HSBC 2010 Annual Report Download - page 367

Download and view the complete annual report

Please find page 367 of the 2010 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

365

Overview Operating & Financial Review Governance Financial Statements Shareholder Information

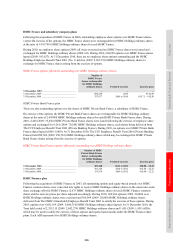

44 Legal proceedings, investigations and regulatory matters

HSBC is party to legal proceedings, investigations and regulatory matters in a number of jurisdictions including the

UK, Hong Kong and the US arising out of its normal business operations. Apart from the matters described below,

HSBC considers that none of these matters is material, either individually or in the aggregate. HSBC recognises a

provision for a liability in relation to these matters when it is probable that an outflow of economic benefits will be

required to settle an obligation which has arisen as a result of past events, and for which a reliable estimate can be

made of the amount of the obligation. While the outcome of these matters is inherently uncertain, management

believes that, based on the information available to it, appropriate provisions have been made in respect of legal

proceedings, investigations and regulatory matters as at 31 December 2010 (see note 33, Provisions).

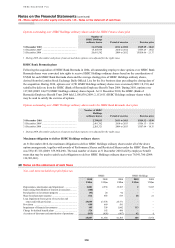

Securities litigation

As a result of an August 2002 restatement of previously reported consolidated financial statements and other

corporate events, including the 2002 settlement with 46 State Attorneys General relating to real estate lending

practices, Household International (now HSBC Finance) and certain former officers were named as defendants in a

class action law suit, Jaffe v Household International Inc, et al No 2. C 5893 (N.D.Ill, filed 19 August 2002). The

complaint asserted claims under the US Securities Exchange Act of 1934, on behalf of all persons who acquired and

disposed of Household International common stock between 30 July 1999 and 11 October 2002. The claims alleged

that the defendants knowingly or recklessly made false and misleading statements of material fact relating to

Household’s Consumer Lending operations, including collections, sales and lending practices, some of which

ultimately led to the 2002 State settlement agreement, and facts relating to accounting practices evidenced by the

restatement. Following a jury trial concluded in April 2009, which was decided partly in favour of the plaintiffs, the

Court issued a ruling on 22 November 2010, within the second phase of the case to determine actual damages, that

claim forms should be mailed to class members, and also set out a method for calculating damages for class members

who filed claims. At subsequent hearings the Court has allowed HSBC Finance to take limited discovery on the issue

of whether investors relied on the ‘misleading statements’ at the time they made their investments and also reserved

on the issue of whether HSBC Finance would ultimately be entitled to a jury trial on the issue of reliance.

Despite the jury verdict and the 22 November 2010 ruling, HSBC continues to believe that it has meritorious

defences, and intends to seek an appeal of the Court’s rulings. Lead Plaintiffs, in Court filings, have estimated that

damages could range ‘somewhere between US$2.4bn to US$3.2bn to class members’, before pre-judgement interest.

The timing and outcome of the resolution of this matter is uncertain. Given the complexity and uncertainties

associated with the actual determination of damages, including but not limited to the number of class members that

may file valid claims, the number of claims that can be substantiated by class members providing adequate

documentation, the reduction of trading losses by any trading gains made over the relevant period, the determination

of reliance by class members on the financial statements, and whether any given class member was the beneficial

owner of the shares, HSBC is unable at this time to estimate reliably the amount of any damages, or range of possible

damages, that could arise, but they could be significant.

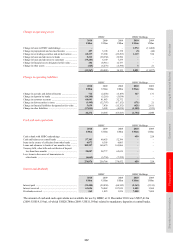

Bernard L. Madoff Investment Securities LLC

In December 2008, Bernard L. Madoff (‘Madoff’) was arrested for running a Ponzi scheme and a trustee was

appointed for the liquidation of his firm, Bernard L. Madoff Investment Securities LLC (‘Madoff Securities’), an

SEC-registered broker-dealer and investment adviser. Since his appointment, the trustee has been recovering assets

and processing claims of Madoff Securities customers. Madoff subsequently pleaded guilty to various charges and is

serving a 150-year prison sentence. He has acknowledged, in essence, that while purporting to invest his customers’

money in securities and, upon request, return their profits and principal, he in fact never invested in securities and

used other customers’ money to fulfil requests for the return of profits and principal. The relevant US authorities are

continuing their investigations into his fraud, and have brought charges against others.

Various non-US HSBC companies provided custodial, administration and similar services to a number of funds

incorporated outside the US whose assets were invested with Madoff Securities.

Based on information provided by Madoff Securities, as at 30 November 2008, the purported aggregate value of

these funds was US$8.4bn, an amount that includes fictitious profits reported by Madoff. Based on information

available to HSBC to date, we estimate that the funds’ actual transfers to Madoff Securities minus their actual

withdrawals from Madoff Securities during the time that HSBC serviced the funds totalled approximately US$4.3bn.