HSBC 2010 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2010 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324 -

325

325 -

326

326 -

327

327 -

328

328 -

329

329 -

330

330 -

331

331 -

332

332 -

333

333 -

334

334 -

335

335 -

336

336 -

337

337 -

338

338 -

339

339 -

340

340 -

341

341 -

342

342 -

343

343 -

344

344 -

345

345 -

346

346 -

347

347 -

348

348 -

349

349 -

350

350 -

351

351 -

352

352 -

353

353 -

354

354 -

355

355 -

356

356 -

357

357 -

358

358 -

359

359 -

360

360 -

361

361 -

362

362 -

363

363 -

364

364 -

365

365 -

366

366 -

367

367 -

368

368 -

369

369 -

370

370 -

371

371 -

372

372 -

373

373 -

374

374 -

375

375 -

376

376 -

377

377 -

378

378 -

379

379 -

380

380 -

381

381 -

382

382 -

383

383 -

384

384 -

385

385 -

386

386 -

387

387 -

388

388 -

389

389 -

390

390 -

391

391 -

392

392 -

393

393 -

394

394 -

395

395 -

396

396

|

|

93

Overview Operating & Financial Review Governance Financial Statements Shareholder Information

• In the EU, new authorities for segments of the

financial services sector took up their powers

with effect from 1 January 2011: the European

Banking Authority, the European Securities

Markets Authority and the European Insurance

and Occupational Pension Authority. In

addition, a European Systemic Risk Board will

consider emerging macro-prudential risks.

• In the UK, the Financial Services Authority’ s

(‘FSA’ ) prudential supervisory responsibilities

will be transferred in 2012 to a Bank of England

agency, the Prudential Regulatory Authority,

while the Financial Conduct Authority will act

as a single regulator of conduct of business for

both retail and wholesale firms.

• In the US, the Dodd-Frank Act re-assigns

responsibilities of existing agencies, demising

the Office of Thrift Supervision and creating

others, including a Financial Stability Oversight

Council to address systemic matters and a

Bureau of Consumer Protection.

Implementation risks

The extensive programme of regulatory change

carries significant implementation risks for

authorities and industry participants alike, including:

• Disparities in implementation: many official

measures are proposals in development and

negotiation, and have yet to be enacted into

regional and national legislation. These

processes could result in differing, fragmented

and overlapping implementation around the

world, leading to risks of regulatory arbitrage, a

far from level competitive playing-field and

increased compliance costs, especially for large,

global financial institutions such as HSBC.

• Timetable and market expectations: while the

Basel Committee has announced the timetable

for its core proposals in Basel III, it remains

uncertain how these and other measures will

play out in practice, for instance with regard to

differences in approach between Basel III and

the Dodd-Frank Act in the US. Meanwhile,

market expectations will exert pressure on

institutions to assess and effect compliance well

in advance of official timetables.

• Wider economic impact and unforeseen

consequences: while the conclusions of official

and industry studies have diverged, the

measures proposed will clearly impact on

financial and economic activity in ways that

cannot yet be clearly foreseen. For example,

higher capital requirements may seriously

constrain the availability of funds for lending to

support economic recovery.

Credit risk

Credit risk management

(Audited)

Credit risk is the risk of financial loss if a customer

or counterparty fails to meet a payment obligation

under a contract. It arises principally from direct

lending, trade finance and leasing business, but also

from off-balance sheet products such as counterparty

risk guarantees and credit derivatives, and from our

holdings of debt securities. Of the risks in which we

engage, credit risk generates the largest regulatory

capital requirement.

Principal objectives of our credit risk management

• to maintain across HSBC a strong culture of responsible

lending and a robust risk policy and control framework;

• to both partner and challenge our businesses in defining,

implementing and continually re-evaluating our risk appetite

under actual and scenario conditions; and

• to ensure there is independent, expert scrutiny of credit

risks, their costs and their mitigation.

The Credit Risk department fulfils the role of an

independent credit control unit as part of the Global

Risk function in our Group Management Office

(‘GMO’ ). Credit approval authorities are delegated

by the Board to the most senior Chief Executive

Officers, who receive commensurate authorities

from their own boards. In each major subsidiary, a

Chief Risk Officer reports to the local Chief

Executive Officer on credit-related issues, while

maintaining a direct functional reporting line to the

Group Chief Risk Officer in GMO.

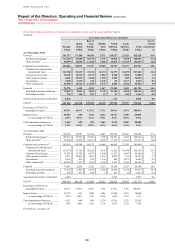

Credit quality

(Audited)

Our credit risk rating systems and processes

differentiate exposures in order to highlight those

with greater risk factors and higher potential severity

of loss. In the case of individually significant

accounts, risk ratings are reviewed regularly and any

amendments are implemented promptly. Within our

retail businesses, risk is assessed and managed using

a wide range of risk and pricing models to generate

portfolio data.

Our risk rating system facilitates the internal

ratings-based (‘IRB’ ) approach under Basel II

adopted by the Group to support calculation of our

minimum credit regulatory capital requirement.

For further details, see ‘Credit quality of financial

instruments’ on page 114.