HSBC 2010 Annual Report Download - page 182

Download and view the complete annual report

Please find page 182 of the 2010 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC HOLDINGS PLC

Report of the Directors: Operating and Financial Review (continued)

Capital > Capital measurement and allocation / Future developments

180

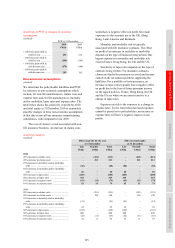

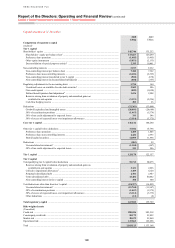

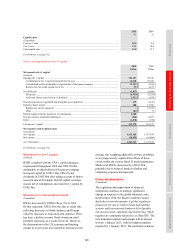

Capital structure at 31 December

2010 2009

US$m US$m

Composition of regulatory capital

(Audited)

Tier 1 capital

Shareholders’ equity ................................................................................................................................. 142,746 135,252

Shareholders’ equity per balance sheet1 ............................................................................................... 147,667 128,299

Preference share premium .................................................................................................................... (1,405) (1,405)

Other equity instruments ...................................................................................................................... (5,851) (2,133)

Deconsolidation of special purpose entities2 ....................................................................................... 2,335 10,491

Non-controlling interests .......................................................................................................................... 3,917 3,932

Non-controlling interest per balance sheet .......................................................................................... 7,248 7,362

Preference share non-controlling interests ........................................................................................... (2,426) (2,395)

Non-controlling interest transferred to tier 2 capital ........................................................................... (501) (678)

Non-controlling interest in deconsolidated subsidiaries ...................................................................... (404) (357)

Regulatory adjustments to the accounting basis ...................................................................................... 1,794 164

Unrealised losses on available-for-sale debt securities3 ...................................................................... 3,843 906

Own credit spread ................................................................................................................................. (889) (1,050)

Defined benefit pension fund adjustment4 ........................................................................................... 1,676 2,508

Reserves arising from revaluation of property and unrealised gains on

available-for-sale equities ..................................................................................................................... (3,121) (2,226)

Cash flow hedging reserve ................................................................................................................... 285 26

Deductions ................................................................................................................................................ (32,341) (33,088)

Goodwill capitalised and intangible assets .......................................................................................... (28,001) (28,680)

50% of securitisation positions ............................................................................................................ (1,467) (1,579)

50% of tax credit adjustment for expected losses ................................................................................ 241 546

50% of excess of expected losses over impairment allowances .......................................................... (3,114) (3,375)

Core tier 1 capital ................................................................................................................................... 116,116 106,260

Other tier 1 capital before deductions ...................................................................................................... 17,926 15,798

Preference share premium .................................................................................................................... 1,405 1,405

Preference share non-controlling interests ........................................................................................... 2,426 2,395

Hybrid capital securities ....................................................................................................................... 14,095 11,998

Deductions ................................................................................................................................................ (863) 99

Unconsolidated investments5 ............................................................................................................... (1,104) (447)

50% of tax credit adjustment for expected losses ................................................................................ 241 546

Tier 1 capital ........................................................................................................................................... 133,179 122,157

Tier 2 capital

Total qualifying tier 2 capital before deductions ..................................................................................... 52,713 50,075

Reserves arising from revaluation of property and unrealised gains on

available-for-sale equities ..................................................................................................................... 3,121 2,226

Collective impairment allowances6 ...................................................................................................... 3,109 4,120

Perpetual subordinated debt ................................................................................................................. 2,781 2,987

Term subordinated debt ........................................................................................................................ 43,402 40,442

Non-controlling interest in tier 2 capital .............................................................................................. 300 300

Total deductions other than from tier 1 capital ........................................................................................ (18,337) (16,503)

Unconsolidated investments5 ............................................................................................................... (13,744) (11,547)

50% of securitisation positions ............................................................................................................ (1,467) (1,579)

50% of excess of expected losses over impairment allowances .......................................................... (3,114) (3,375)

Other deductions .................................................................................................................................. (12) (2)

Total regulatory capital ......................................................................................................................... 167,555 155,729

Risk-weighted assets

(Unaudited)

Credit risk ................................................................................................................................................. 890,696 903,518

Counterparty credit risk ............................................................................................................................ 50,175 51,892

Market risk ................................................................................................................................................ 38,679 51,860

Operational risk ........................................................................................................................................ 123,563 125,898

Total .......................................................................................................................................................... 1,103,113 1,133,168