans.

For dened benet plans, pension costs are assessed using the

projected unit credit method: the pension cost is recognized in the

consolidated income statement so as to spread the current service

cost over the service lives of employees. The pension obligation is

measured as the present value of the estimated future cash outows

using interest rates on high-quality corporate bonds or government

bonds with appropriate maturities. Actuarial gains and losses arising

from experience adjustments and changes in actuarial assumptions

are charged or credited to equity in other comprehensive income in

the period in which they arise. Past service costs and settlement gains

and losses are recognized immediately in the consolidated income

statement as part of service cost, when the plan amendment,

curtailment or settlement occurs. Curtailment gains and losses are

accounted for as past service costs.

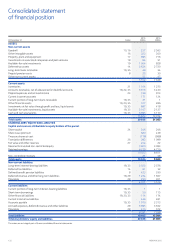

The liability or asset recognized in the consolidated statement of

nancial position is the pension obligation at the closing date less the

fair value of plan assets including eects relating to any asset ceiling.

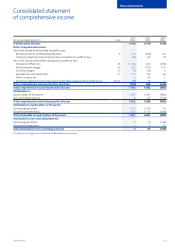

Remeasurements, comprising actuarial gains and losses, the eect

ofthe asset ceiling and the return on plan assets, excluding amounts

recognized in net interest, are recognized immediately in the

consolidated statement of nancial position with a corresponding

debit or credit to retained earnings through the consolidated

statement of comprehensive income in the period in which they occur.

Remeasurements are not reclassied to the consolidated income

statement in subsequent periods.

Actuarial valuations for the Group’s dened benet pension plans are

performed annually or when a material curtailment or settlement of

adened benet plan occurs.