HSBC 2010 Annual Report Download - page 349

Download and view the complete annual report

Please find page 349 of the 2010 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

347

Overview Operating & Financial Review Governance Financial Statements Shareholder Information

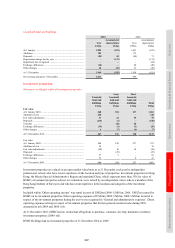

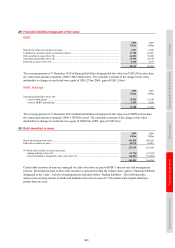

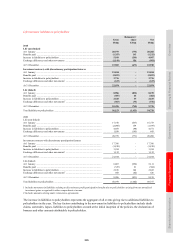

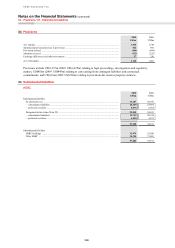

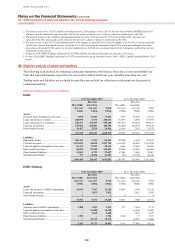

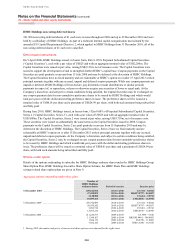

HSBC’s subordinated liabilities

2010 2009

US$m US$m

Amounts owed to third parties by HSBC Holdings (see page 349) ................................................... 22,878 23,048

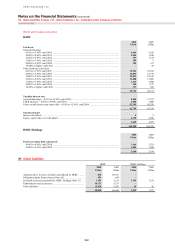

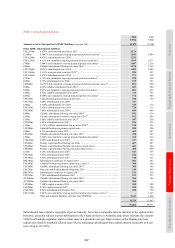

Other HSBC subordinated liabilities

US$2,939m 6.676% senior subordinated notes 20211 ..................................................................... 2,174 –

€1,400m 5.3687% non-cumulative step-up perpetual preferred securities2 ............................... 1,843 1,804

US$1,250m 4.875% subordinated notes 2020 ................................................................................. 1,252 –

US$1,250m 4.61% non-cumulative step-up perpetual preferred securities2 ................................... 1,185 1,077

£700m 5.844% non-cumulative step-up perpetual preferred securities3 ................................. 1,087 1,136

€800m Callable subordinated floating rate notes 20164 .......................................................... 1,070 1,152

US$1,000m 4.625% subordinated notes 2014 ................................................................................. 1,009 1,002

US$1,000m 5.911% trust preferred securities 20355 ....................................................................... 994 993

US$1,000m 5.875% subordinated notes 2034 ................................................................................. 971 950

€750m 5.13% non-cumulative step-up perpetual preferred securities2 ................................... 958 960

£600m 4.75% subordinated notes 2046 ................................................................................... 919 961

US$900m 10.176% non-cumulative step-up perpetual preferred securities, series 22 ................. 891 890

€600m 4.25% callable subordinated notes 20164 .................................................................... 823 904

€600m 8.03% non-cumulative step-up perpetual preferred securities2 ................................... 801 862

£500m 4.75% callable subordinated notes 20206 .................................................................... 774 785

£500m 8.208% non-cumulative step-up perpetual preferred securities2 ................................. 772 806

US$750m Undated floating rate primary capital notes ................................................................. 750 750

US$750m 5.00% subordinated notes 2020 ................................................................................... 747 –

£500m 5.375% subordinated notes 2033 ................................................................................. 729 776

US$750m 5.625% subordinated notes 2035 ................................................................................. 728 712

US$700m 7.00% subordinated notes 2039 ................................................................................... 694 688

€500m Callable subordinated floating rate notes 20207 .......................................................... 592 639

£350m Callable subordinated variable coupon notes 20178..................................................... 562 608

£350m 5.00% callable subordinated notes 20239 .................................................................... 547 550

US$500m 6.00% subordinated notes 2017 ................................................................................... 526 521

£350m 5.375% callable subordinated step-up notes 203010 .................................................... 510 531

US$500m Undated floating rate primary capital notes ................................................................. 500 500

£300m 6.5% subordinated notes 2023 ..................................................................................... 462 483

US$450m Callable subordinated floating rate notes 201611 ......................................................... 450 449

£300m 5.862% non-cumulative step-up perpetual preferred securities3 ................................. 434 412

CAD400m 4.80% subordinated notes 2022 ................................................................................... 417 382

US$400m Primary capital undated floating rate notes ................................................................. 407 407

US$400m Primary capital undated floating rate notes (second series) ........................................ 403 404

US$400m Primary capital undated floating rate notes (third series) ............................................ 400 400

£225m 6.25% subordinated notes 2041 ................................................................................... 347 363

US$300m 7.65% subordinated notes 2025 ................................................................................... 342 312

US$300m 6.95% subordinated notes 2011 ................................................................................... 310 321

BRL500m Subordinated certificates of deposit 2016 ................................................................... 301 287

US$300m Undated floating rate primary capital notes, series 3 .................................................. 300 300

US$300m Callable subordinated floating rate notes 201712 ......................................................... 300 299

US$250m Non-convertible subordinated obligations 2019 .......................................................... 248 247

BRL383m Subordinated certificates of deposit 2015 ................................................................... 231 220

US$250m 7.20% subordinated debentures 2097 .......................................................................... 213 213

AUD200m Callable subordinated floating rate notes 201613 ......................................................... 204 180

AUD200m Callable subordinated floating rate notes 2020 ........................................................... 204 –

US$200m 7.808% capital securities 2026 .................................................................................... 200 200

US$200m 8.38% capital securities 2027 ...................................................................................... 200 200

CAD200m 4.94% subordinated debentures 2021 .......................................................................... 200 190

US$1,350m 9.547% non-cumulative step-up perpetual preferred securities, series 114 .................. – 1,349

Other subordinated liabilities each less than US$200m .............................................. 3,343 3,688

34,324 31,863

57,202 54,911

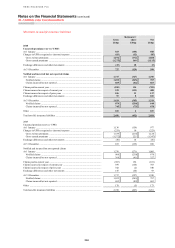

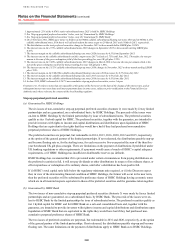

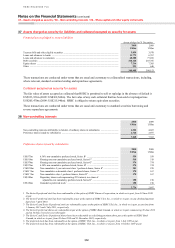

Subordinated loan capital is repayable at par on maturity, but some is repayable prior to maturity at the option of the

borrower, generally subject to prior notification to the Financial Services Authority and, where relevant, the consent

of the local banking regulator, and in certain cases at a premium over par. Interest rates on the floating rate loan

capital are related to interbank offered rates. On the remaining subordinated loan capital, interest is payable at fixed

rates of up to 10.176%.