HSBC 2010 Annual Report Download - page 285

Download and view the complete annual report

Please find page 285 of the 2010 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

283

Overview Operating & Financial Review Governance Financial Statements Shareholder Information

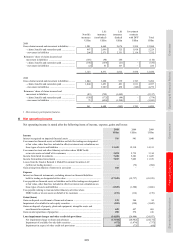

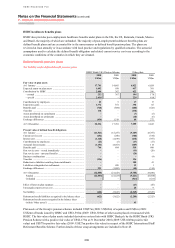

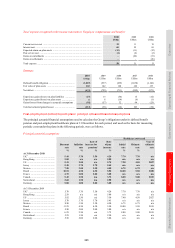

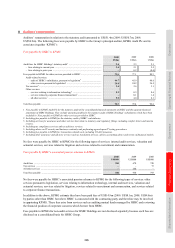

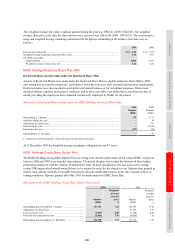

Expected rates of return

2010 2009

Expected

rates of return1 Value

Expected

rates of return1 Value

% US$m

% US$m

HSBC Bank (UK) Pension Scheme

Fair value of plan assets ............................................................... 22,236 17,701

Equities ..................................................................................... 8.4 3,415 8.4 2,770

Bonds ........................................................................................ 5.3 15,638 5.3 12,597

Property .................................................................................... 7.6 1,438 7.7 1,502

Other ......................................................................................... 4.0 1,745 5.3 832

Other plans

Fair value of plan assets ............................................................... 7,559 6,822

Equities ..................................................................................... 8.2 2,617 8.2 2,302

Bonds ........................................................................................ 5.0 4,073 5.0 3,809

Property .................................................................................... 6.1 98 6.4 55

Other ......................................................................................... 6.2 771 3.5 656

Healthcare plans

Fair value of plan assets ............................................................... 165 142

Equities ..................................................................................... 12.0 49 12.2 43

Bonds ........................................................................................ 8.4 81 8.7 72

Other .......................................................................................... 7.6 35 4.6 27

1 The expected rates of return are used to measure the net defined benefit pension costs in each subsequent year, and weighted on the

basis of the fair value of the plan assets.

The expected return on plan assets represents the best estimate of long-term future asset returns, which takes into

account historical market returns plus additional factors such as the current rate of inflation and interest rates.

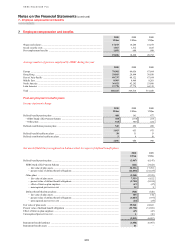

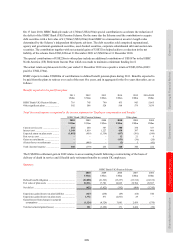

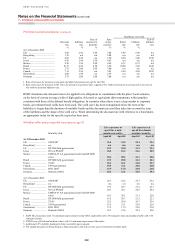

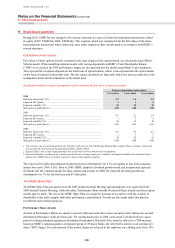

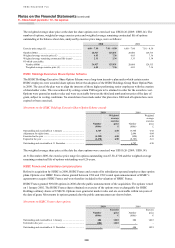

Actuarial assumption sensitivities

The discount rate is sensitive to changes in market conditions arising during the reporting period. The mortality rates

used are sensitive to experience from the plan member profile. The following table shows the effect of changes in

these and the other key assumptions on the principal defined benefit pension plan:

The effect of changes in key assumptions on the principal plan

HSBC Bank (UK) Pension Scheme

2010 2009

US$m US$m

Discount rate

Change in pension obligation at year end from a 25bps increase ....................................................... (941) (879)

Change in pension obligation at year end from a 25bps decrease ....................................................... 1,003 946

Change in 2011 pension cost from a 25bps increase ........................................................................... (9) (13)

Change in 2011 pension cost from a 25bps decrease .......................................................................... 9 13

Rate of inflation

Change in pension obligation at year end from a 25bps increase ....................................................... 1,029 964

Change in pension obligation at year end from a 25bps decrease ....................................................... (978) (907)

Change in 2011 pension cost from a 25bps increase ........................................................................... 67 65

Change in 2011 pension cost from a 25bps decrease .......................................................................... (64) (63)

Rate of increase for pensions in payment and deferred pensions

Change in pension obligation at year end from a 25bps increase ....................................................... 813 800

Change in pension obligation at year end from a 25bps decrease ....................................................... (775) (766)

Change in 2011 pension cost from a 25bps increase ........................................................................... 48 50

Change in 2011 pension cost from a 25bps decrease .......................................................................... (45) (49)

Rate of pay increase

Change in pension obligation at year end from a 25bps increase ....................................................... 216 195

Change in pension obligation at year end from a 25bps decrease ....................................................... (203) (174)

Change in 2011 pension cost from a 25bps increase ........................................................................... 20 18

Change in 2011 pension cost from a 25bps decrease .......................................................................... (17) (16)

Investment return

Change in 2011 pension cost from a 25bps increase ........................................................................... (54) (44)

Change in 2011 pension cost from a 25bps decrease .......................................................................... 54 44

Mortality

Change in pension obligation from each additional year of longevity assumed ................................. 497 487