HSBC 2010 Annual Report Download - page 351

Download and view the complete annual report

Please find page 351 of the 2010 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

349

Overview Operating & Financial Review Governance Financial Statements Shareholder Information

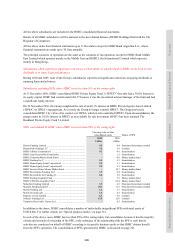

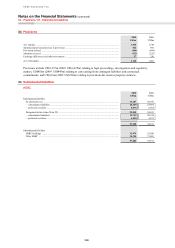

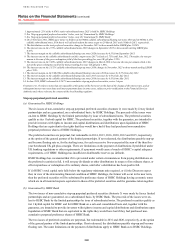

as described above. HSBC Bank has provided a similar covenant to that provided by HSBC Holdings, also as

described above.

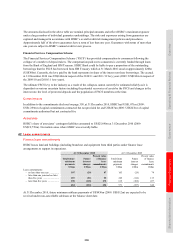

If (i) any of the two issues of preferred securities are outstanding in November 2048 or April 2049, respectively,

or (ii) the total capital ratio of HSBC Bank on a solo and consolidated basis falls below the regulatory minimum

ratio required, or (iii) in view of the deteriorating financial condition of HSBC Bank, the Directors expect (ii) to

occur in the near term, then the preferred securities will be substituted by preference shares of HSBC Bank

having economic terms which are in all material respects equivalent to those of the preferred securities and the

guarantee taken together.

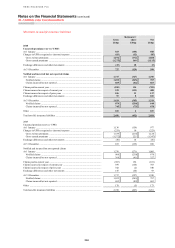

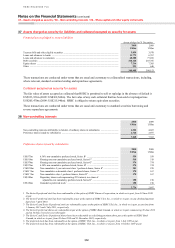

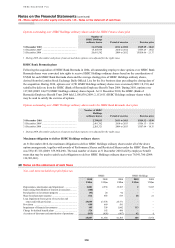

HSBC Holdings

2010 2009

US$m US$m

Subordinated liabilities:

– at amortised cost ............................................................................................................................... 13,313 14,406

– designated at fair value (Note 29) .................................................................................................... 16,288 16,909

29,601 31,315

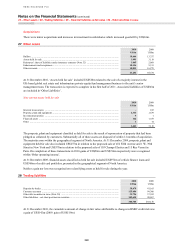

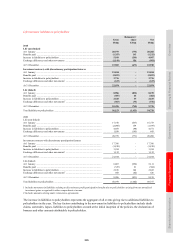

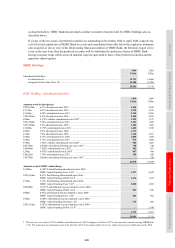

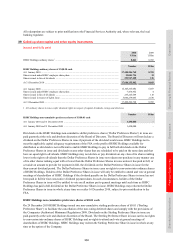

HSBC Holdings’ subordinated liabilities

2010

US$m

2009

US$m

Amounts owed to third parties

US$2,500m 6.5% subordinated notes 2037 ..................................................................................... 2,695 2,659

€1,750m 6.0% subordinated notes 2019 ..................................................................................... 2,578 2,835

€1,600m 6.25% subordinated notes 2018 ................................................................................... 2,142 2,306

US$2,000m 6.5% subordinated notes 2036 ..................................................................................... 2,050 2,052

£900m 6.375% callable subordinated notes 20221 .................................................................. 1,493 1,517

US$1,400m 5.25% subordinated notes 2012 ................................................................................... 1,492 1,488

US$1,500m 6.8% subordinated notes 2038 ..................................................................................... 1,485 1,484

€1,000m 5.375% subordinated notes 2012 ................................................................................. 1,405 1,549

£900m 6.0% subordinated notes 2040 ..................................................................................... 1,372 –

£750m 7.0% subordinated notes 2038 ..................................................................................... 1,210 1,267

£650m 6.75% subordinated notes 2028 ................................................................................... 1,000 1,043

£650m 5.75% subordinated notes 2027 ................................................................................... 971 1,000

€700m 3.625% callable subordinated notes 20202 .................................................................. 928 1,005

US$750m Callable subordinated floating rate notes 20163 .......................................................... 750 750

US$488m 7.625% subordinated notes 2032 ................................................................................. 582 587

£250m 9.875% subordinated bonds 20184 .............................................................................. 467 496

US$222m 7.35% subordinated notes 2032 ................................................................................... 258 260

US$750m Callable subordinated floating rate notes 20155 .......................................................... – 750

22,878 23,048

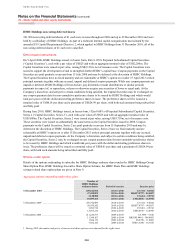

Amounts owed to HSBC undertakings

€1,400m 5.3687% fixed/floating subordinated notes 2043 –

HSBC Capital Funding (Euro 2) LP ............................................................................ 1,957 2,042

US$1,250m 4.61% fixed/floating subordinated notes 2043 –

HSBC Capital Funding (Dollar 2) LP ......................................................................... 1,274 1,223

€750m 5.13% fixed/floating subordinated notes 2044 –

HSBC Capital Funding (Euro 3) LP ............................................................................ 1,028 1,095

US$900m 10.176% subordinated step-up cumulative notes 2040 –

HSBC Capital Funding (Dollar 1) LP ......................................................................... 891 890

€600m 8.03% subordinated step-up cumulative notes 2040 –

HSBC Capital Funding (Euro 1) LP ............................................................................ 801 862

£500m 8.208% subordinated step-up cumulative notes 2040 –

HSBC Capital Funding (Sterling 1) LP ....................................................................... 772 806

US$1,350m 9.547% subordinated step-up cumulative notes 2040 –

HSBC Capital Funding (Dollar 1) LP6 ........................................................................ – 1,349

6,723 8,267

29,601 31,315

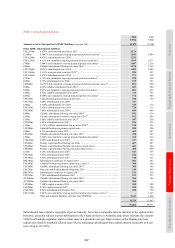

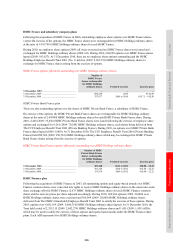

1 The interest rate on the 6.375% callable subordinated notes 2022 changes in October 2017 to become three-month sterling LIBOR plus

1.3%. The notes may be redeemed at par from October 2017 at the option of the borrower, subject to the prior notification to the FSA.