HSBC 2010 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2010 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC HOLDINGS PLC

Report of the Directors: Operating and Financial Review (continued)

Risk > Credit risk > Credit risk management / Credit exposure

94

Special attention is paid to problem exposures

in order to accelerate remedial action. Where

appropriate, our operating companies use specialist

units to provide customers with support in order to

help them avoid default wherever possible.

The high-level oversight and management of credit risk

provided globally by the Credit Risk function within GMO

• to formulate Group credit policy. Compliance, subject to

approved dispensations, is mandatory for all operating

companies which must develop local credit policies

consistent with Group policies;

• to guide operating companies on our appetite for credit risk

exposure to specified market sectors, activities and banking

products and controlling exposures to certain higher-risk

sectors;

• to undertake an independent review and objective

assessment of risk. Global Risk assesses all commercial

non-bank credit facilities and exposures over designated

limits, prior to the facilities being committed to customers

or transactions being undertaken;

• to monitor the performance and management of portfolios

across the Group;

• to control exposure to sovereign entities, banks and other

financial institutions, as well as debt securities which are not

held solely for the purpose of trading;

• to set our policy on large credit exposures, ensuring that

concentrations of exposure by counterparty, sector or

geography do not become excessive in relation to our

capital base, and remain within internal and regulatory

limits;

• to control our cross-border exposures (see page 102);

• to maintain and develop our risk rating framework and

systems. The Group Chief Risk Officer chairs the Credit

Risk Analytics Oversight Committee, which reports to the

Risk Management Meeting and oversees risk rating model

governance for both wholesale and retail business;

• to report on retail portfolio performance, high risk

portfolios, risk concentrations, country limits and cross-

border exposures, large impaired accounts, impairment

allowances and stress testing results and recommendations

to the Risk Management Meeting, the Group Risk

Committee and the Board; and

• to act on behalf of HSBC Holdings as the primary interface,

for credit-related issues, with the Bank of England, the FSA,

local regulators, rating agencies, analysts and counterparts

in major banks and non-bank financial institutions.

Group and regional Credit Review and Risk

Identification teams regularly review exposures

and processes in order to provide an independent,

rigorous assessment of credit risk across the HSBC

Group, reinforce secondary risk management

controls and share best practice. Internal audit,

as a tertiary control function, focuses on risks

with a global perspective and on the design and

effectiveness of primary and secondary controls,

carrying out oversight audits via sampling of

global/regional control frameworks, themed audits

of key or emerging risks and project audits to assess

major change initiatives.

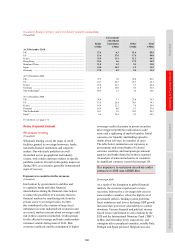

Impairment assessment

(Audited)

It is HSBC’s policy that each operating company

creates allowances for impaired loans promptly and

consistently.

Impairment allowances may be assessed and

created either for individually significant accounts

or, on a collective basis, for groups of individually

significant accounts for which no evidence of

impairment has been individually identified or for

high-volume groups of homogeneous loans that are

not considered individually significant.

When impairment losses occur, we reduce the

carrying amount of loans and advances through the

use of an allowance account. When impairment of

available-for-sale financial assets and held-to-

maturity financial investments occurs, we reduce

the carrying amount of the asset directly. For further

details, see ‘Critical accounting policies’ on page 33.

Write-off of loans and advances

Loans are normally written off, either partially or

in full, when there is no realistic prospect of further

recovery. For secured loans, write-off generally

occurs after receipt of any proceeds from the

realisation of security. Write-off may occur earlier

when the net realisable value of any collateral has

been determined and there is no reasonable

expectation of further recovery.

In HSBC Finance, the carrying amounts of

residential mortgage and second lien loans in excess

of net realisable value are written off at or before

the time foreclosure is completed or settlement is

reached with the borrower. If there is no reasonable

expectation of recovery, and foreclosure is pursued,

the loan is normally written off no later than the end

of the month in which the loan becomes 180 days

contractually past due.

Unsecured personal facilities, including credit

cards, are generally written off at between 150 and

210 days past due, the standard period being the end

of the month in which the account becomes 180 days

contractually delinquent. Write-off periods may be

extended, generally to no more than 360 days past

due but in very exceptional circumstances exceeding

that figure, in a few countries where local regulation

or legislation constrain earlier write-off, or where the

realisation of collateral for secured real estate

lending extends to this time.

In the event of bankruptcy or analogous

proceedings, write-off may occur earlier than at the