HSBC 2010 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2010 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324 -

325

325 -

326

326 -

327

327 -

328

328 -

329

329 -

330

330 -

331

331 -

332

332 -

333

333 -

334

334 -

335

335 -

336

336 -

337

337 -

338

338 -

339

339 -

340

340 -

341

341 -

342

342 -

343

343 -

344

344 -

345

345 -

346

346 -

347

347 -

348

348 -

349

349 -

350

350 -

351

351 -

352

352 -

353

353 -

354

354 -

355

355 -

356

356 -

357

357 -

358

358 -

359

359 -

360

360 -

361

361 -

362

362 -

363

363 -

364

364 -

365

365 -

366

366 -

367

367 -

368

368 -

369

369 -

370

370 -

371

371 -

372

372 -

373

373 -

374

374 -

375

375 -

376

376 -

377

377 -

378

378 -

379

379 -

380

380 -

381

381 -

382

382 -

383

383 -

384

384 -

385

385 -

386

386 -

387

387 -

388

388 -

389

389 -

390

390 -

391

391 -

392

392 -

393

393 -

394

394 -

395

395 -

396

396

|

|

HSBC HOLDINGS PLC

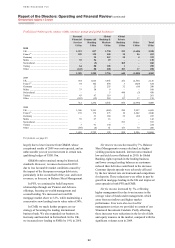

Report of the Directors: Operating and Financial Review (continued)

Customer groups and global businesses > GB&M

44

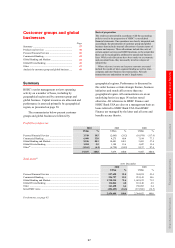

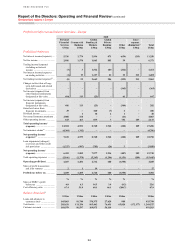

Global Banking and Markets

GB&M is a global business which

provides tailored financial solutions

to major government, corporate and

institutional clients worldwide.

2010 2009 2008

US$m US$m US$m

Net interest income ........... 7,348 8,610 8,541

Net fee income .................. 4,725 4,363 4,291

Net trading income49 ......... 5,831 6,875 481

Other income ..................... 2,043 1,972 205

Net operating income46 ... 19,947 21,820 13,518

Impairment charges47 ........ (990) (3,168) (1,471)

Net operating income ..... 18,957 18,652 12,047

Total operating expenses .. (9,962) (8,537) (9,092)

Operating profit .............. 8,995 10,115 2,955

Income from associates48 ... 541 366 528

Profit before tax .............. 9,536 10,481 3,483

Employee expenses (including

payroll and bonus taxes)

in operating expenses

US$4,737m

(2009: US$4,335m: 2008: US$4,263m)

Strong contribution from

emerging markets

Best Global Emerging

Markets Bank

Best Global Emerging

Markets Debt House

Best Debt House

in Asia

Euromoney Awards

for Excellence 2010

Emerging Markets

Bond House of the Year

International Financing

Review Awards 2010

Strategic direction

In 2010, GB&M continued to pursue its now well-established

‘emerging markets-led and financing-focused’ strategy,

encompassing HSBC’s objective to be a leading wholesale bank

by:

• utilising the Group’s extensive distribution network;

• developing GB&M’s hub-and-spoke business model; and

• continuing to build capabilities in major hubs to support the

delivery of an advanced suite of services to major government,

corporate and institutional clients across the HSBC network.

This combination of product depth and distribution strength is

fundamental to meeting the needs of existing and new clients and

allowing GB&M to achieve its strategic goals.

For footnotes, see page 83.

Review of performance

• GB&M reported profit before tax of US$9.5bn,

9% lower than in 2009. On an underlying basis,

which excludes the gains resulting from the sale

of Eversholt Rail Group and HSBC Private

Equity (Asia) Ltd in 2010, profit before tax

declined by 14%, driven by lower income from

Balance Sheet Management and Credit and

Rates trading and higher operating costs.

Profitability benefited from a significant

reduction in loan impairment charges and

other credit risk provisions. Operating results

remained well diversified across our businesses

with a strong contribution from emerging

markets, where we continued to support existing

and anticipated new business, including

introducing a ‘China desk’ in the Middle East

and a ‘Latam desk’ in Hong Kong.

• Net operating income before loan impairment

charges and other credit risk provisions

decreased by 11%, mainly due to lower net

interest income in Balance Sheet Management

from the maturing of higher yielding positions,

low interest rates and flattening yield curves.

Lower trading income largely reflected

uncertainty in the eurozone, particularly in the

second half of 2010. This was offset in part by

a net release of US$429m largely relating to

legacy positions in Credit trading and monoline

Credit exposures, compared with a reported

write-down of US$331m in 2009, following a

general improvement in ABS prices. Trading

income also benefited from a small favourable

fair value movement on structured liabilities,

compared with an adverse fair value movement

in 2009, resulting in a reported favourable

movement of US$466m.

• Loan impairment charges and other credit risk

provisions decreased by US$2.2bn. A US$1.2bn

reduction in loan impairment charges to

US$500m was driven by a general improvement

in the credit environment and the non-recurrence

of significant charges taken in relation to a small

number of clients in 2009. Credit risk provisions

on the available-for-sale portfolio decreased by

US$981m to US$490m, of which US$444m

related to ABSs, significantly lower than the

US$1.5bn impairment reported in 2009, due to

a slowing in the rate of anticipated losses in the

underlying collateral pools.

• Higher operating expenses in 2010 reflected the

one-off payroll and bonus taxes in the UK and

France on certain bonuses paid in respect of

2009 totalling US$309m, the non-recurrence of

an accounting gain related to a change in the